These are strange and mysterious times, and unless you are the staunchest contrarian, then these are times to be very cautious.

Whether you believe in technical analysis or not, global equity markets are trending lower. This suggests looking much more aggressively at shorting opportunities, or at least being neutral. One will be hard pushed to find a developed market above their 50-day moving average, and it seems that today’s US session marked the point where the S&P 500 joined in.

The US markets have held up well of late, being viewed as somewhat of a safe-haven. This view seems to have deteriorated somewhat with the S&P 500 closing below its multi-month trading range – a fate the credit markets and US yield curve have been screaming for some time. Equities always follow credit.

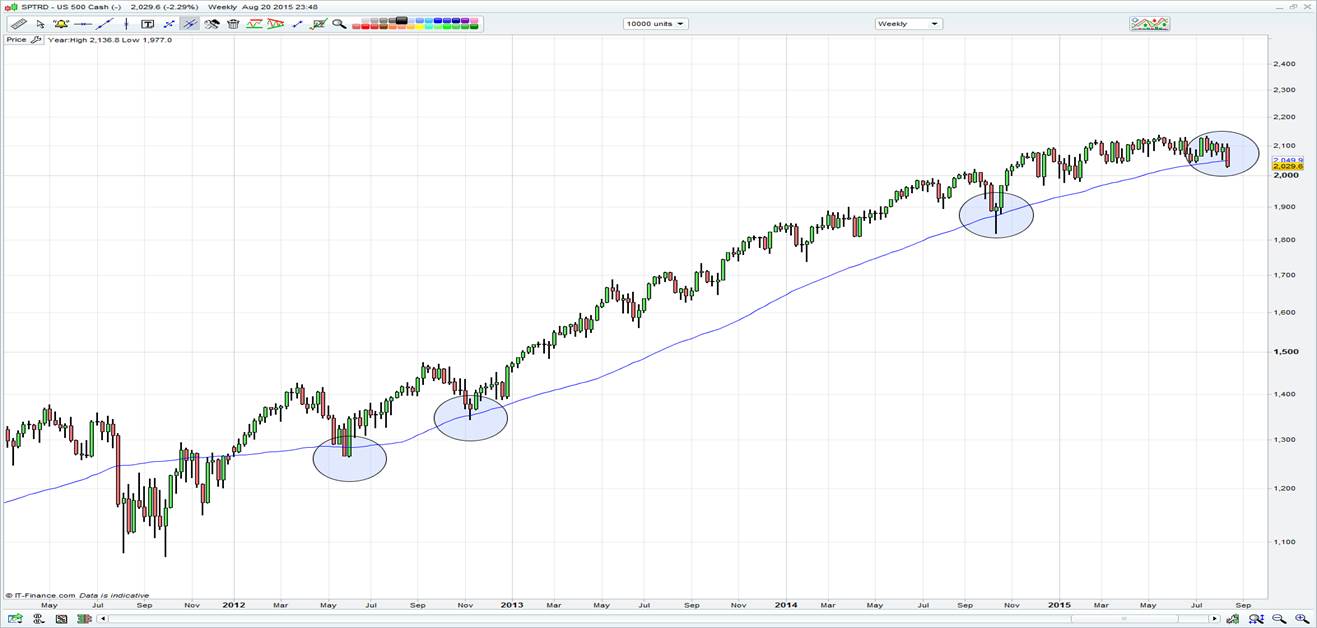

The bears will now be eyeing the December lows of 1972; however, I would urge traders to look at the 55-week moving average (currently 2048) – See chart below. The S&P is now firmly below this average and looks set to close the week below this level, a fate it has avoided for 167 weeks. This is important, as we have seen investors support the index in late 2012, 2013 and 2014, so a convincing move through this average could be the sign a deeper correction is on the cards.

Certainly European markets look horrible at present, as does the Hang Seng and H-shares. The Nikkei 225, despite the recent strong earnings season, is going to open sharply through the 20,000 area. The Shanghai Composite closed right on the 200-day moving average and it will be interesting to see if China Finance Corp. can actively support the market today. The issue many foreign traders have is what happens when the Finance Corp stops supporting the equity market. It seems that every time traders see signs that the State is not buying, the Chinese markets get sold off heavily. When do they stop buying? Will they stop buying?

The irony of what we are seeing is that whatever the Federal Reserve does in September, global markets would still sell off. Clearly the chances of a move in the fed funds rate in September has diminished, but the market is still placing a 34% probability of this occurring. One struggles to see how they hike when inflation expectations are in free-fall and the trade-weighted USD (in nominal terms) is at multi-year highs. Still, the fact we have seen concerns from the Fed (in the July minutes) and a repricing of expectations from markets has generally raised concern levels in the capital markets, and implied volatility measures have spiked.

We need to remember that this isn’t a US problem as such. This stems from the emerging markets, and the fact is that despite a bloodbath in the domestic currencies, producer price deflation persists in all major Asian countries – except Indonesia. The problems is global debt levels, which have simply sky rocketed since the Fed moved to a Zero Interest Rate Policy. The problem is the lack of ammunition that developed market central banks have, if we see the issue of low inflation become something more sinister. Where is the support mechanism?

If we do see something much more pronounced in global markets, the epi-centre is Asian emerging markets. We are now hearing news (source: Xinhau) that Kim Jong Un has ordered its military into a state of war and that will keep markets on edge. These issues put Australia in the firing line and to a degree we are already seeing this play out with the ASX 200 looking to test 5200 on open. I was looking at levels to be long in the ASX 200 earlier in the week, but as stated, the macro backdrop and technicals need to be respected. A bounce will come, but it feels like there’s much more to play out in this story, and the US has only just joined in.

Interestingly, copper has actually rallied from yesterday’s close and the miners performed well in London. BHP's (NYSE:BHP) American Depository Receipts (ADR) are suggestive of the miner opening on a modestly stronger footing, so the fact our opening index call is so bearish suggests banks are going to be savaged on open.

This issue could change if today’s Caixin China manufacturing PMI index falls to improve to 48.2 and the miners could see deterioration into the close. One also feels for those companies who have to report earnings, and clearly you are not going to get the appreciation you deserve if you report better-than-forecast numbers.

Trade of the day: I would be a buyer of EUR/AUD on a break of the December high of A$1.5336. The EUR has become somewhat of a safe-haven given the current account surplus, while the AUD is still seen as having sharp vulnerabilities, given the moves in emerging markets. Strength should breed strength here.