- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Urban Outfitters (URBN) Q4 Earnings Beat Fails To Lift Stock

Urban Outfitters Inc. (NASDAQ:URBN) delivered better-than-expected results for the third straight quarter, when it reported fourth-quarter fiscal 2018 financial numbers. Notably, this lifestyle specialty retail company posted earnings per share of 69 cents that surpassed the Zacks Consensus Estimate of 63 cents and also improved 25.5% year over year.

Despite robust quarterly numbers, the company’s shares declined 5% in after-hours trading. Investors took an apprehensive stance after it reported substantial decline in GAAP earnings and margins. Urban Outfitters’ GAAP earnings came in at 1 cent per share, sharply below the prior-year quarter earnings of 55 cents. The decline can be primarily attributed to new tax law, wherein the company had to pay repatriation charges and write down certain net deferred tax assets of roughly $64.7 million.

However, the company outperformed the industry in the past six months. While the stock has soared 71%, the industry gained 27.4% owing to robust top- and bottom-line surprise history.

An Insight Into Revenues

In the reported quarter, net sales of $1,089.1 million surpassed the Zacks Consensus Estimate of $1,086 million and were up 5.7% year over year. The increase in the top line was owing to robust performance of its Urban Outfitters, Anthropologie Group and Free People brands. Also, the company registered double-digit growth in the digital channel, marginally overshadowed by fall in retail store sales.

At Urban Outfitters, net sales were up 4.9% to $433.9 million while the same at Anthropologie Group improved 5.5% to $447.2 million. At Free People, the metric increased 8.2% to $201.7 million. In the quarter under review, Food and Beverage net sales came in at $6.3 million compared with $6 million in the prior-year quarter.

The company’s net sales inched up 0.6% to $1,010.2 million at the Retail Segment and 6.3% to $78.9 million at the Wholesale Segment.

Comparable retail segment’s net sales, including the comparable direct-to-consumer channel, were up 4% year over year. Meanwhile, comparable retail segment net sales inched up 2% at Urban Outfitters, 5% at Anthropologie Group and 8% at the Free People brands. Also, the company registered double-digit growth in direct-to-consumer channel. At the Wholesale segment, net sales improved 6.3%. Comparable sales were driven by robust apparel sales performance.

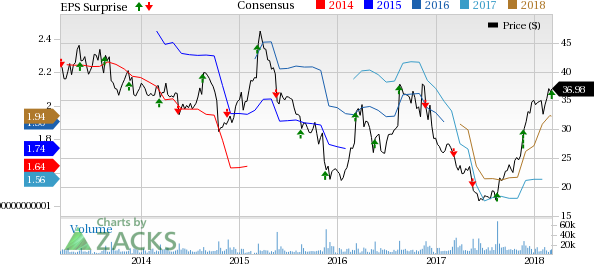

Urban Outfitters, Inc. Price, Consensus and EPS Surprise

Margin Performance

In the quarter under review, adjusted gross profit came in at $352 million, up 2.1% from the year-ago quarter. On the contrary, adjusted gross margin contracted 120 basis points to approximately 32.3% primarily due to deleverage in customer delivery and logistics expense rates and also merchandise mark-ups.

While adjusted operating income increased to $104.3 million from $103.9 million in the year-ago quarter, operating margin came in at 9.6%, down 60 basis points year over year.

Store Update

In fiscal 2018, this Zacks Rank #3 (Hold) company opened 18 new outlets — eight Free People stores, five Urban Outfitters store, four Anthropologie Group store and one Beverage restaurant. This apart, Urban Outfitters shuttered 11 stores — three Anthropologie Group store, two Urban Outfitters stores, three Food and Beverage restaurant and three Free People stores — in the same time frame.

Other Financial Details

The company ended the quarter with cash and cash equivalents of $282.2 million, marketable securities of $165.1 million and shareholders’ equity of $1,300.9 million.

In fiscal 2018, the company repurchased 8.1 million of shares for $157 million. At the end of the quarter, the company has an outstanding authorization of 17.9 million shares.

Key Picks

Some better-ranked stocks in the retail sector are G-III Apparel Group (NASDAQ:GIII) , Delta Apparel (NYSE:DLA) and Michael Kors Holdings Limited (NYSE:KORS) . All the three stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

G-III Apparel Group delivered a positive earnings surprise in the last three quarters.

Delta Apparel has an impressive long-term earnings growth of 15%.

Michael Kors Holdings pulled off an average positive earnings surprise of 32.7% in the trailing four quarters.

Breaking News: Cryptocurrencies Now Bigger than Visa

The total market cap of all cryptos recently surpassed $700 billion – more than a 3,800% increase in the previous 12 months. They’re now bigger than Morgan Stanley (NYSE:MS), Goldman Sachs (NYSE:GS) and even Visa! The new asset class may expand even more rapidly in 2018 as new investors continue pouring in and Wall Street becomes increasingly involved.

Zacks has just named 4 companies that enable investors to take advantage of the explosive growth of cryptocurrencies via the stock market.

Click here to access these stocks >>

Urban Outfitters, Inc. (URBN): Free Stock Analysis Report

G-III Apparel Group, LTD. (GIII): Free Stock Analysis Report

Michael Kors Holdings Limited (KORS): Free Stock Analysis Report

Delta Apparel, Inc. (DLA): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Every investor should know the term CEP, or customer engagement platform, because it is central to businesses' use of AI. CEPs provide software services to connect and communicate...

As markets try to look through the blizzard of policy changes flowing out of Washington, the crowd has shifted its preferences considerably in recent weeks based on a sector lens....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.