Most markets around the world snapped back last week, putting passive beta portfolios back in the lead for performance.

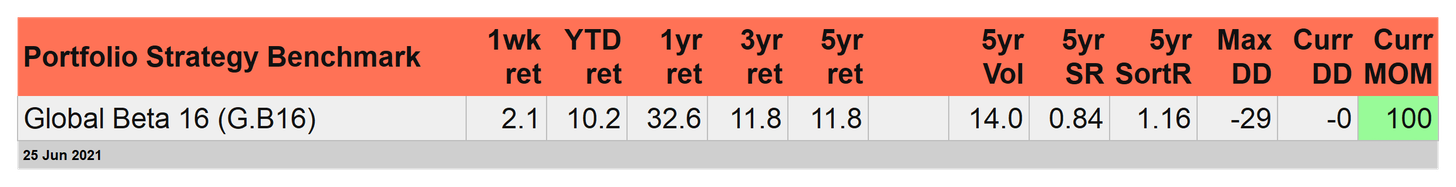

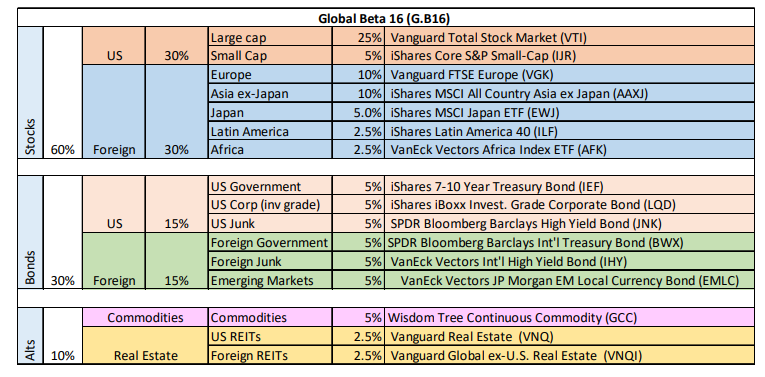

Global Beta 16 (G.B16), the benchmark for our three proprietary strategies, outperformed with a strong 2.1% gain for the trading week through June 25. G.B16 holds all 16 funds in the standard opportunity set on these pages and is rebalanced to target weights at the end of each calendar year (see table of weights below).

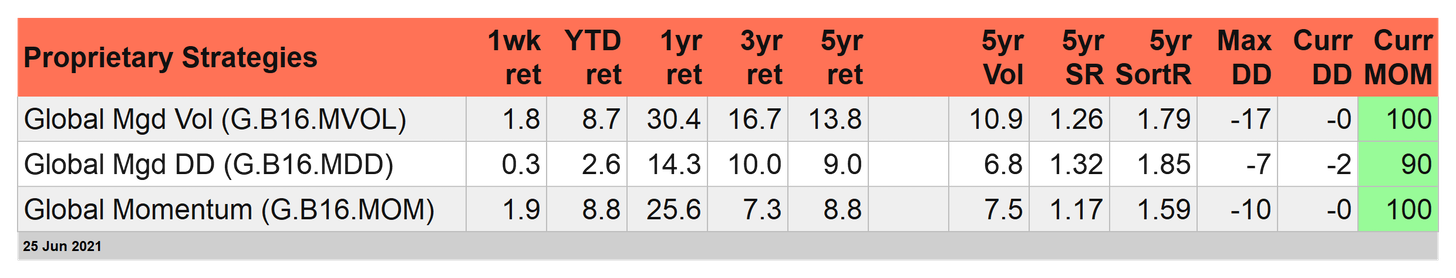

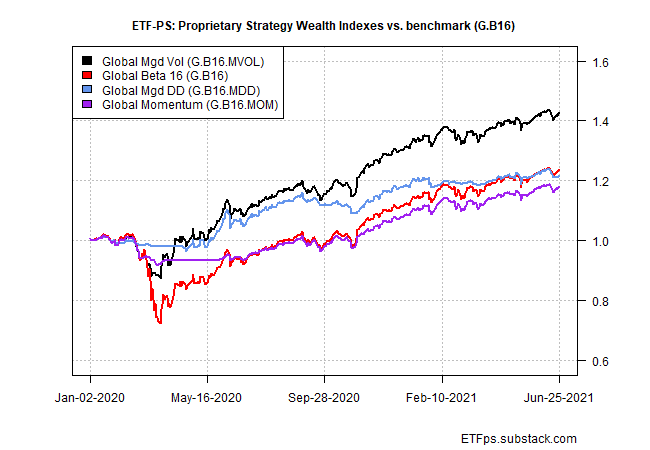

Global Momentum (G.B16.MOM) came closest to matching the benchmark’s gain: G.B16.MOM rose 1.9% last week. Global Managed Volatility was a close second with a 1.8% gain. A distant third: Global Managed Drawdown (G.B16.MDD), which added a modest 0.3% last week. For details on strategy rules and risk metrics in the tables below, please see this summary.

For longer-run results, the proprietary strategies continue to post competitive results vs. the benchmark, especially on a risk-adjusted basis. Trailing 5-year Sharpe and Sortino ratios, for instance, are substantially higher than the equivalents for G.B16.

Nonetheless, 2021 continues to highlight that simple, globally diversified portfolios remain tough to beat. On a year-to-date basis, G.B16 still has a performance edge over our trio of prop strategies.

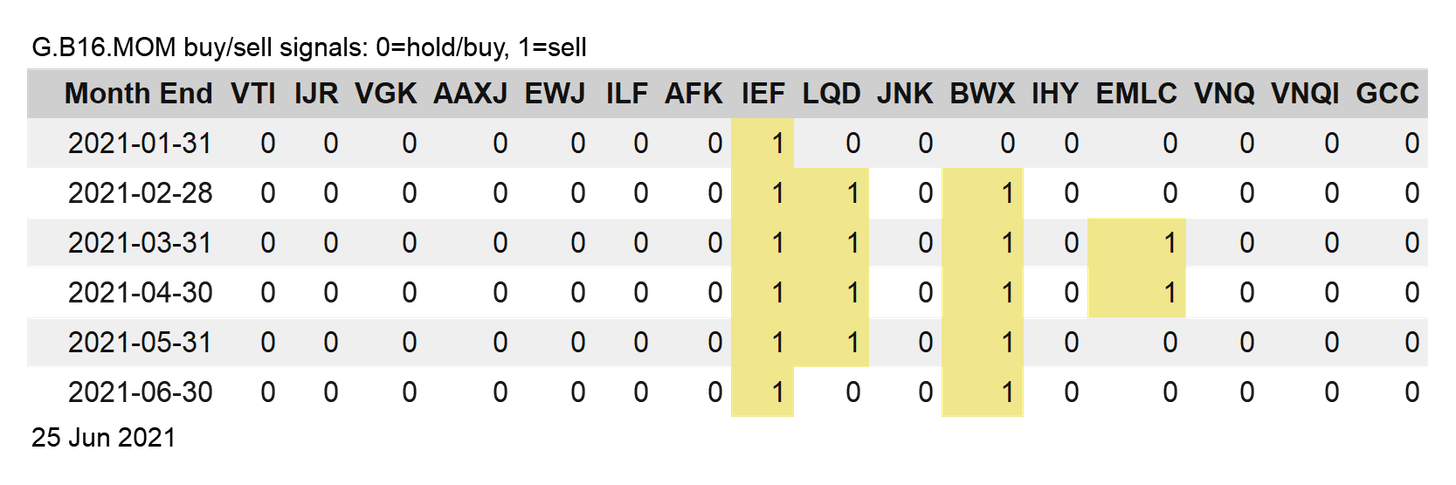

On the rebalancing front, G.B16.MOM shifted to a slightly more aggressive risk-on profile as of Friday’s close, as shown in the table below. (Note: G.B16.MOM uses a monthly rebalancing schedule.)

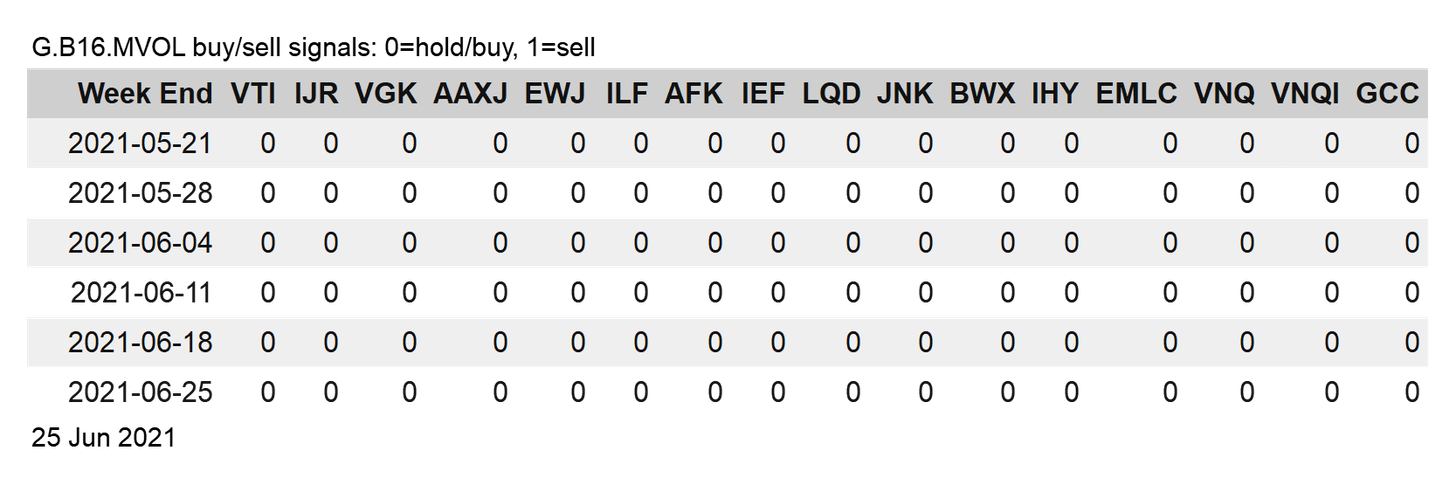

Meanwhile, G.B16.MVOL remains in an all-out risk-on position.

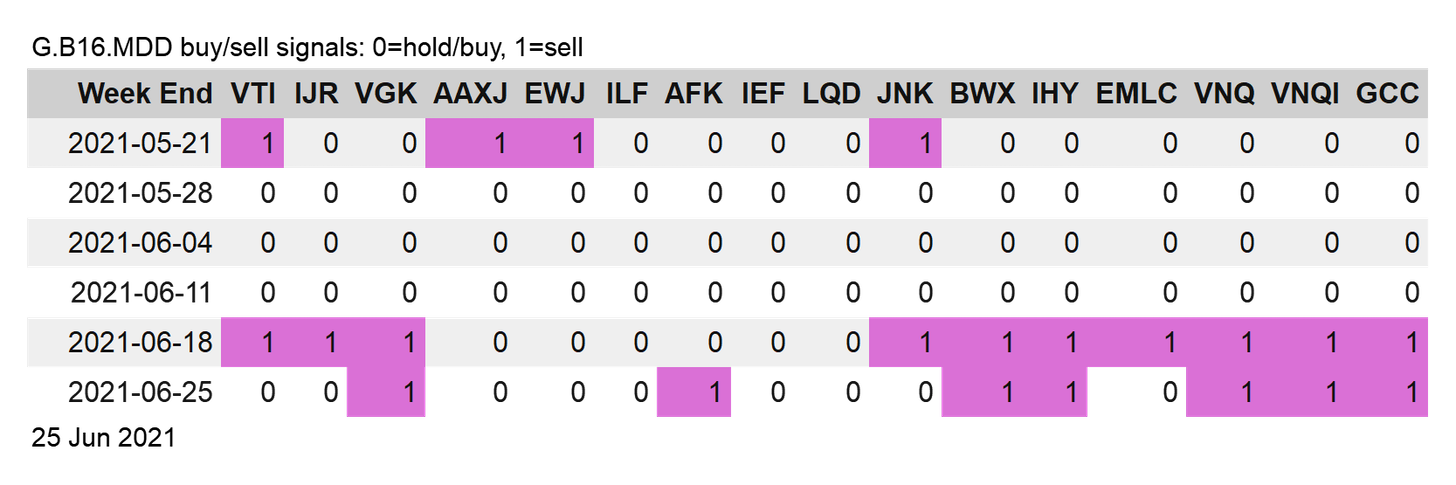

G.B16.MDD is still the most cautious of the three proprietary strategies, albeit slightly less so in the wake of last week’s market action.