- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Top Ranked Momentum Stocks To Buy For March 23rd

Here are three stocks with buy rank and strong momentum characteristics for investors to consider today, March 23rd:

The Clorox Company (NYSE:CLX) (CLX): This manufacturer and marketer of consumer and professional products has a Zacks Rank #2 (Buy) and witnessed the Zacks Consensus Estimate for its current year earnings increasing 2.1% over the last 60 days.

The Clorox Company Price and Consensus

Clorox's shares gained 7.8% over the last one month compared to S&P 500’s fall of 30.9%. The company possesses a Momentum Score of A.

The Clorox Company Price

Regeneron Pharmaceuticals, Inc. (REGN): This biopharmaceutical company has a Zacks Rank #1 (Strong Buy) and witnessed the Zacks Consensus Estimate for its current year earnings increasing 8.4% over the last 60 days.

Regeneron Pharmaceuticals, Inc. Price and Consensus

Regeneron’s shares gained more than 100% over the last one month. The company possesses a Momentum Score of B.

Regeneron Pharmaceuticals, Inc. Price

Zeons Corporation (ZEON): This producer of bio fuels, including fuels for diesel, gasoline, and natural gas engines from agricultural feed stocks, such as soybeans and corn has a Zacks Rank #2 (Buy) and witnessed the Zacks Consensus Estimate for its current year earnings increasing more than 100% over the last 60 days.

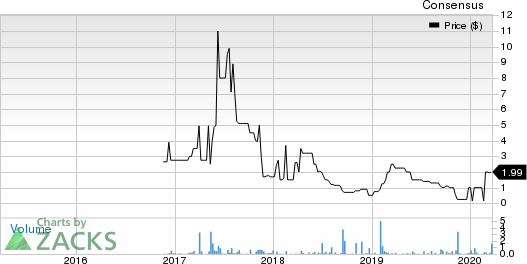

Zeons Corporation Price and Consensus

Zeons’ shares gained 65.8% over the last one month. The company possesses a Momentum Score of A.

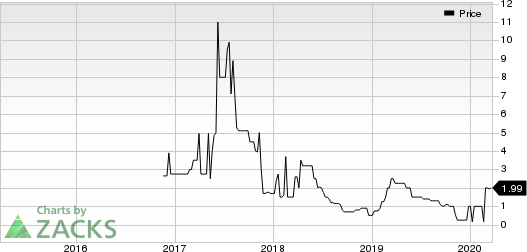

Zeons Corporation Price

See the full list of top ranked stocks here

Learn more about the Momentum score and how it is calculated here.

Free: Zacks’ Single Best Stock Set to Double

Today you are invited to download our latest Special Report that reveals 5 stocks with the most potential to gain +100% or more in 2020. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

This pioneering tech ticker had soared to all-time highs and then subsided to a price that is irresistible. Now a pending acquisition could super-charge the company’s drive past competitors in the development of true Artificial Intelligence. The earlier you get in to this stock, the greater your potential gain.

Zeons Corporation (ZEON): Free Stock Analysis Report

Regeneron Pharmaceuticals, Inc. (REGN): Free Stock Analysis Report

The Clorox Company (CLX): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Every investor should know the term CEP, or customer engagement platform, because it is central to businesses' use of AI. CEPs provide software services to connect and communicate...

As markets try to look through the blizzard of policy changes flowing out of Washington, the crowd has shifted its preferences considerably in recent weeks based on a sector lens....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.