If the current minor correction in the market (SPY) does not continue, it will certainly result in the Fed tapering at the December meeting. Even without continued gains in the indices, the Fed is likely to begin tapering sooner rather than later with the December meeting being the most likely start date.

The reason for this is simple: as the market continues to higher PE multiples the potential for a catastrophic Minsky Moment approaches unity. A Minsky Moment is different than a stock market correction because the price collapse spreads to other assets. An example is the 2006 collapse in the housing bubble which spread (through securitization) to other assets classes, causing a general financial crisis in 2008.

People talk about the Fed's dual mandate of full employment and low inflation, but they don't mention the Fed's Prime Directive: stability of the financial system, the reason the Fed was established in 1913.

How close are we to a Minsky Moment? Usually this is really difficult to set a date to but two recent projections show a crisis in January 2014:

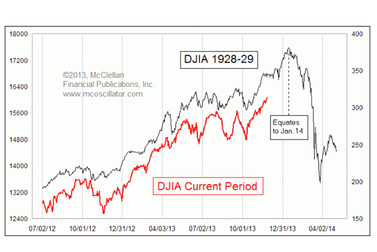

First is the DJIA performance leading up to the 1929 stock market crash. Via Anthony MIrhaydari, the chart below by Tom McClellan of the McClellan Market Report (informed by Tom Demark) shows a crisis point in January 2014 if the current market follows the 1929 market.

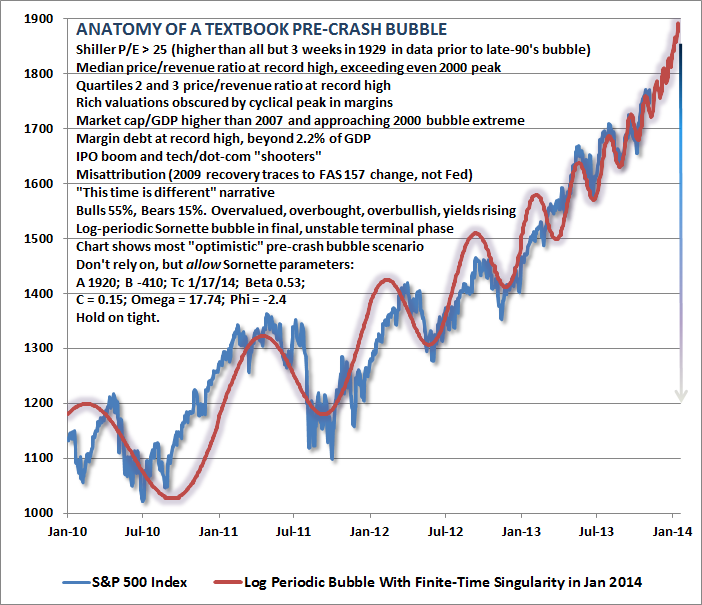

Second is an analysis presented by John Hussman in his November 25th "An Open Letter to the FOMC: Recognizing the Valuation Bubble In Equities". The chart is below and you will have to read the article for details as there is too much for me to cover here. Point is that Hussman concludes that a crisis could occur as early as December and as late as January.

The combination of a historical analysis and a theoretical analysis pointing to a crisis at the same time is particularly scary. Obviously, the actual crisis will occur at some other time, but the Fed will be aware of these sorts of analyses and will consider the actions they need to do to eliminate the potential for a catastrophic crash.

Even many of the optimistic forecasts are scary. A Barron's article by Jeremy Grantham forecasts that the markets could advance 20% to 30% over the next two years before "the third in the series of serious market busts since 1999." Grantham is generally accurate within an 18 month window so this could be sooner rather than later.

The Fed is in a dangerous situation: No action at the December meeting will be a go signal for the market to continue to unsustainable levels, but an aggressive taper will immediately trigger the financial crisis they want to avoid. Most likely, the Fed will do a "tiny taper" of around $5 billion which Hussman described as "so small that it could make the Fed appear timid" - a position that will not scare the markets into a crash.

Why December is the Month Taper Will Start:

Bernanke is leaving in December. If Taper is started as his last action, Yellen has the option/excuse of making changes to correct his "mistakes" once her term starts (and when she can see how the markets react.) If there are negative economic reactions or the market plunges too fast, she can modify or even reverse the taper quickly under the guise of placing her stamp on Fed actions.

What the Fed Will Do:

The Fed will be aiming for a sideways moving market with a worst-case scenario of a gradually decreasing market. A "Minsky Moment" is a financial crisis caused by financial intermediaries (AKA banks and shadow banks) reducing lending due to changes in risk perceptions - as long as the stock market deflates slowly enough that cash squeezes are manageable there will not be a crisis.

The current downward action in the market in anticipation of taper is predictable and will not deter the Fed until drops approach 15% (based on previous ends of QE) or signs of financial distress occur in the banking system. Even then, the Fed may decide to support distressed banks rather than increase QE as academic studies have shown QE to be ineffective at supporting most economic activity except housing.

The best overview of the effect of QE is the paper presented by Arvind Krishnamurthy of Northwestern University and Annette Vissing-Jorgensen of the University of California, Berkeley at the 2013 Jackson Hole conference titled, The in's and out's of LSAP's (Large Scale Asset Purchases). This paper gave a suggested exit pathway which the Fed will probably follow, with modifications. The steps, in order, are: Cease Treasury purchases; Sell Treasury portfolio; Sell older MBS; Cease new MBS purchases.

The Fed will also be trying to moderate increases in interest rates for the critical housing sector, so they might modify the above by increasing purchases of high-quality mortgage-backed securities and decreasing purchases of treasuries, which they currently purchase in about twice the quantity of MBS's.

How to React:

Investing in this situation is "difficult" to say the least. If the Fed does taper, then stocks are going to perform poorly. In addition, Treasuries will probably also perform poorly with MBS's potentially performing well.

If the Fed doesn't taper, then the potential for a catastrophic crash at some point in the near future increases exponentially as the stock market will immediately take off like a rocket.

Investors will have to prepare to exit the market and safe haven investments such as Treasuries and gold will become very attractive - though Treasuries can be expected to be very volatile. (Note that safe haven investments should be exited within two weeks of the crisis peak to maintain gains.)

Alternatively, you could follow the Alfred E Newman theory of investing, "What, me worry?" as most investors seem to be doing - the Investors Intelligence Bulls minus Bears poll has bullish sentiment in the 96 percentile.

We will find out exactly what the Fed will do in a few days. Even after their decision is announced, investors will remain in what is probably the most difficult investing situation in modern history with high stock and bond valuations, low interest rates and weak global economic growth.

Conservative investors have no good options and should be happy with increased cash positions until GDP growth solidifies or a significant market correction occurs. The upside is that speculators will have many opportunities to make or lose money.