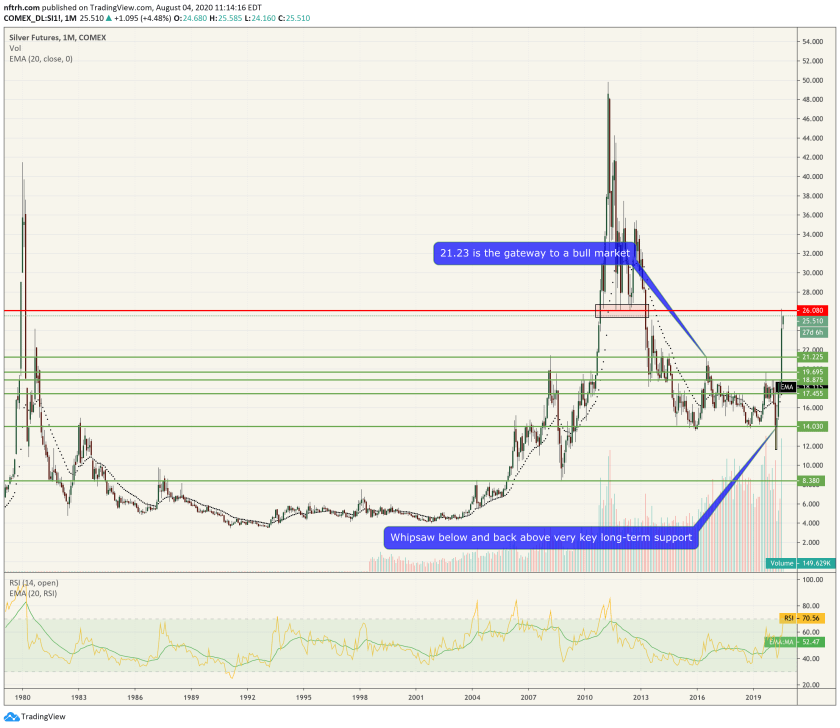

I have not gone raving silver bug on you. The title says “silver bull” because that is what silver is in, a bull market by definition of having taken out the 2016 high of 21.23. We targeted that point as a cyclical bull market gateway, silver cut through it like a knife through warm butter… and there you have it. A key higher high. I don’t apologize for any of the above. It is fact.

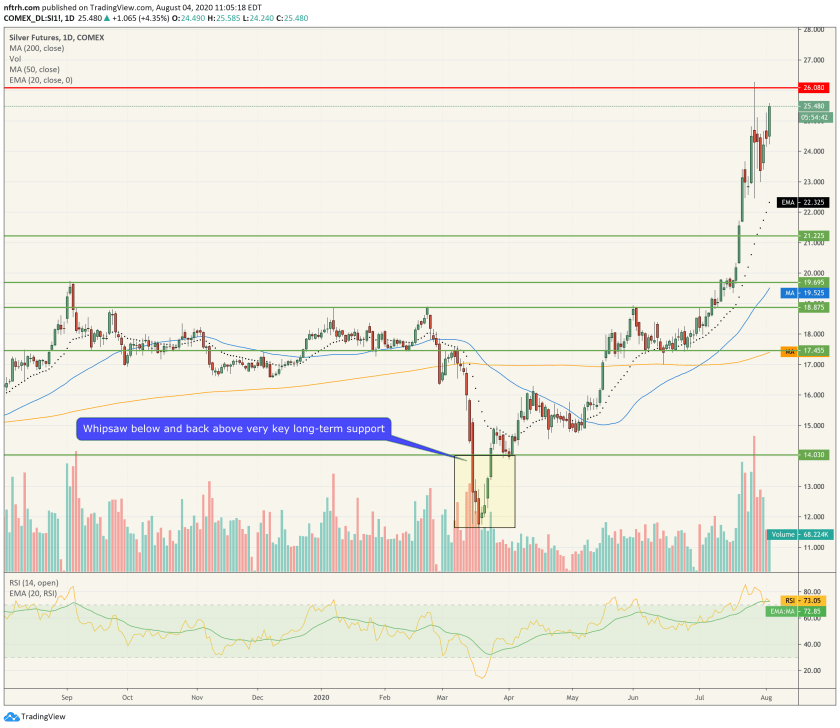

So let’s catch up on gold’s wild little bro as it hangs tough below the NFTRH ultimate cyclical bull target, which has been the 24-26 long-term resistance zone (per the 3rd chart below). Silver made a violent hit and recoiled, but…

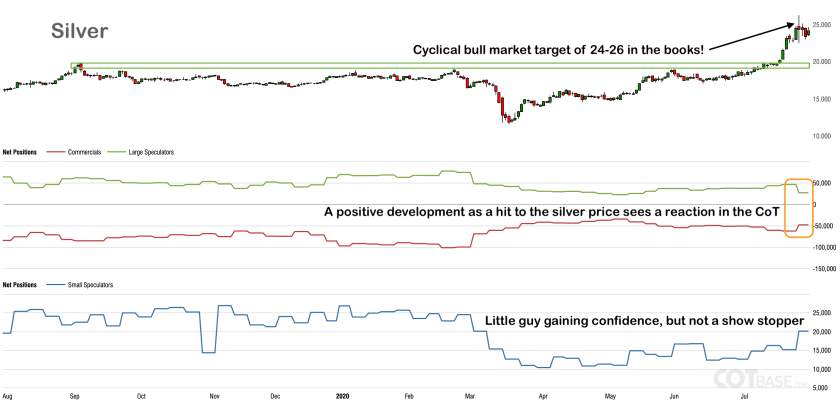

…this caused a reaction in the Commitments of Traders data that was positive for the metal. Here is the chart (courtesy COTbase, markups mine). The recent negative price reaction drove the CoT to recoil from its situation, which had been seeing over-bullishness by large Specs gaining momentum. Now? Not so much. As noted on the chart, sentiment-wise this was a positive development.

Okay, on to the weekly chart, below. While it is likely that silver is on some sort of blow-off move right now, the fact that it made the higher high to 2016 calls it a launch, not a final blow off. In other words, the launch phase will blow off and get punished at some point, but it has all the makings of the beginning of an extended bull market (as noted above, it’s already registered our anticipated cyclical bull market resistance zone).

Here’s the monthly view, which is good for perspective. The resistance from 2011-2012 is clear. That does not mean it has to hold as resistance, but it’s there and it should be respected. If silver should take that out however, the sky’s the limit and the lunatics in the silver bug community could be guiding us to a new high one day above the point where this massive, decades-long Cup’s Handle began to form at $50/oz. For now however, let’s realize that silver is gaining a lot of attention and the move will be punished.

The question is, at what level and from what proximity to resistance (above or below)?