- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Strayer Education (STRA) Q4 Earnings Miss, Enrollments Up

Strayer Education Inc. (NASDAQ:STRA) reported fourth-quarter 2017 adjusted earnings of $1.09 per share, missing the Zacks Consensus Estimate of $1.29 by 15.5%. However, earnings improved 15% year over year.

Revenues declined 0.5% to $118.7 million from $119.3 million in the same quarter last year, owing to lower revenue per student due to higher scholarships during the fall term.

Enrollment Details

Total enrollment at Strayer University increased 6% to 48,144 students from 45,509 in the prior-year quarter. New student enrollments rose 4% and continuing student enrollments increased 6%.

Financial Details

Strayer Education ended the year with cash and cash equivalents of $155.9 million, compared with $129.2 million at 2016-end.

The company generated $56.2 million in cash from operating activities in 2017, compared with $44.5 million in the year-ago period. Capital expenditures totaled $18.1 million compared with $13.2 million at the end of 2016.

The company had $70 million worth of share repurchase authorization as of Dec 31, 2017. Notably, no shares were repurchased in the fourth quarter of 2017.

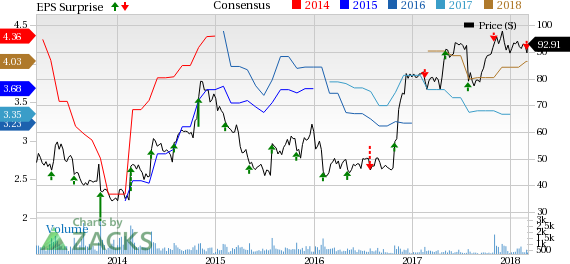

Strayer Education, Inc. Price, Consensus and EPS Surprise

Q1 Guidance

Total enrollments at Strayer University are expected to grow 6% to approximately 46,100 students from the prior-year quarter.

New student enrollments are anticipated to increase approximately 6%. Continuing student enrollments are likely to increase approximately 6%.

Revenue per student in the quarter is likely to decline 5%.

Tax rate for the quarter is expected in the range of 21-22%.

Strayer-Capella Merger

In October 2017, Strayer Education and Capella Education Company (NASDAQ:CPLA) announced an all-stock merger deal of equal transactions. The merger is expected to achieve annual cost savings of approximately $50 million to be fully phased in within 18 months of closing.

Notably, the transaction is expected to close in the third quarter of 2018. Post completion, Strayer Education’s shareholders will own approximately 52% of the combined entity and Capella’s shareholders will own the remaining 48%. The newly-formed entity will be renamed Strategic Education Inc. and its ticker symbol will remain STRA.

The combined company is aimed to become a national leader in education innovation. The companies are likely to accelerate innovation in key products and services as well as return capital to shareholders through an expected annual dividend of $2 per share following the close of the transaction.

The merger is expected to ensure students’ success and positive employment outcomes. A shared effort by the companies is expected to improve academic outcomes by combining each of the university’s competencies. The merger will also facilitate a diversified product offering that will result in a balanced revenue mix.

Zacks Rank & Peer Release

Strayer Education carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

American Public Education, Inc. (NASDAQ:APEI) reported fourth-quarter 2017 earnings per share of 51 cents, beating the Zacks Consensus Estimate of 33 cents by 54.5%. Adjusted earnings in the year-ago quarter were 42 cents.

Adtalem Global Education Inc. (NYSE:ATGE) reported second-quarter fiscal 2018 results with earnings surpassing the Zacks Consensus Estimate, while revenues missing the same. Earnings and revenues increased 18.8% and 1%, respectively. Revenues increased across all operating segments except U.S. Traditional Postsecondary segment.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

American Public Education, Inc. (APEI): Free Stock Analysis Report

Strayer Education, Inc. (STRA): Free Stock Analysis Report

Capella Education Company (CPLA): Free Stock Analysis Report

Adtalem Global Education Inc. (ATGE): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Nvidia’s earnings beat didn’t erase investor concerns over slowing growth. Soft Q1 guidance and valuation worries may limit the stock’s upside. Weak network and gaming sales...

Warren Buffett and Berkshire Hathaway (NYSE:BRKa) always make headlines in February when the firm holds its annual meeting. Among the many takeaways is what the company has been...

While Tuesday I wrote about the strength of junk bonds in the face of risk-off ratios (TLT v. SPY, HYG), today, I am still quite concerned about Granny Retail or the consumer...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.