The United States Mint, which is responsible for producing coinage for the US, is being overwhelmed by the effects of the coronavirus. The two different types of coinage that the US Mint produces—legal tender coinage and coin-related products such as silver and gold bullion coins, are each facing supply issues.

Coins such as pennies, nickels, dimes and quarters are becoming increasingly scarce as consumers shop less and turn to contactless payment methods, while the number of deposits from third-party coin processors has also declined. As a result, it's becoming increasingly common to see signs in stores telling customers that they will be unable to receive coin change for their purchases.

The US Mint is now asking for Americans' help to resolve the coin supply issue. They're asking people to make payments in exact change or return spare change to circulation.

"We ask that the American public start spending their coins, depositing them, or exchanging them for currency at financial institutions or taking them to a coin redemption kiosk."

"The coin supply problem can be solved with each of us doing our part."

The Mint also announced earlier this week that it is reducing the number of gold and silver coins it will distribute to authorized purchasers as the coronavirus has slowed production of the coins.

The Mint's West Point complex is anticipating slower coin production for the next 12 to 18 months. The complex is currently unable to produce gold and silver coins at the same time, thereby forcing them to choose one over the other based on demand. To gauge demand, the Mint is asking dealers for their 10-day and 90-day demand forecasts for the first time ever.

"The pandemic created a whole new set of challenges for us to manage," the US Mint said. "We believe that this environment is going to continue to lead to some degree of reduced capacity as West Point struggles to balance employee safety against market demand."

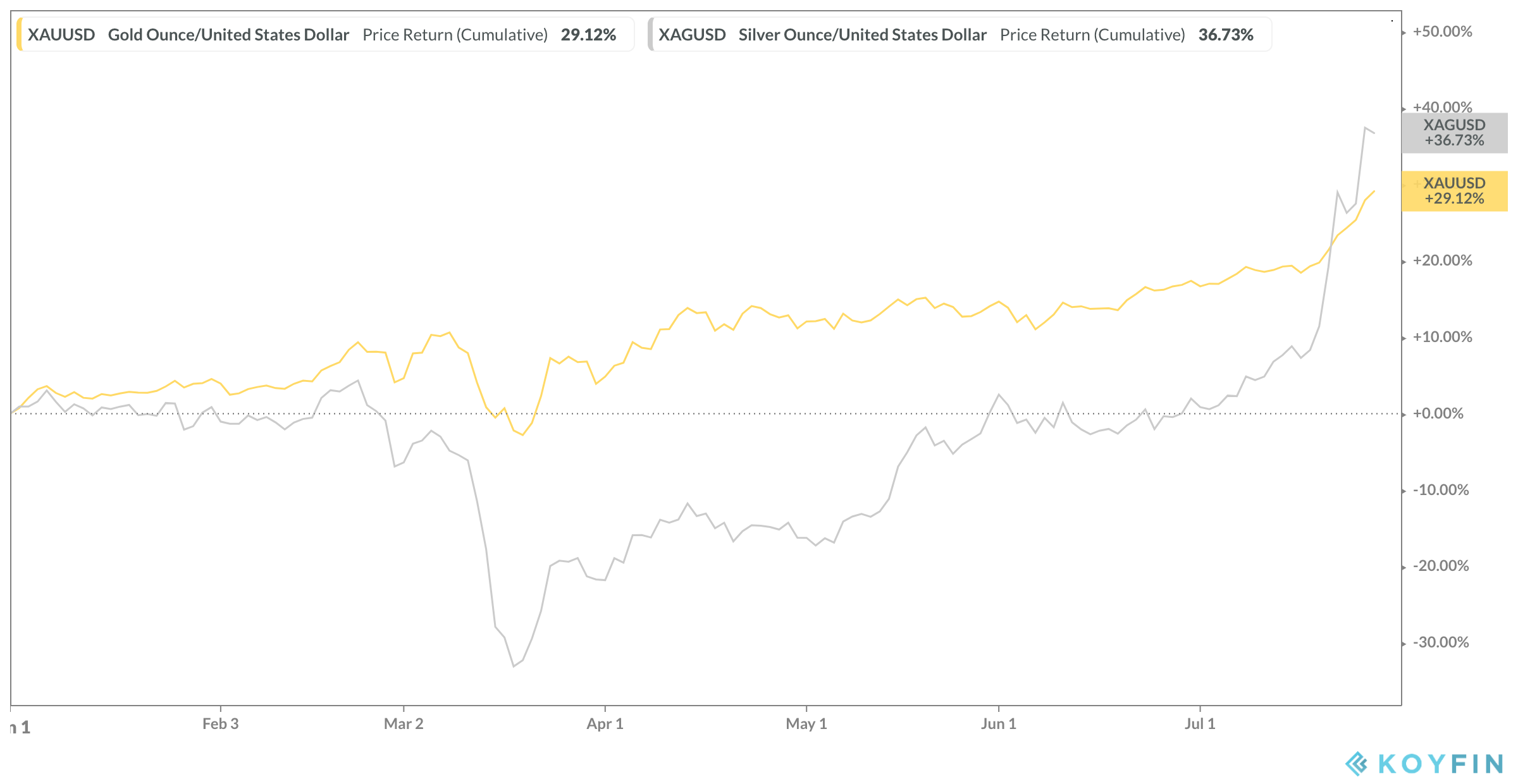

The timing of the supply reduction couldn't come at a worse time for the Mint. With gold and silver prices continuing to surge, gold and silver coins have become increasingly difficult to buy on popular online retailers' websites.

In regards to the coin shortage, it could end up leading people to question whether coins are really necessary anymore, as they turn to contactless payment methods. If that does end up happening, it could become the latest example of the coronavirus forcing a change that may have been inevitable regardless.