- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

TE Connectivity (TEL) Shares To Propel On Intrinsic Strength

Investors seem to be optimistic about TE Connectivity Ltd. (NYSE:TEL) recent earnings beat streak, as the company’s earnings have trumped estimates in each of the four trailing quarters.

This has been an impressive year for the company. We expect this Zacks Rank #2 (Buy) company to retain this bullish momentum going forward, driven by rise in global auto production, continued progress on strategic priorities and solid execution. As investors continue to seek both growth and value in the market, infrastructure stocks which are priced fairly relative to earnings, might witness soaring share prices in 2018 as well.

Investors also seem to think the same, as they have favored this stock in recent times. The company has outperformed the industry quarter to date, having appreciated 14.7% compared with the industry’s gain of 9.7%.

TE Connectivity recently reported fourth-quarter fiscal 2017 results, wherein it reported its eighth consecutive earnings beat, buoyed by encouraging industry trends and solid operational execution. Its adjusted operating margins expanded 110 basis points to 16.8%, with contribution from all three segments, highlighting robust operational execution. The company is enjoying sturdy momentum in emerging markets in Asia, which were up 16% year over year in the fiscal fourth quarter, outstripping the solid growth of the more mature American and European markets, which rose 9%.

The company actually recorded 9% revenue growth and 8% organic growth in fiscal 2017, which, according to CEO Terrence Curtin, is best-in-class, compared with its industrial technology peers. The transportation segment registered 11% growth in the year, much ahead of the global oil production growth of 3%, reflecting consistent outperformance due to content growth trends as well as robust global position.

In terms of guidance, the company is optimistic about 2018 being another strong year. It expects 6% top-line growth, of which 4% would likely be organic. The company also expects double-digit growth in adjusted earnings.

SubCom, the deep sea cable component of TE Connectivity’s business, which has been weak this year, is anticipated to rebound to a strong fiscal 2018. Further, several new projects are in the pipeline for the coming fiscal, including a trans-Pacific Asian-U.S. cable. In addition, the company expects to address a project backlog worth a whopping $1 billion in the next fiscal.

Of late, TE Connectivity’s transportation business has been displaying remarkable signs of progress. Growth in electronic content and a rich pipeline of platform ramps from design wins bode well for the company’s transportation business in fiscal 2018.

The consensus analyst community’s optimism toward the stock is reflected in its upward earnings estimate revisions. The stock has seen the Zacks Consensus Estimate for fiscal 2018 earnings being revised upward to $5.02 from $5.27 over the past 60 days, and reflects bullish analyst sentiment.

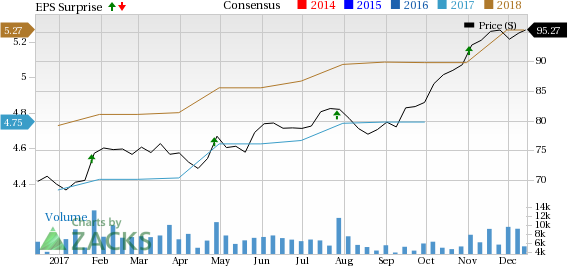

TE Connectivity Ltd. Price, Consensus and EPS Surprise

This technological infrastructure firm remains the market leader in the connectivity and sensor business, with about 80% of its revenues being driven by harsh environment applications. Over the past five years, the company’s harsh applications business has experienced mid-single digit growth, fueling top-line growth.

The company believes this business will provide ample opportunities for margin expansion. Also, it might help fend competition from key players, including Hubbell Incorporated (NYSE:HUBB) , Honeywell International Inc. (NYSE:HON) and Amphenol Corporation (NYSE:APH) . You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

TE Connectivity’s business is well diversified, and it enjoys a strong foothold in each of the sectors it operates in. The company’s harsh sensors will likely begin to find new markets soon, given rapid advancement in areas such as the Internet of Things.

Overall, we anticipate sturdy demand in end markets, along with an overarching business model, will continue to stoke TE Connectivity’s growth in times to come.

Zacks Editor-in-Chief Goes "All In" on This Stock

Full disclosure, Kevin Matras now has more of his own money in one particular stock than in any other. He believes in its short-term profit potential and also in its prospects to more than double by 2019. Today he reveals and explains his surprising move in a new Special Report.

Honeywell International Inc. (HON): Free Stock Analysis Report

TE Connectivity Ltd. (TEL): Free Stock Analysis Report

Amphenol Corporation (APH): Free Stock Analysis Report

Hubbell Inc (HUBB): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Nvidia’s earnings beat didn’t erase investor concerns over slowing growth. Soft Q1 guidance and valuation worries may limit the stock’s upside. Weak network and gaming sales...

Shares of Etsy (NASDAQ:ETSY) are down approximately 7% since the company reported earnings on February 19. Concerns over slowing growth are overriding revenue and earnings that...

Warren Buffett and Berkshire Hathaway (NYSE:BRKa) always make headlines in February when the firm holds its annual meeting. Among the many takeaways is what the company has been...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.