The dollar dropped against most major currencies on Tuesday, pressured by a surge in the euro, after the European Central Bank hinted that the days of the ECB’s aggressive stimulus are numbered.

Further pressure on the dollar came after a vote on U.S. healthcare legislation was delayed, while Fed chair Janet Yellen reiterated the need to raise rates “very gradually”. Yellen also left a positive note saying that banks are much stronger and much balanced nowadays and that another financial crisis is not likely in our lifetime.

The euro rose to 10-month highs after ECB President Mario Draghi said at a conference in Portugal on Tuesday that deflationary forces had been replaced by reflationary ones.

But any change in the ECB's stance should be gradual as "considerable" monetary support is still needed and the rebound in inflation will also depend on global financing conditions, he added.

For today, the heads of the ECB, BoE, Bank of Japan and Bank of Canada are to speak at the ECB central banking forum in Portugal.

Later in the day, the U.S. is to release figures on pending home sales.

The euro rallied around 1% against the dollar on Tuesday boosted by comments from European Central Bank President Mario Draghi, while the dollar was broadly lower following cautious remarks by Federal Reserve Chair Janet Yellen.

EUR/USD touched 1.1305, the highest level since June 14 and was at 1.1288 by 14.03 GMT.

Draghi mentioned that the ECB sees growth that is above trend and well distributed across the euro area, but reiterated that “a considerable degree” of stimulus is still needed in the euro zone, and that the ECB must be “prudent” in how it unwinds it.

For today the focus is shifted towards US housing data and speeches by several banking heads at the ECB central banking forum in Portugal.

Pivot: 1.1305

Support: 1.1305 1.128 1.1245

Resistance: 1.14 1.1425 1.146

Scenario 1: long positions above 1.1305 with targets at 1.1400 & 1.1425 in extension.

Scenario 2: below 1.1305 look for further downside with 1.1280 & 1.1245 as targets.

Comment: the RSI is bullish and calls for further upside.

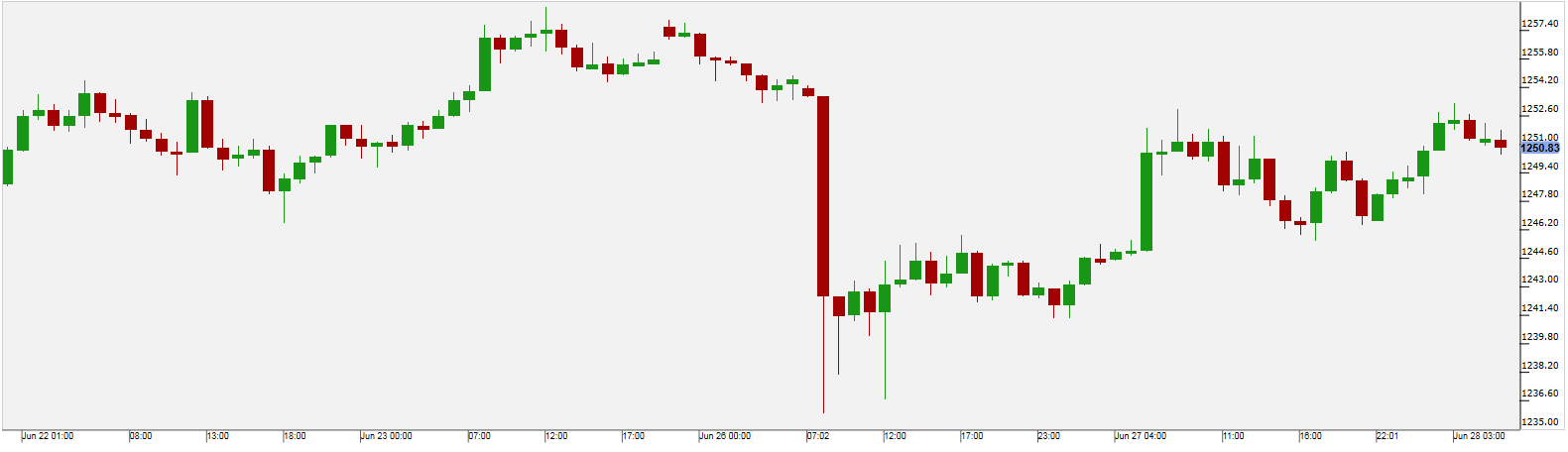

Gold prices recovered slightly from six-week lows, supported by weakness in the dollar as Fed chair Janet Yellen reiterated the need to raised rates “very gradually”.

A rise in treasury yields added significant pressure on gold which fell as low as $1236 on Monday, only to recover in later sessions, and to trade currently around $1251 per ounce at 06:25 am GMT on Wednesday.

US housing data and speeches by several banking heads at the ECB central banking forum in Portugal will be in the spotlight for today.

Pivot: 1246

Support: 1246 1241 1238

Resistance: 1257 1259 1263

Scenario 1: long positions above 1246.00 with targets at 1257.00 & 1259.00 in extension.

Scenario 2: below 1246.00 look for further downside with 1241.00 & 1238.00 as targets.

Comment: the RSI advocates for further advance.

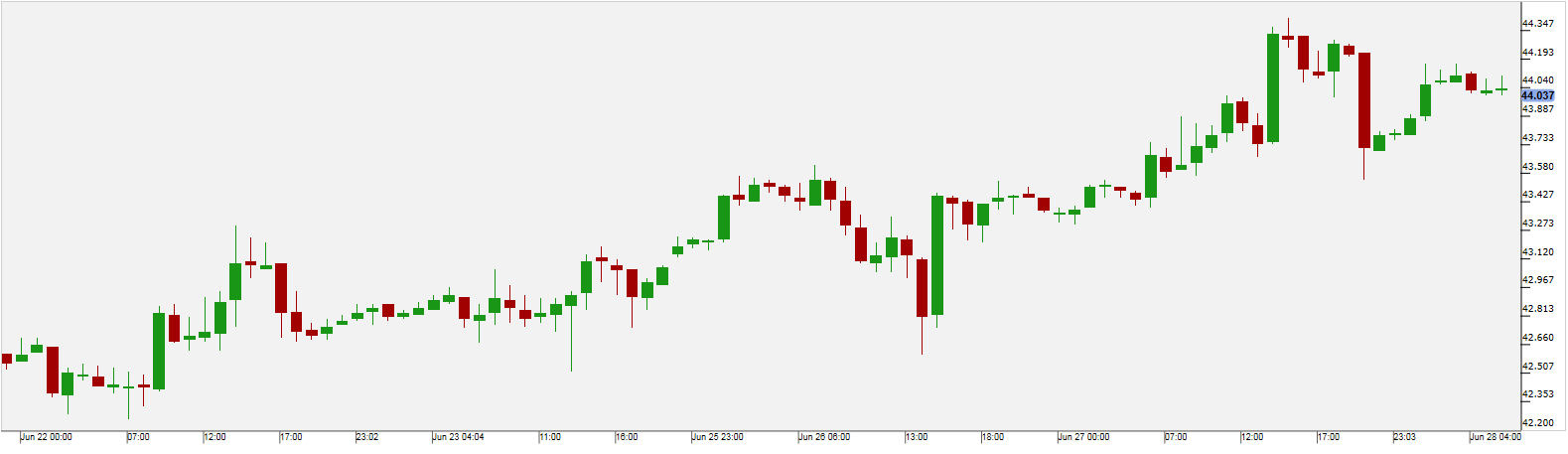

WTI Oil

U.S. crude oil prices traded higher on Tuesday, ending the day at $43.8 per barrel, despite a rise in inventories according to the API report.

The API reported an increase of 851K barrels in U.S. crude oil supplies for the week ending June 23, compared to last week's drop of 2.72M barrels.

The market generally expected a decline in weekly crude oil inventories as Tropical Storm Cindy disrupted production in the Gulf of Mexico last week.

Gasoline showed a build of 1.35M barrels and distillates showed a build of 678K barrels.

Inventory data from the Energy Information Administration will remain in focus for today.

Pivot: 43.55

Support: 43.55 43.25 42.9

Resistance: 44.65 44.98 45.25

Scenario 1: long positions above 43.55 with targets at 44.65 & 44.98 in extension.

Scenario 2: below 43.55 look for further downside with 43.25 & 42.90 as targets.

Comment: the RSI is mixed with a bullish bias.

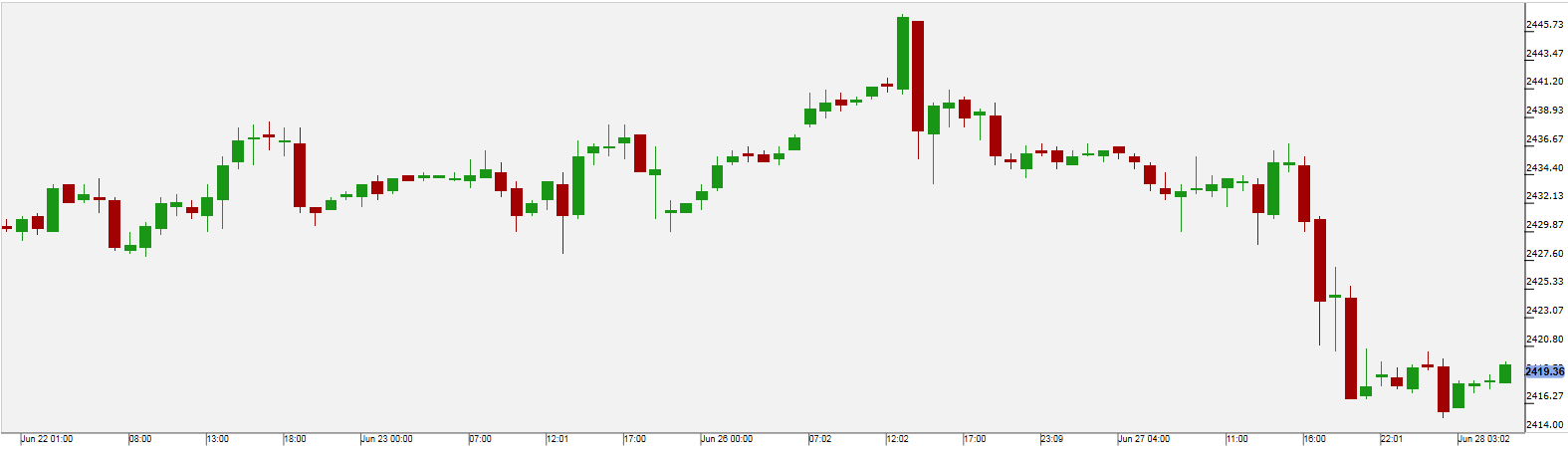

US 500

The main U.S. indices dropped after the close on Tuesday, as losses in the Technology, Telecoms and Utilities sectors led shares lower.

The best performers of the session were JPMorgan Chase & Co (NYSE:JPM) which rose 0.93% and Wal-Mart Stores Inc (NYSE:WMT) that added 0.68%.

The worst performers of the session were Verizon Communications Inc (NYSE:VZ) which fell 1.99%, Microsoft Corporation (NASDAQ:MSFT) that declined 1.87and Cisco Systems Inc (NASDAQ:CSCO) that was down 1.49%.

At the close in NYSE, the Dow Jones Industrial Average lost 0.46%, while the S&P 500 index declined 0.81%, and the NASDAQ Composite index lost 1.61%.

Pivot: 2428

Support: 2412 2409 2405

Resistance: 2428 2431 2437

Scenario 1: short positions below 2428.00 with targets at 2412.00 & 2409.00 in extension.

Scenario 2: above 2428.00 look for further upside with 2431.00 & 2437.00 as targets.

Comment: the RSI advocates for further decline.