- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Tenet Healthcare Sells MacNeal Hospital To Streamline Trade

Tenet Healthcare Corporation (NYSE:THC) has recently completed the sale of MacNeal Hospital and its associated operations to Loyola Medicine, an affiliate of Trinity Health. The company has also sold its minority interest in Baylor Scott & White Medical Center.

MacNeal Hospital’s divestiture marks one of the multiple business-streamlining steps taken by Tenet Healthcare due to its sufferance from a decline in admissions, inpatient and outpatient surgeries, emergency department visits and total outpatient visits.

The company has also completed the divestiture of its Philadelphia-area acute care hospitals and related operations to American Academic Health System, LLC, an affiliate of Paladin Healthcare in January 2018. These divestitures have generated more than $550 million of cash proceeds in the first quarter of 2018.

The company also sold its Huston-based hospitals and related operations to HCA Healthcare Inc. (NYSE:HCA) last quarter. This continuous sale of units aims at making a consistent improvement in its business portfolio by exiting non-core and least profitable business lines.

Tenet Healthcare has been utilizing the sale proceeds generated from its subsidiaries to repay debt and reduce interest burden as well as strengthen the company’s balance sheet in turn. At the end of 2017, the company’s long-term debt lowered 2% year over year.

The funds are also being invested in growth areas such as the company's Ambulatory platform wherein it targets $100-$150 million of annual acquisition opportunities.

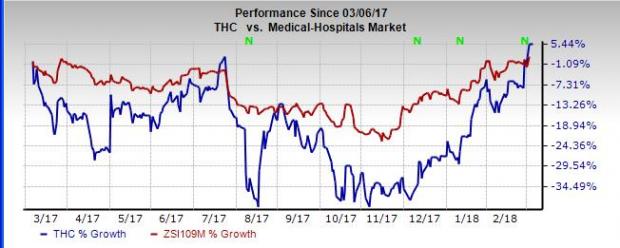

In a year’s time, shares of Tenet Healthcare have gained 5.4%, outperforming the industry’s rise of 1.4%.

Another player in the same space, Community Health Systems, Inc. (NYSE:CYH) has been engaged in frequent divestitures to streamline its core businesses and reduce long-term debt. Of late in February 2018, Community Health signed definitive agreements to sell off a 60-bed Byrd Regional Hospital and its associated assets to the subsidiaries of Allegiance Health Management.

Zacks Rank

Tenet Healthcare holds a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Stock to Consider

A better-ranked stock from the hospital industry is Universal Health Services, Inc (NYSE:UHS) , having delivered positive surprises in two of the last four quarters with an average beat of 0.2%.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Universal Health Services, Inc. (UHS): Free Stock Analysis Report

Tenet Healthcare Corporation (THC): Free Stock Analysis Report

Community Health Systems, Inc. (CYH): Free Stock Analysis Report

HCA Holdings, Inc. (HCA): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Shares of Caesars Entertainment (NASDAQ:CZR), a leading gambling stock, traded around 3% higher on Wednesday morning, though the stock was trading around 1.5% lower shortly before...

Amazon (NASDAQ:AMZN) is making a significant push into the future with a robust investment in robotics and artificial intelligence. The company has earmarked $35 billion for...

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.