- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Synopsys Boosts Portfolio With Black Duck Software Buyout

Synopsys, Inc. (NASDAQ:SNPS) recently completed the acquisition of Black Duck Software announced in November. Black Duck is a provider of solutions related to security and management of open source software. The deal was valued at $547 million net of cash acquired.

Synopsys is a vendor of electronic design automation (EDA) software to the semiconductor and electronics industries. Black Duck’s flagship product, Software Composition Analysis is anticipated to enhance Synopsys’ solutions as well as broaden its clientele, thus boosting the top line.

Synopsys’ Software Integrity Platform combines testing technologies and automated analysis for detection and remediation of defects and vulnerabilities at the beginning of the development process to ensure minimal risk and optimum profit levels.

Notably, the rapid increase in the use of open source software (OSS) that comprises almost 60% of the underlying codes in current applications has lowered development costs but is plagued by security breach issues. The addition of Black Duck’s software solutions will detect known security vulnerabilities affecting open source code and also generate alerts for the same. This will improve the effectiveness of Synopsys’ solutions.

Acquisitions: A Key Growth Driver

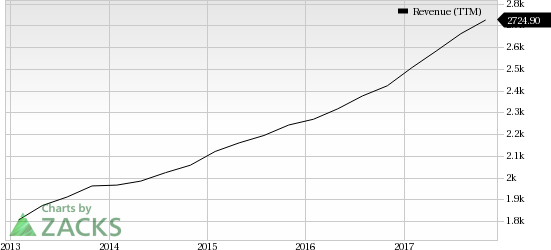

Acquisitions are central to Synopsys’ growth strategy and are helping it to gain access to newer markets and technologies. Intense competition from the likes of Cadence Design Systems Inc. (NASDAQ:CDNS) and Mentor Graphics Corporation has made the EDA market tougher to penetrate. Synopsys’ acquisitions have helped it to boost revenues.

Most recently, Synopsys acquired Forcheck, which offers static code analysis tools in Fortran applications. These tools meet the industry coding standards and compliances. Prior to that, the company had added Cigital, Codiscope and Simpleware to its kitty.

The acquisitions have expanded the company’s product suite thereby driving the company’s top line. This is evident from the company’s fourth-quarter revenues that jumped 9.9% year over year to $696.6 million.

Synopsys stock has gained 52.2% year to date, substantially outperforming the 35.3% rally of the industry it belongs to.

Factors Influencing Synopsys’ Performance

We believe unique intellectual properties and global support provided by Synopsys are likely to drive near-term performance of the company. The company’s recent product launches and deal wins will boost results, going ahead.

However, a challenging technology spending environment and uncertainty regarding the exact time of realizing acquisition synergies keep us on the sidelines. Moreover, escalating costs and expenses, which are putting pressure on margins, make us increasingly cautious about its near-term profitability.

Further, customer concentration risk remains a huge concern for the company. Additionally, a substantial portion of the company’s revenues are generated from outside the United States. This might adversely impact the top line due to unfavorable currency fluctuations and an uncertain macroeconomic environment.

Zacks Rank and Stock to Consider

Synopsys has a Zacks Rank #5 (Strong Sell).

Some top-ranked stocks worth considering in the sector are Intel Corporation (NASDAQ:INTC) and Lam Research Corporation (NASDAQ:LRCX) , both sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term expected EPS growth rate for Intel and Lam Research is projected to be 8.42% and 14.85%, respectively.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Synopsys, Inc. (SNPS): Free Stock Analysis Report

Cadence Design Systems, Inc. (CDNS): Free Stock Analysis Report

Intel Corporation (INTC): Free Stock Analysis Report

Lam Research Corporation (LRCX): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Since the Robotaxi event on October 11th, Tesla (NASDAQ:TSLA) stock is up 38%, currently priced at $291.60 per share This is a return to the early November 2024 price level. But...

The Q4 2024 earnings season tapers off from here, with S&P 500® EPS growth surpassing 17%, the highest in 3 years Large cap outlier earnings dates this week include:...

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.