- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

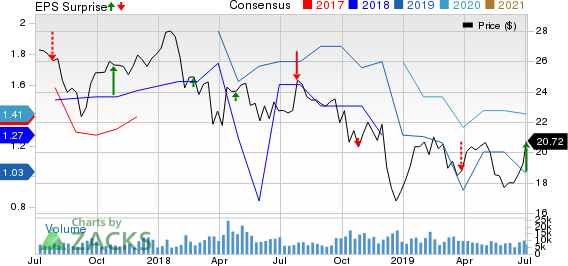

Jefferies (JEF) Stock Up 6.4% As Q2 Earnings Beat Estimates

Shares of Jefferies Financial Group Inc. (NYSE:JEF) gained 6.4%, following the release of its second-quarter 2019 results. Adjusted earnings per share for the three-month period ended May 31, 2019, was 41 cents, surpassing the Zacks Consensus Estimate of 24 cents.

The company’s results benefited from improvement in revenues. However, higher expenses created a headwind. The Merchant Banking and Corporate segment’s performance was decent.

In the reported quarter, there was a non-recurring tax benefit. After taking its impact into consideration, net income attributable to shareholders for the three months ended May 31, 2019, was $670.8 million. This compares with net income attributable to shareholders of $725.5 million recorded in the three months ended Jun 30, 2018.

Revenues Improve, Expenses Rise

Net revenues for the reported quarter were $1.10 billion, up from $911.2 million recorded in the three months ended Jun 30, 2018. The figure surpassed the Zacks Consensus Estimate of $927.3 million.

Total expenses were $940.3 million, up from $907 million reported in the second quarter of 2018. This increase was due to rise in compensation and benefits costs, floor brokerage and clearing fees, and depreciation and amortization costs.

Segmental Information

Jefferies Group: This segment reported net revenues of $901.9 million in the three months ended May 31, 2019, up from $822.6 million recorded in the three months ended Jun 30, 2018. Expenses were $746.7 million, up from $700.7 million recorded in the second quarter of 2018.

Merchant Banking: Net revenues were $187.3 million in the three months ended May 31, 2019, up from $86.4 million recorded in the three months ended Jun 30, 2018. Expenses were $158.3 million, down from $169.8 million recorded in the three-month period ended Jun 30, 2018.

Corporate: This segment reported net revenues of $9 million, up from $3 million recorded in the three months ended Jun 30, 2018. Expenses were $22.9 million, down from $24.2 million recorded in the second quarter of 2018.

Share Repurchases

During the reported quarter, the company repurchased 7.8 million shares for $150 million.

Our Viewpoint

Jefferies is a geographically diversified company, with presence in almost all the major global markets. Thus, risks stemming from geographical diversification might hurt financials. Moreover, elevated costs are likely to hurt profits. However, decent revenue growth remains a positive for the company. Further, supported by a solid capital position, Jefferies is expected to continue enhancing shareholder value through efficient capital deployment activities.

Currently, the company carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Among the other finance companies, Citigroup Inc. (NYSE:C) is scheduled to report quarterly results on Jul 15. JPMorgan Chase (NYSE:JPM) and The Bank of New York Mellon Corp. (NYSE:BK) are expected to report numbers on Jul 16 and Jul 17, respectively.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

JPMorgan Chase & Co. (JPM): Free Stock Analysis Report

Citigroup Inc. (C): Free Stock Analysis Report

The Bank of New York Mellon Corporation (BK): Free Stock Analysis Report

JEFFERIES FINANCIAL GROUP INC. (JEF): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Shares of Caesars Entertainment (NASDAQ:CZR), a leading gambling stock, traded around 3% higher on Wednesday morning, though the stock was trading around 1.5% lower shortly before...

Amazon (NASDAQ:AMZN) is making a significant push into the future with a robust investment in robotics and artificial intelligence. The company has earmarked $35 billion for...

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.