EUR/USD little changed after Fed minutes

Macroeconomic overview: Minutes of the Fed's last policy meeting on June 13-14 showed that Federal Reserve policymakers were increasingly split on the outlook for inflation and how it might affect the future pace of interest rate rises.

The details of the meeting also showed that several officials wanted to announce a start to the process of reducing the Fed's large portfolio of Treasury bonds and mortgage-backed securities by the end of August but others wanted to wait until later in the year.

Last month's 8-1 vote to lift the benchmark interest rate another quarter percentage point, its second this year, signaled the Fed's confidence in a growing U.S. economy and the eventual inflationary effects of low unemployment.

In a press conference at the time, Fed Chair Janet Yellen described a recent decline in inflation as temporary and the central bank kept its forecast of one more rate rise this year and three the next. Some policymakers since then, however, have shown increasing worry about the Fed's struggle to get inflation back to its 2% objective. The Fed's preferred measure of underlying inflation slipped again in May to 1.4%, the Commerce Department reported on Friday, and has run below target for more than five years.

In the minutes, a few policymakers also said the inflation weakness made them less comfortable with the current implied path of rate hikes.

The rate-setting committee is next scheduled to meet to decide interest rate policy on July 25-26. We think that the next rate hike is likely in December.

The dollar was little changed against a basket of currencies after the release of the Fed’s minutes.

U.S. data on tap later in the day includes the ADP employment report, ISM non-manufacturing PMI and the initial jobless claims.

Investors will also look to comments from San Francisco Fed President John Williams and Fed Board Governor Jerome Powell.

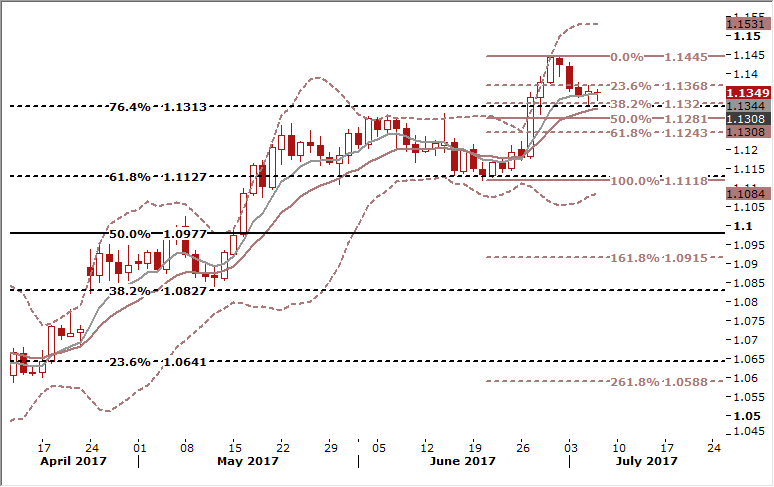

Technical analysis: The rebound from the 10-day moving average and failure to close under the 1.1320, 38.2% fibo despite the break and doji signal on the daily candles could give hope to EUR/USD bulls. On the flip side, we do not see any stronger signals suggesting comeback towards the double top at 1.1445.

Short-term signal: We still see a risk of further weakness in the EUR/USD rate. That is why we do not raise our bid. We are still looking to buy this pair at 1.1265.

Long-term outlook: Bullish

AUD/USD: Foreign trade surplus supports the Aussie

Macroeconomic overview: The Australian dollar got support from a higher-than-expected trade surplus today. The surplus surged to AUD 2.47 billion in May, more than twice market forecasts of AUSD 1.1 billion. The April surplus was revised down to AUD 90 million.

The recovery in export volumes should result in higher GDP growth in the second and third quarter. We think that real net exports will be neutral for growth in the second quarter, but its contribution to third-quarter GDP growth should be sizeable.

Despite sharp rebound in trade balance the currency is likely to have its worst weekly performance since early April. The drag came largely on Tuesday with bulls holding a grudge against the Reserve Bank of Australia (RBA) for sticking to its neutral bias on interest rates.

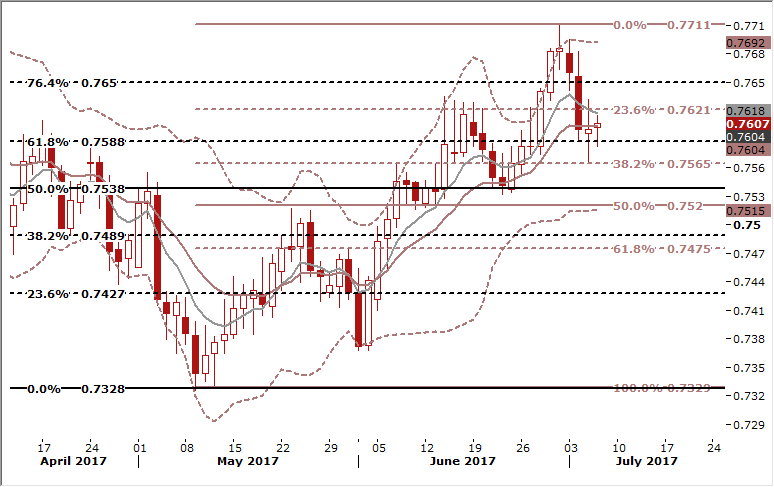

Technical analysis: The AUD/USD rebounded slightly above the 38.2% fibo of May-June rise yesterday and is trying to come back above short-term moving averages today. A close above the 14-day ema (currently at 0.7604) would support our bullish view.

Short-term signal: Our long was under pressure yesterday, but today’s comeback above the 14-day exponential moving average gives hope for further rise.

Long-term outlook: Bullish