- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

UK Economy Looking Solid

The UK economy looks to be the stand out in the European region after another strong result; as CPI data came in strong for the year at 1.9% compared to forecasts of 1.6%. Clearly well within the target range (1-3%) mandated by the Bank of England when it comes to inflation management and .1% off the magic 2%.

The past 24 hours have been interesting for sterling traders, as the retail sales monitor y/y came in at -0.8%. This was a disappointing result, especially when you factor in forecasts of 1.0%. So it shows there still may be some weakness in the market.

With a sick neighbour next door in the form of the European Union; which is currently afflicted with the warning signs of deflation, markets are watching the UK economy closely to see if that deflation threat gets exported on to the UK. So far, things are certainly looking good for the economy, and with strong monetary policy it’s likely the UK economy will stay in good stead for some time -especially when it comes to inflation data.

Sterling traders will now have to turn their attention though to tomorrow's employment data, with claimant count change and the unemployment rate likely to act as major market movers for the economy. Markets will be increasingly interested to see if the unemployment rate can indeed fall to 6.5%; as economic growth has been substantial for the UK economy.

In addition, many will be listening to US data, and the FED especially as Yellen is still giving her talk to congress for another day. Big movements could indeed be in store for the GBP/USD on the charts.

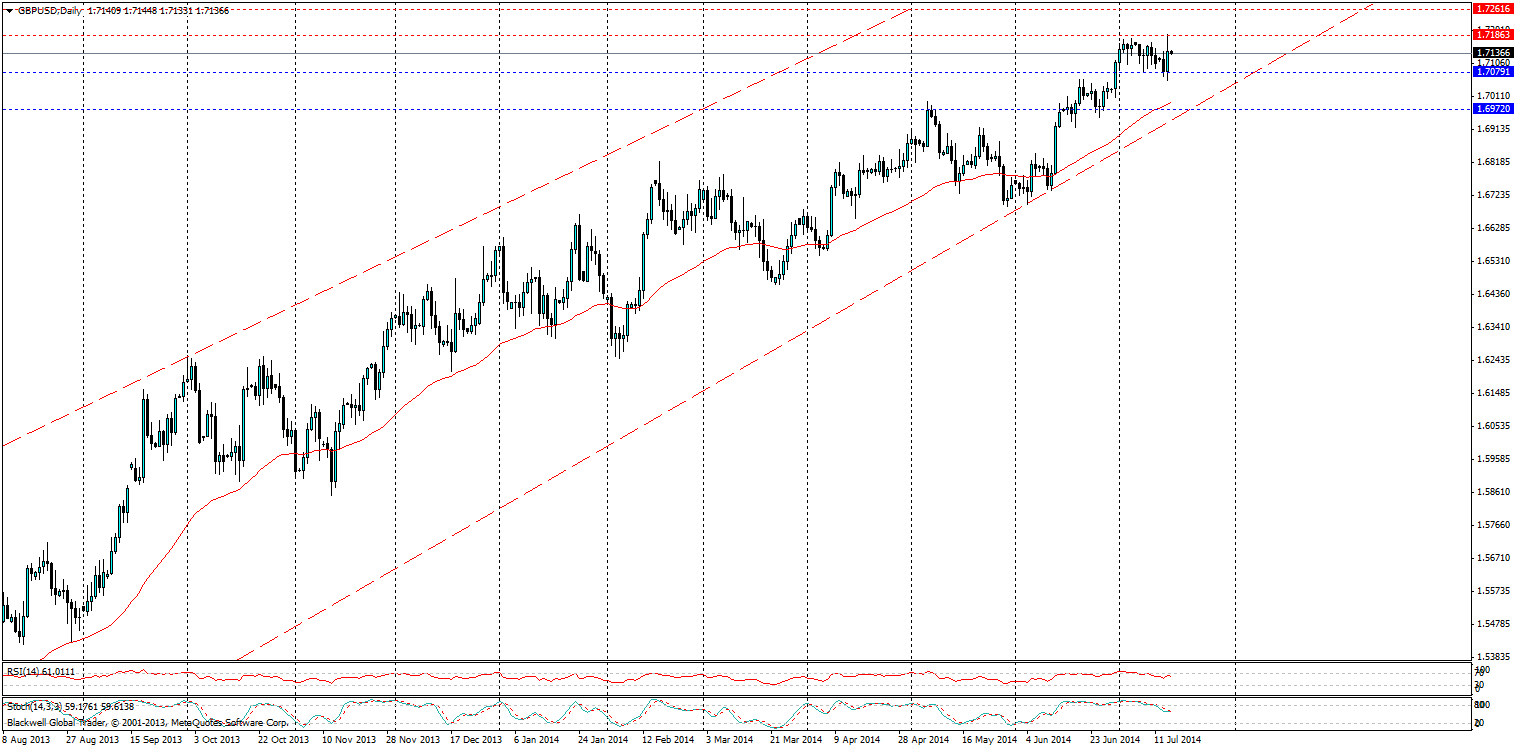

On the GBP/USD chart it’s clear that there is a key level of resistance still to beat at 1.7186, and it’s certainly a stubborn level at that, as the market is a little coy about further movements higher until it sees’ more positive data overall. The next resistance level above is at 1.7261 and this is likely to act as a second level in the event of a breakout, the strength of this is likely to be a little weaker though, and its likely movements above will more than likely look for psychological levels at 1.73 and 1.74.

Support levels are easily found at 1.7079 and 1.69720 – these are all likely to act as firm support in the environment as the UK economy is still bullish. If there was a breakthrough I would check the data and if it's not consistent with a move lower, it could be from traders looking to push the present trend line and create more bullish opportunities.

Either way the current UK economy is looking still relatively bullish and traders should look for opportunities in the present market climate. Jumping in might be the wrong idea at present, instead I would look at the upcoming data and any moves on support levels to look to enter the present market.

Related Articles

The US dollar has come under some pressure on the back of the rerating of the US growth outlook and expectations that the Russia-Ukraine conflict is nearing an end. However, we...

The Japanese yen is slightly lower on Wednesday. In the North American session, USD/JPY is trading at 148.92, down 0.07% on the day. What is the best performing G-10 currency...

USD/JPY is consolidating near 149.33 on Wednesday, with the yen pausing its rally while holding near four-month highs against the USD. This stabilisation follows renewed support...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.