Pre-Open Market Analysis

After 2 strong bull days, yesterday was a trading range day. The 2 bull days were strong enough so that the odds favor at least one more small leg up. There is a measured move target above 2740 on the 60-minute chart. Additionally, the 2750 Big Round Number is also a magnet. Yet, Cohn resigned and the Emini fell overnight. Consequently, the 2nd leg down from the month-long wedge might have begun.

Today will be an information day. If it is a strong bear day, then the Emini will probably sell off for a few days. It would then probably complete its objective of 2 legs down from the wedge. Alternatively, if today is neutral to up, it still might reach the 2750 area before the 2nd leg down begins.

Since the monthly chart is so bullish, a 2nd leg down on the daily chart could mark the end of the 2 month correction. Therefore, traders should look for a reversal up from around 2600 – 2650 to a test of the all-time high.

Possible High 2 Bull Flag At Moving Average On Weekly Chart

It is possible that a gap down today could be the end of the 2nd leg sideways to down correction from the wedge. The bulls are trying to form a buy signal bar on the weekly chart. If this week closes near its high, this week would be a good buy signal bar. In addition, it would be the 2nd one in 3 weeks. It would therefore be a High 2 bull flag at the moving average in a bull trend. That is a reliable buy signal.

Overnight Emini Globex Trading

The Emini is down 19 points in the Globex session. But, Thursday and Friday were strongly up. The odds still favor a 2nd leg sideways to up after that strong 2 day rally. However, if the Emini reaches 2750 this week, the rally will probably fail. The target for the 2nd leg down from the wedge on the daily chart is 2600 – 2650.

Since the Emini is in a trading range on the daily chart, there is confusion. In addition, the bulls will be disappointed by today’s opening drop. However, the bears will be disappointed if today reverses back up.

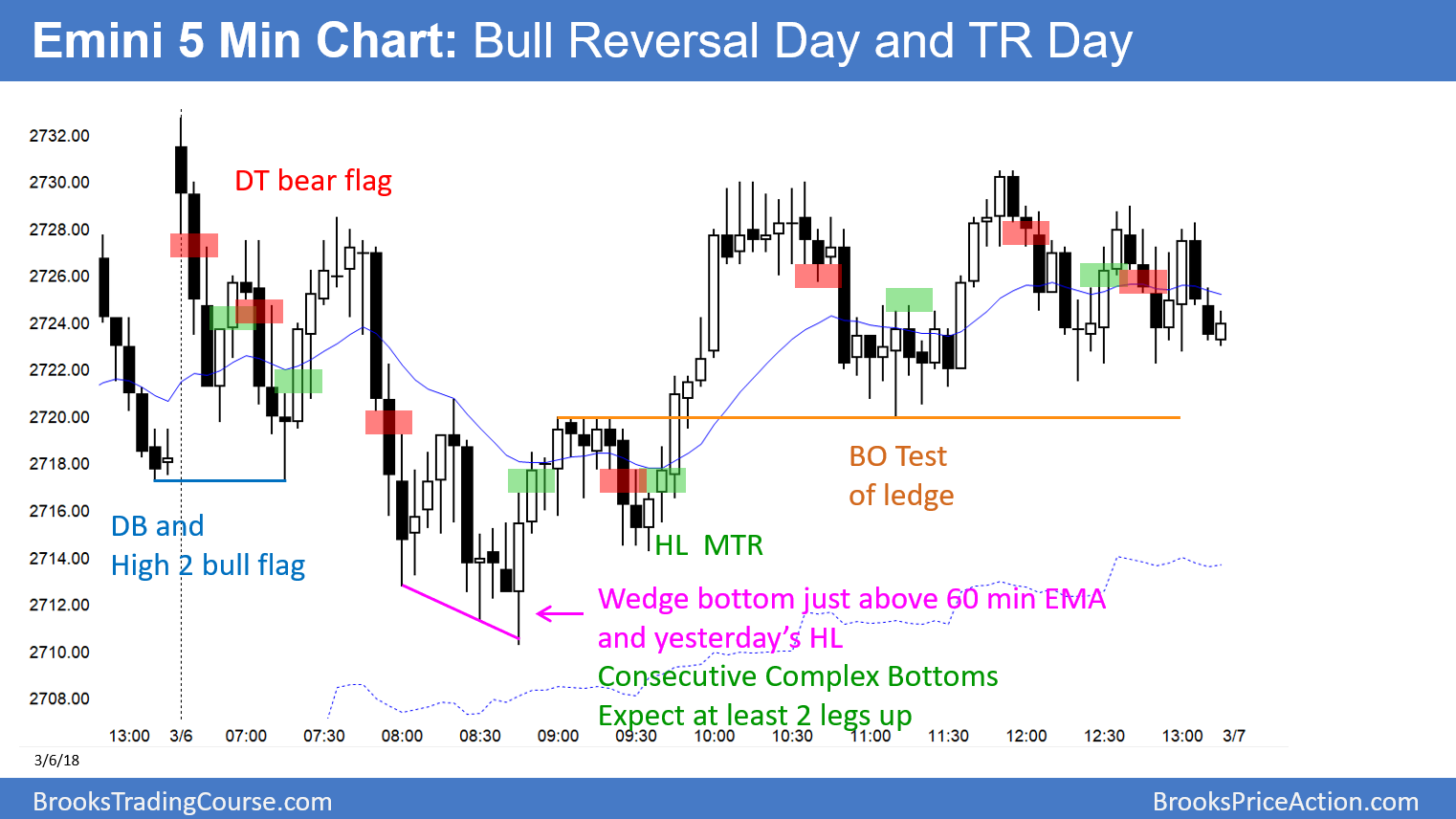

The Emini is in the middle of a 2-month trading range. This is the area of maximum confusion and disappointment. The odds therefore are that today will have at least one swing up and one swing down. The Emini will decide in the 1st hour which will come first.

Because a 2nd leg down on the daily chart is likely to begin within a week, today has an increased chance of being a bear trend day. Since last week rallied strongly, today has an increased chance of being a bull trend day.

Furthermore, this week might close on its high and form a buy signal bar on the weekly chart. The lack of a compelling reason for the Emini to go strongly up or down increases the odds of the Emini trading sideways today and tomorrow.

Yesterday’s Setups

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars.