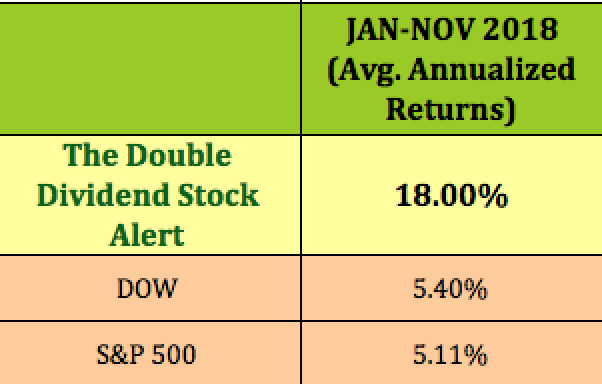

How is your portfolio handling the volatile market of 2018?

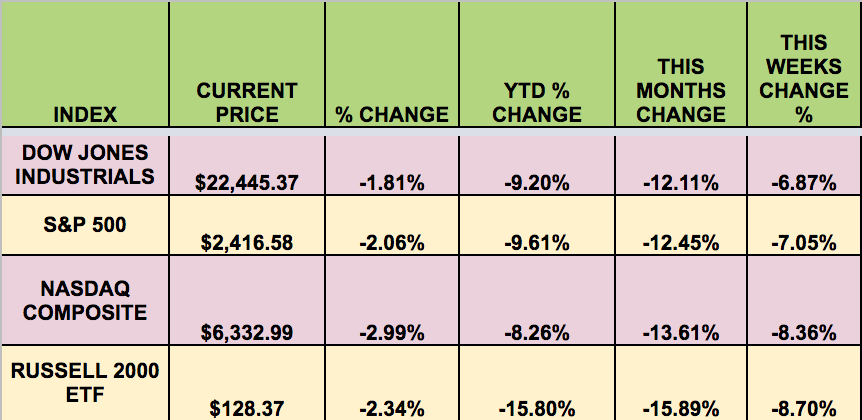

Markets:

It was a very rough week for the market, with all 4 indexes posting big losses, from -6.87% for the DOW, to 8.7% for the RUSSELL small caps, as the market moved further into the red year to date.

The DOW and the S&P all down over -12% in December, but the NASDAQ and the RUSSELL 2000 have fared even worse, dropping –13.6% and -15.9% respectively.

As if investors didn’t have enough to fret about, with Fed rate hikes, trade wars, and possible slowing worldwide economic data, the U.S. administration and Congress are now embroiled in a government shutdown melodrama, which snuffed out Friday’s morning rally.

Stocks initially surged and bonds sold off, as New York Fed President John Williams indicated on CNBC that the Fed would be flexible and could consider changing policy if the economy or financial conditions warrant. Williams took a step toward undoing the blunt blow to markets delivered by Fed Chairman Jerome Powell when he said the Fed was happy to maintain its balance sheet reduction on “autopilot." (CNBC)

High Dividend Stocks Going Ex-Dividend Next Week:

CDRE, GMRE, BBDO, BSMX, ACRE, BTI, CGBD, MFA, ABDC, AGNC, AHT, ARI, CBL, CLNY, CLDT, CPLG, EARN, HCFT, LOAN, ORC, PEGI, PK, RC, SCM, SMTA, STWD, UNIT.

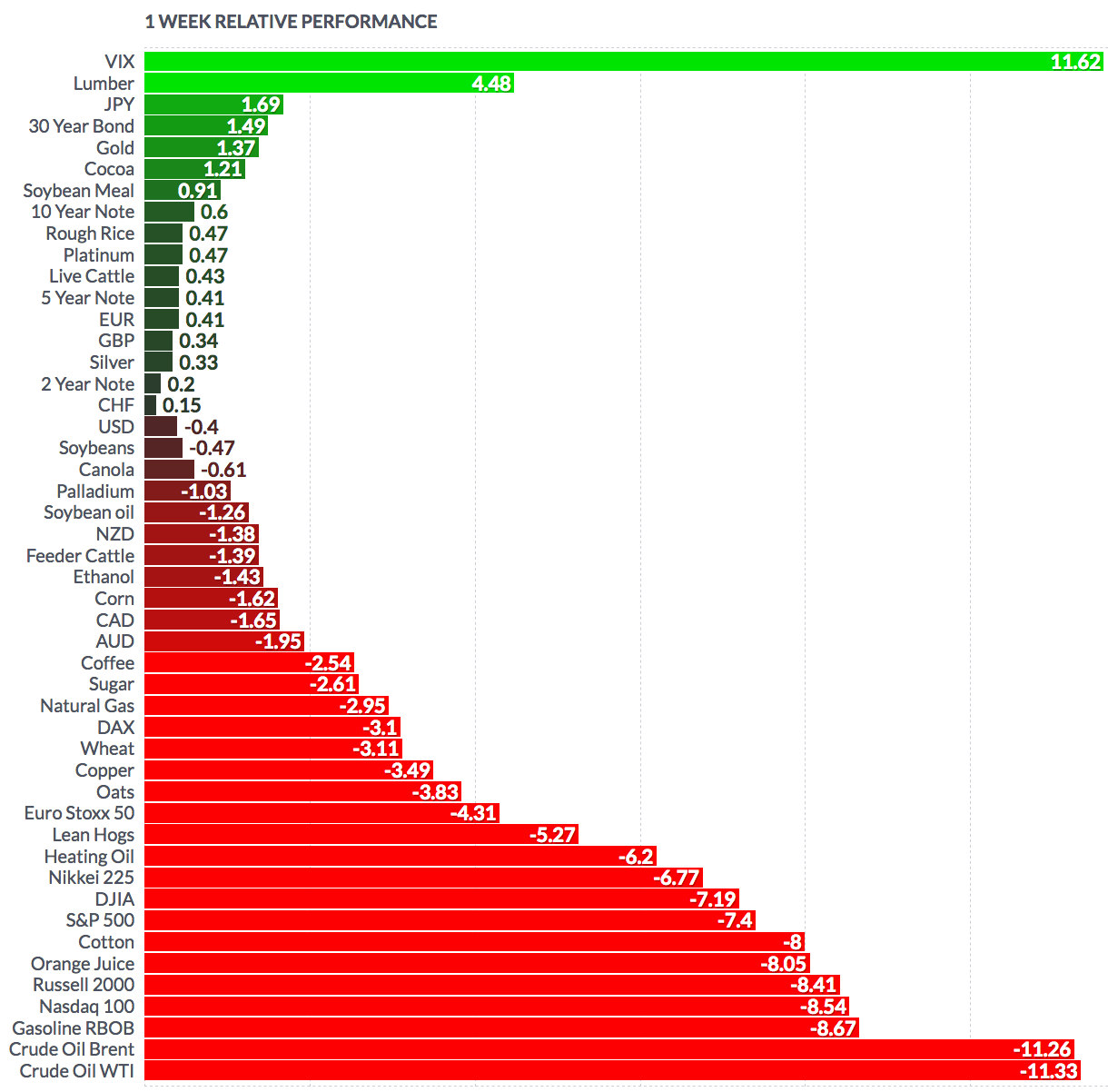

Volatility:

The VIX rose 39.2% this week, ending at $30.11, its highest point since 2011.

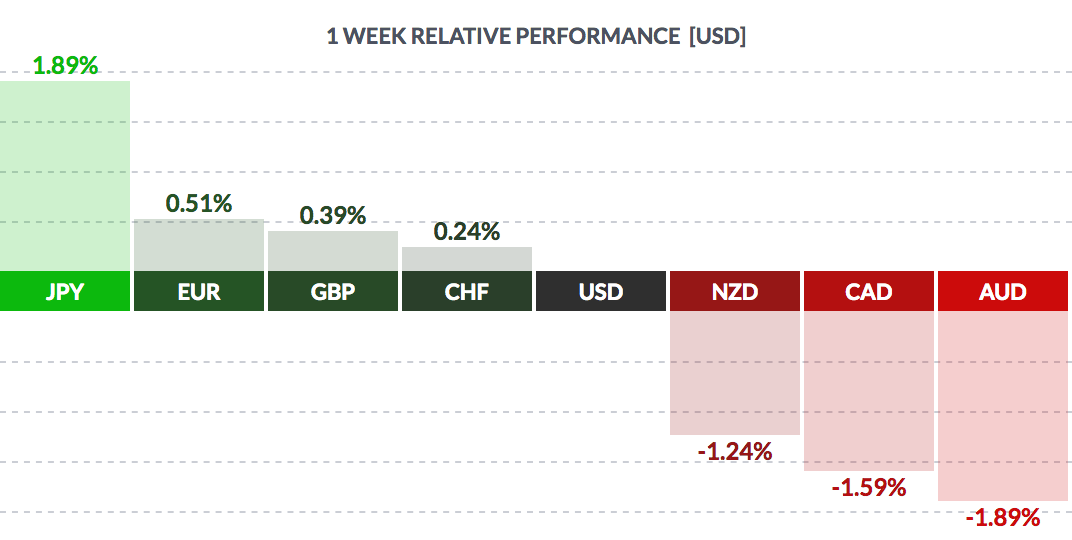

Currency:

The U.S. dollar rose vs. the NZ and Aussie dollar, and the Canadian Loonie, but fell vs. the yen, euro, pound, and Swiss franc this week.

Market Breadth:

All DOW 30 stocks fell this week, vs. 8 rising last week. Only 1.8%% of the S&P 500 rose this week, vs. 27% rising last week.

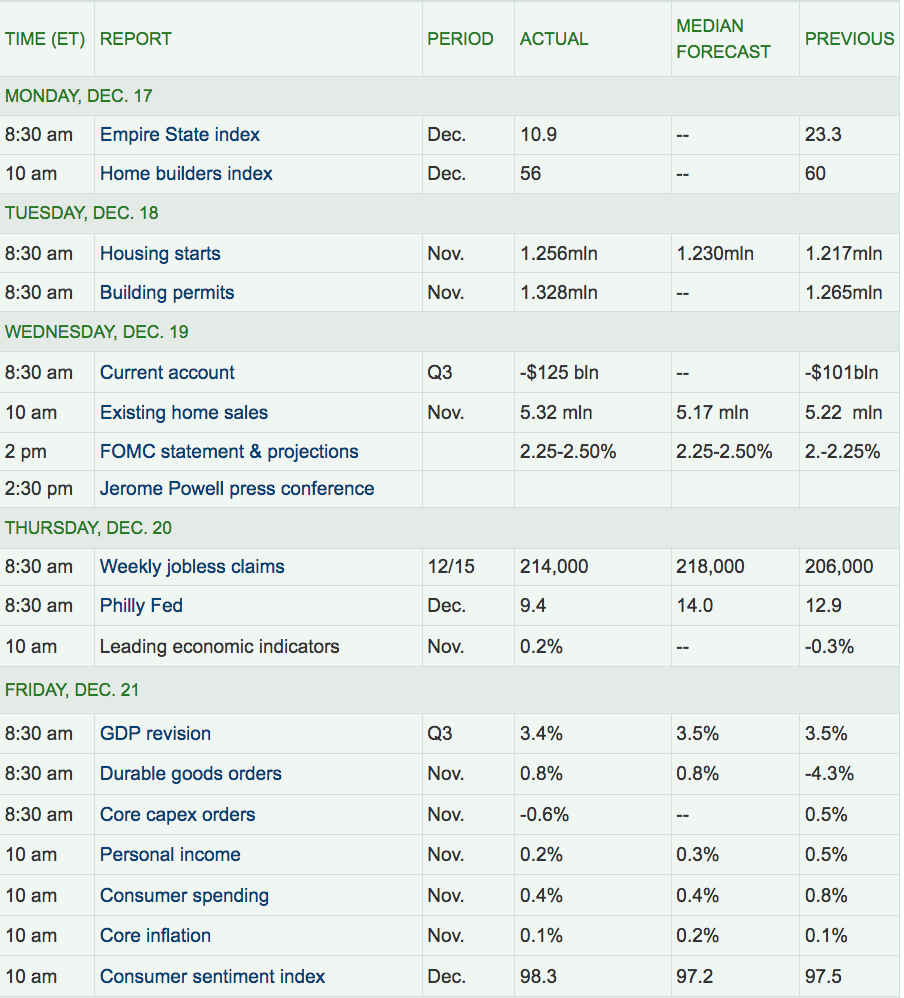

Economic News:

Housing Starts, Building Permits, and Existing Home Sales all rose in November, vs. October’s figures.

Week Ahead Highlights:

U.S. and European markets will be closed on Tuesday, in observance of the Christmas holiday. Additionally, the NYSE will close early, at 1 pm on Monday, Christmas Eve.

Next Week’s US Economic Reports:

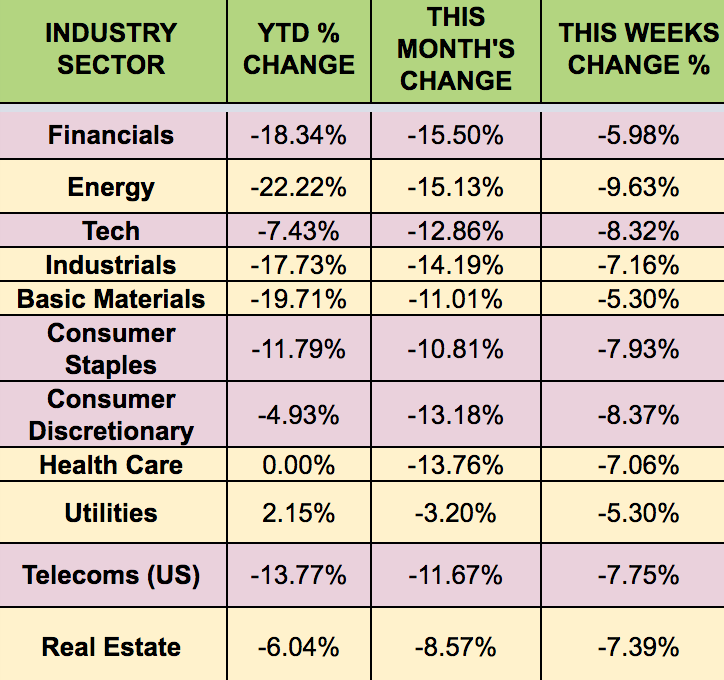

Sectors:

All sectors fell this week, with the Basic Materials and Utilities sectors falling the least. Utilities are now the only sector that’s up year to date.

Futures:

WTI Crude fell -11.33% this week, finishing the week at $45.38, while Natural Gas fell -2.95% for the week. Losses for oil intensified late Tuesday morning, with prices for the U.S. benchmark crude dropping by more than 4%.

"Oil is under pressure again as it was reported that Russia [is] increasing their output to 11.42 million barrels per day this month, and that would be a record, if it turns out to be true,” said David Madden, market analyst at CMC Markets UK. "Major oil producers can talk about coordinated production cuts all they want, but at the end of the day they usually persue their own interests."