Stocks had a nice day rising by about 80 basis points on the S&P 500. However, once again, the index was stuck at 2,925. It is interesting to me that the 2925 level has been such a problem area for the market, considering it wasn’t a problem in the last few weeks.

S&P 500

The good news is that the chart appears to have formed a bullish continuation pattern known as a rising triangle. It would suggest that this short period of consolidation is coming to an end, very soon. The breakout, should it happen, most likely on August 22, and is likely to push the index above 2,935, straight to 2,952.

VIX (VXX)

The VIX tested resistance today at 16.10 twice and failed each time. Again, the vix is likely to continue to fall towards 14.4.

Housing Index (HGX)

Another positive sign is the Housing Index; the HGX is again knocking the door of a breakout. This index has been a leading indicator for the broader S&P 500 over the past year. A break out at 325 sends it on to 331.

Hong Kong (EWH)

The Hong Kong HSI is also showing sign of a potentially big break out, as it sits at resistance around 26,250. The index is likely heading higher towards 27,350.

Qualcomm (NASDAQ:QCOM)

Qualcomm (NASDAQ:QCOM) has been on the move higher and is recovering from its post-earnings sell-off. The stock is sitting at resistance at $76.50, and on is the move towards $82.

Broadcom (NASDAQ:AVGO)

Broadcom Inc (NASDAQ:AVGO) is another chip stock that is nearing a breaking out as it rises to resistance at $289. A break out likely sends it to $305.

Nvidia (NVDA)

NVIDIA (NASDAQ:NVDA) is acting healthy and continues to be on a course to around $176 to $178.

GE (GE)

General Electric (NYSE:GE) continues its road lower and is falling below support at $8.23. It could be on its way to around $7.60. I had written about this on August 16. GE: More Bearish Bets Piling On

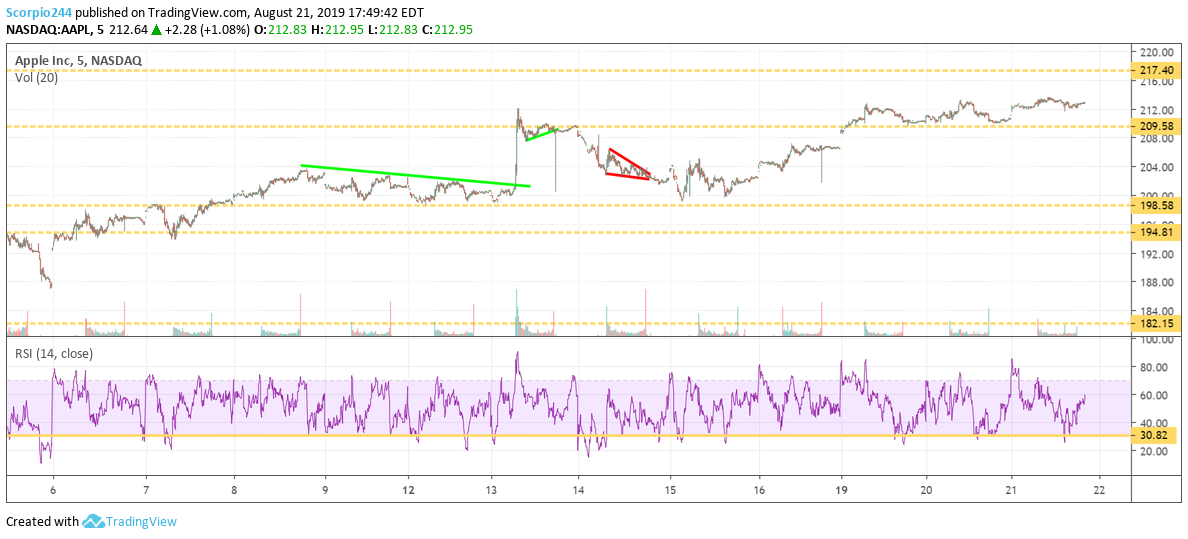

Apple (NASDAQ:AAPL)

Apple Inc (NASDAQ:AAPL) is still looking healthy with a path to $217.