The immediate Brexit process has had the breaks slammed on it thanks to a ruling by the British High Court overnight that will force parliamentary approval for Brexit to officially begin.

This goes against the British Government’s wishes which were arguing for the immediate implementation of Article 50, so the Brexit process could begin before March 2017. A date that now looks long gone.

In a statement, the Government expressed its disappointment over the court’s judgment:

“The country voted to leave the European Union in a referendum approved by Act of Parliament. And the Government is determined to respect the result of the Brexit referendum.”

From here, May has indicated that they intend to appeal the decision in the British Supreme Court, with December 5-8 being penned in as the dates. This isn’t the last we’ve heard of this.

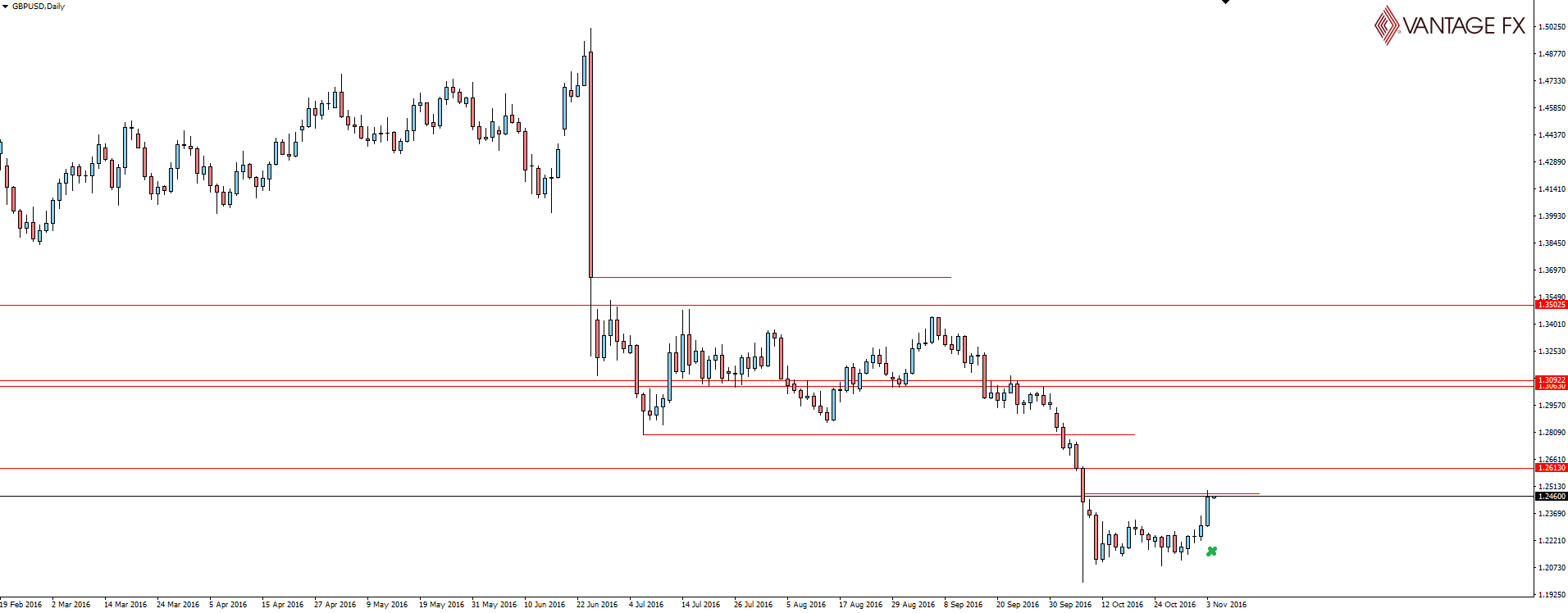

GBP/USD Daily:

Taking a look at the cable chart, we can see that the pound shot up as markets interpreted the decision as it now meaning that the Government will take longer to invoke Article 50 and that the Brexit process will encounter yet more hurdles.

This will also mean that by giving the slim opposition in parliament a say, the manner that Britain leaves the EU will be a soft rather than hard Brexit, something the market sees as pound positive.

I don’t really get how dragging the inevitable Brexit out with further uncertainty can be a positive for GBP, but hey that’s markets for you.

Alongside last night’s court decision, the Bank of England also released their inflation report and quarterly economic forecasts in which Governor Mark Carney had this to say:

“It’s an example for the uncertainty that will govern this process.”

Central Bank speak for ‘I can’t touch this, just get it done so I can do my job!’

While you can read the details yourself by clicking the link and downloading the meaty PDF, the BoE effectively signaled to the market that the bank now has a neutral bias in terms of interest rates, while also revising their growth forecasts for the coming two years to the upside.

THIS is really why the pound is catching a bid.

EUR/GBP Daily:

EUR/GBP was another pair that is obviously highly sensitive to these developments. I’ve published the daily chart here to highlight the short term drop, but on your own MT4 charts I want you to check out the weekly horizontal level that I have marked for that extra reason as to why the pair has given up some of its gains.

From a trading perspective, price holds higher time frame resistance, then you look for intra-day re-tests to get short. Now go.

Well that’s another trading week down. As always, don’t blow your week’s gains chasing low quality setups on a volatile Friday afternoon session.

See you next week!

On the Calendar Friday

AUD: RBA Monetary Policy Statement

AUD: Retail Sales m/m

CAD: BOC Gov Poloz Speaks

CAD: Employment Change

CAD: Unemployment Rate

USD: Average Hourly Earnings m/m

USD: Non-Farm Employment Change

USD: Unemployment Rate

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Forex broker Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, forex news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the Forex account of the reader. We always aim for maximum accuracy and timeliness, and FX broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.