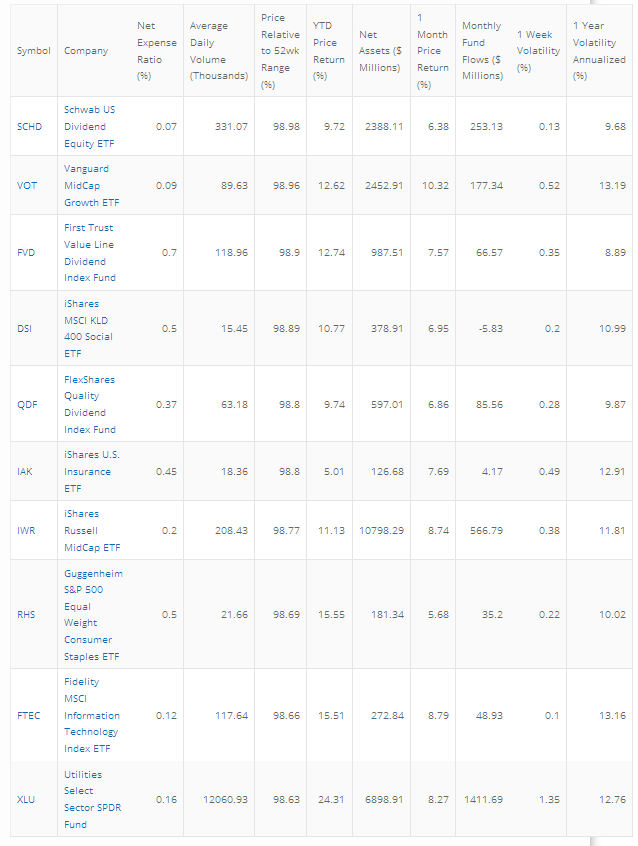

The data was compiled using CapitalCube's ETF Screener

With

the confidence in the US economy is increasing and hence dividend paying stocks and US mid caps are trading around 98% of their 52 week high. Momentum ETFs have been identified as those ETFs that are trading at a price discount to their 52 week high and have exhibited a positive momentum for the last one year.

Top 10 Momentum ETFs with assets of more than $25 million for Nov 11, 2014. (Non- Leveraged)

More on the top 3 momentum ETFs in the non leveraged category

-

The ETF seeks investment results that track as closely as possible before fees and expenses the total return of the Dow Jones U.S. Dividend 100 Index. Provides exposure to high dividend yielding stocks issued by U.S. companies that have a record of consistently paying dividends and have strong relative fundamental strength based on select financial ratios

- Seeks to track the performance of the CRSP U.S. Mid Cap Growth Index which measures the investment return of midcapitalization growth stocks. Provides a convenient way to match the performance of a diversified group of midsize growth companies. Follows a passively managed fullreplication approach.

- The First Trust Value Line Dividend Index Fund is an exchange traded index fund. The objective of the fund is to seek investment results that correspond generally to the price and yield before fees and expenses of the Value Line Dividend Index.

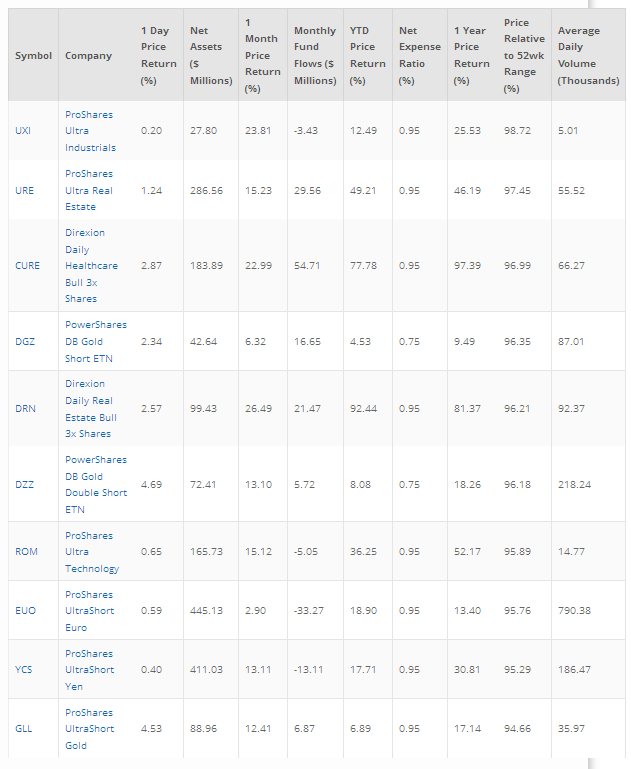

Top 10 Momentum ETFs with assets of more than $25 million for Nov 11, 2014. (Leveraged)

More on the top 3 momentum ETFs in the leveraged category

- ProShares Ultra Industrials seeks daily investment results before fees and expenses that correspond to twice (200) the daily performance of the Dow Jones U.S. Industrials Index.

- ProShares Ultra Real Estate seeks daily investment results before fees and expenses that correspond to twice (200) the daily performance of the Dow Jones U.S. Real Estate Index.

- The Daily Healthcare Bull 3x Shares seeks daily investment results before fees and expenses of 300 of the price performance of the Healthcare Select Sector Index. There is no guarantee the fund will meet its stated investment objective.