Delta Air Lines Inc. (NYSE:DAL) began the third-quarter earnings season for the airline space on a bright note. The company’s earnings as well as revenues surpassed expectations, despite recent natural calamities.

The Atlanta, GA-based carrier’s third-quarter 2017 earnings (excluding 7 cents from non-recurring items) of $1.57 per share beat the Zacks Consensus Estimate of $1.54. Earnings, however, declined 7.6% on a year-over-year basis due to higher costs.

Operating revenues came in at $11,060 million, surpassing the Zacks Consensus Estimate of $11,036.6 million. Revenues increased 5.5% from the year-ago figure.

During the quarter, passenger revenues, cargo revenues and others increased 3.6%, 11.5% and 18.4%, respectively, on a year-over-year basis. Average fuel price (adjusted) was up 13.2% to $1.68 per gallon.

Operating Statistics

Revenue passenger miles (a measure of air traffic) increased 3.4% to approximately 61 billion. Capacity or available seat miles expanded 1.6% to 70.2 billion. Load factor (percentage of seats filled by passengers) improved 150 basis points year over year to 86.9% as traffic growth outpaced capacity expansion in the quarter, leading to packed planes.

Passenger revenue per available seat mile (PRASM) was up 1.9% year over year. In fact, this was the second successive quarter in which the carrier recorded quarterly unit revenue growth since the fourth quarter of 2014. In addition, passenger mile yield grew 0.2%.

Operating Expenses

Total operating expenses, including special items, increased 8% year over year to $9,221 million. Non-fuel consolidated unit cost or cost per available seat mile (CASM:normalized), including profit sharing, rose 2.6%, mainly owing to wage increases, product investments and accelerated depreciation pertaining to the carrier’s narrowbody fleet initiatives.

Liquidity

At the end of the third quarter, Delta had $1.48 billion in cash and cash equivalents and adjusted net debt of $8.8 billion. Operating cash flow and free cash flow in the quarter generated by the company were $1.6 billion and $471 million, respectively.

Dividend and Share Repurchase

Delta returned $769 million to its shareholders through dividends ($219 million) and share buybacks ($550 million) in the quarter under review. We are impressed with the company’s efforts to return greater value to its investors.

In May 2017, the company’s board of directors approved a new share repurchase program worth $5 billion. The new share buyback plan is expected to be completed by June 2020. The airline major also increased its quarterly dividend by over 50%.

Strong Q4 Guidance

For the fourth quarter of 2017, the carrier expects operating margin in the range of 11% to 13%. Fuel price, including taxes and refinery impact, is expected between $1.82 and $1.87 per gallon in the final quarter of the year. System capacity is expected to be up approximately 2% on a year-over-year basis.

The company expects passenger unit revenues to increase in the band of 2% to 4% (on a year-over-year basis) in the fourth quarter. Non-fuel consolidated unit cost (normalized), including profit sharing, is expected to increase in the band of 4% to 5% in the fourth quarter.

The upbeat fourth-quarter view, particularly with respect to passenger unit revenues, and the third-quarter outperformance pleased investors. Consequently, Delta Air Lines stock gained in early trading.

Upcoming Airline Releases

Chicago-based United Continental Holdings (NYSE:UAL) is scheduled to release third quarter results on Oct 18. Hawaiian Holdings (NASDAQ:HA) , headquartered in Honolulu County, HI., is slated to release its third-quarter results on Oct 19. JetBlue Airways (NASDAQ:JBLU) , based in Long Island City, NY, is slated to release its third-quarter results on Oct 24.

Zacks Rank

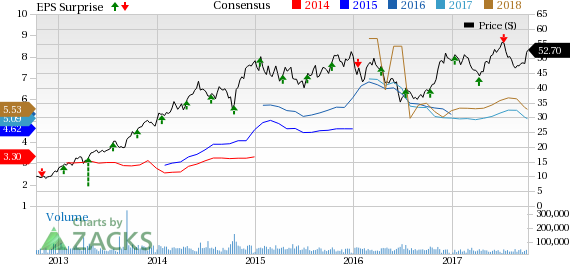

Delta Air Lines currently carries a Zacks Rank #5 (Strong Sell). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

JetBlue Airways Corporation (JBLU): Free Stock Analysis Report

Delta Air Lines, Inc. (DAL): Free Stock Analysis Report

United Continental Holdings, Inc. (UAL): Free Stock Analysis Report

Hawaiian Holdings, Inc. (HA): Free Stock Analysis Report

Original post

Zacks Investment Research