Major equity markets around the globe continued to rally yesterday (except for the post-Brexit FTSE). Our benchmark S&P 500 surged at the open, regressed a bit and then drifted higher to a narrow afternoon trading range that included the 0.85% intraday high.

The session closed with a trimmed gain of 0.70%. But of course, any gain ensured another record close. The yield on the 10-year note rose ten basis points to close at 1.53%.

Here is a snapshot of past five sessions in the S&P 500:

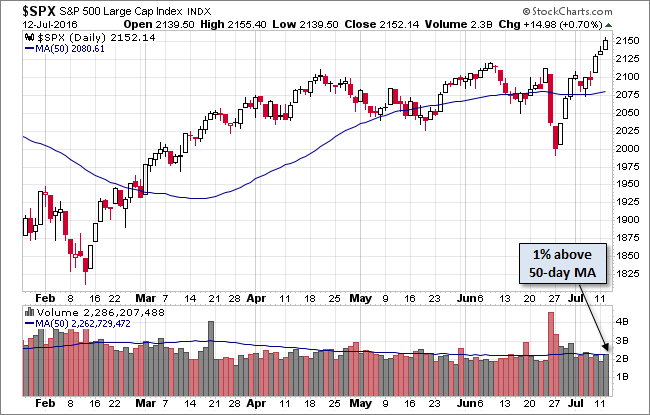

Here is a daily chart of the S&P 500. Trading volume was unremarkable on yesterday's advance:

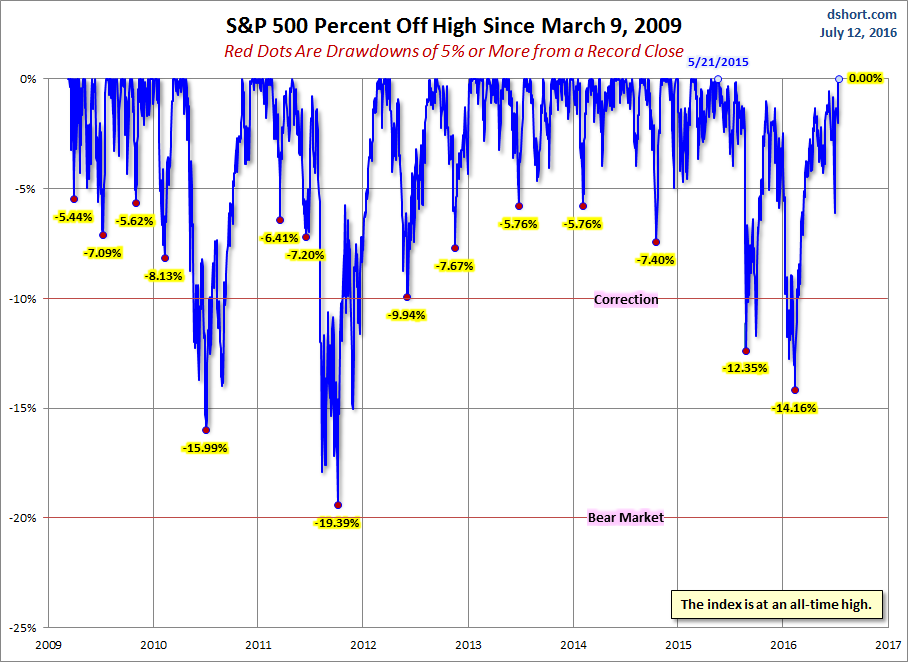

A Perspective on Drawdowns

Here's a snapshot of selloffs since the 2009 trough:

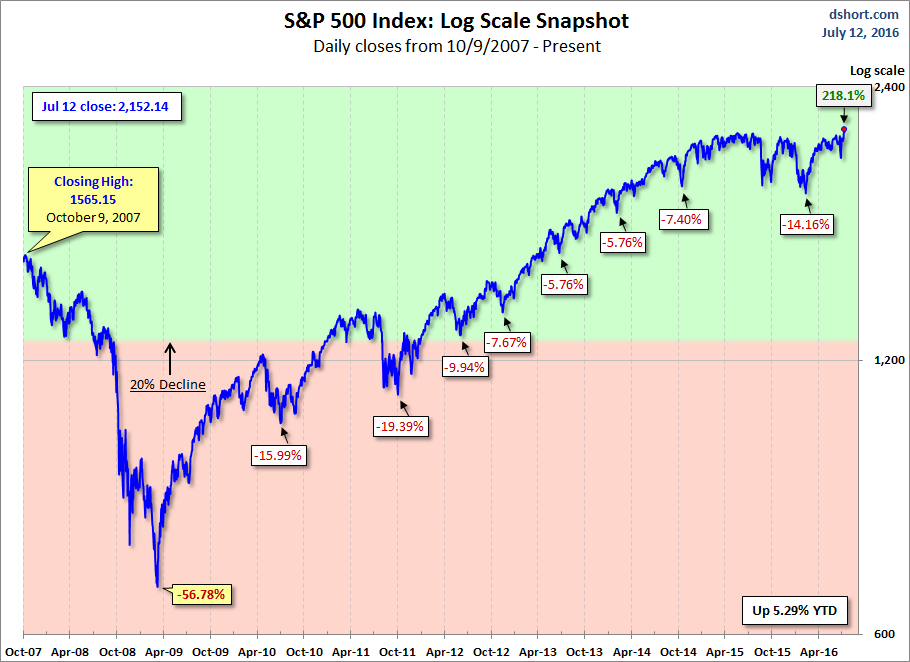

Here is a more conventional log-scale chart with drawdowns highlighted.

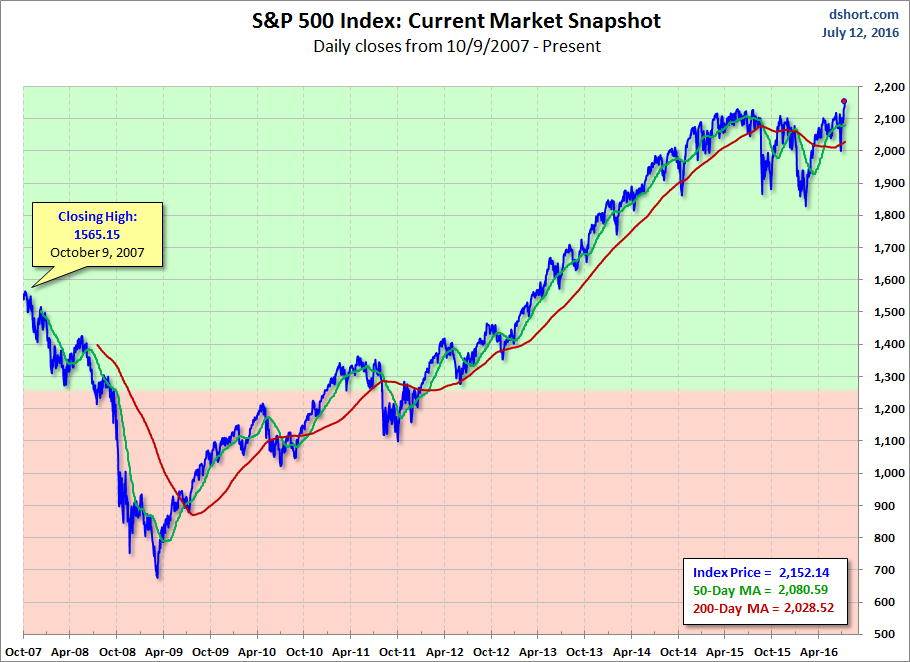

Here is a linear scale version of the same chart with the 50- and 200-day moving averages:

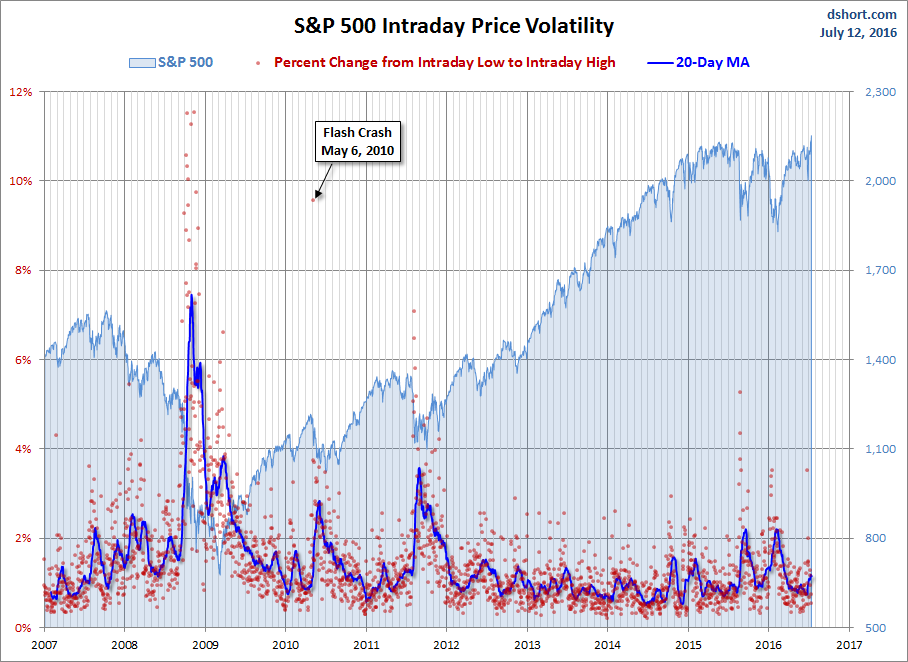

A Perspective on Volatility

For a sense of the correlation between the closing price and intraday volatility, the chart below overlays the S&P 500 since 2007 with the intraday price range. We've also included a 20-day moving average to help identify trends in volatility.