- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Twitter (TWTR) Joins Tech Club To Ditch Q1 View On Coronavirus Woes

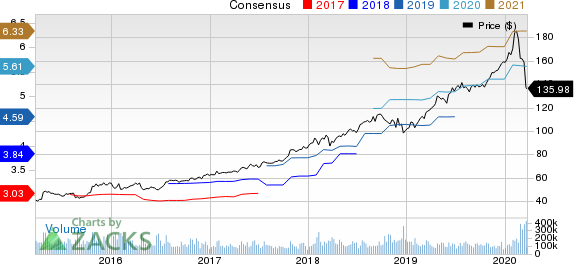

Twitter (NYSE:TWTR) is the latest casualty of the coronavirus pandemic. On Mar 23, in an 8k filing, this social media company announced withdrawal of its first-quarter 2020 revenue and operating income guidance due to the pervasive impact of the coronavirus (COVID-19) anxiety on advertiser demand. Notably, Twitter generated 86.4% of 2019 revenues from advertisements.

The company now expects first-quarter 2020 revenues to dip from the year-ago reported figure. Twitter’s previous projection for total revenues came in between $825 million and $885 million. The company reported revenues of $787 million in first-quarter 2019.

Moreover, this Zacks Rank #3 (Hold) player’s earlier forecast for operating income was between a breakeven and $30 million. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

However, management at Twitter stated that total monetizable DAU (mDAU), which measures the number of users, has been benefiting from frequent discussions on the burning issue of coronavirus and an improving product experience. Quarter to date, average total mDAU reached approximately 164 million, up 23% from 134 million in first-quarter 2019 and up 8% from 152 million in fourth-quarter 2019.

Twitter also scraped 2020 guidance for expenses, stock-based compensation, headcount and capital expenditures.

Coronavirus Compels Tech Giants to Scrap Views

The coronavirus outbreak that has claimed 16,653 lives is wreaking havoc on global trade, investments, tourism, supply chains and consumer confidence. Total number of infected persons is now 381,621, per the Johns Hopkins University data.

Twitter jumps on the bandwagon of technology companies who either withdrew their guidance or warned of missing expectations.

The list includes bigwigs like Apple (NASDAQ:AAPL) , Microsoft (NASDAQ:MSFT) , Microchip, Baidu (NASDAQ:BIDU), Cree, Hewlett-Packard Enterprise, HP, Nutanix, ON Semiconductor, PayPal, Qorvo (NASDAQ:QRVO) , Skyworks (NASDAQ:SWKS) , Universal Display, et al.

Apple is experiencing a negative impact from supply-chain disruption due to the outbreak of the coronavirus in China. On Feb 17, the company announced that it doesn’t expect to meet second-quarter fiscal 2020 revenue outlook due to iPhone supply constraints and lower demand in China. For second-quarter fiscal 2020, this Zacks #3 Ranked stock’s revenue view was between $63 billion and $67 billion.

Meanwhile, on Feb 26, Microsoft announced that it may fail to meet its More Personal Computing’s third-quarter fiscal 2020 revenue expectation due to the coronavirus crisis in China. This Zacks Rank #1 stock’s prior revenue prediction came in between $10.75 billion and $11.15 billion.

Apple Suppliers, Travel Companies Worst Hit

Qorvo, a radio frequency chip supplier for Apple’s iPhone, lowered its fourth-quarter revenue expectation to $770 million. The figure was significantly down from the $800-$840 million range, guided earlier in late January by this Zacks #1 Ranked company. (Read More: Apple Supplier Qorvo Trims Q4 View on Coronavirus Woes)

Skyworks, another chip supplier for Apple’s iPhone, also trimmed its revenue and earnings guidance for the second quarter of fiscal 2020 ending Mar 27, 2020. The stock with a Zacks Rank of 3 now anticipates revenues to be $760-770 million (midpoint being $765 million), down from its prior-anticipated band of $800-$820 million (midpoint being $810 million) citing weak customer demand due to the coronavirus disaster and its impact on smartphone supply chain. The revised revenue outlook indicates a decline of 6.5% considering the midpoint level.

Skyworks’ now expects non-GAAP earnings to be $1.34 per share, implying a decrease from the prior guidance of $1.46.

Further, leading OLED provider Universal Display, another supplier of Apple, cautioned that coronavirus will adversely impact 2020 revenues by $40-$50 million. Universal Display expects revenues between $430 million and $470 million for the ongoing year.

Furthermore, Apple supplier Jabil’s second-quarter fiscal 2020 results were affected by higher expenses due to business interruptions caused by the coronavirus outbreak.

Meanwhile, Bookings Holdings and Expedia (NASDAQ:EXPE), two prominent tech-based travel companies, withdrew their guidance. Management at Trivago also stated that the coronavirus concern will significantly drain business volumes.

Conclusion

Twitter’s guidance withdrawal due to the coronavirus catastrophe on advertiser demand reflects the severity of the pandemic’s impact on economy. Soft advertiser demand can also ruin prospects of Facebook (NASDAQ:FB) and Google (NASDAQ:GOOGL), which recognize a huge portion of their revenues from advertisements.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Microsoft Corporation (MSFT): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Skyworks Solutions, Inc. (SWKS): Free Stock Analysis Report

Qorvo, Inc. (QRVO): Free Stock Analysis Report

Twitter, Inc. (TWTR): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Nvidia’s earnings beat didn’t erase investor concerns over slowing growth. Soft Q1 guidance and valuation worries may limit the stock’s upside. Weak network and gaming sales...

Shares of Etsy (NASDAQ:ETSY) are down approximately 7% since the company reported earnings on February 19. Concerns over slowing growth are overriding revenue and earnings that...

Warren Buffett and Berkshire Hathaway (NYSE:BRKa) always make headlines in February when the firm holds its annual meeting. Among the many takeaways is what the company has been...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.