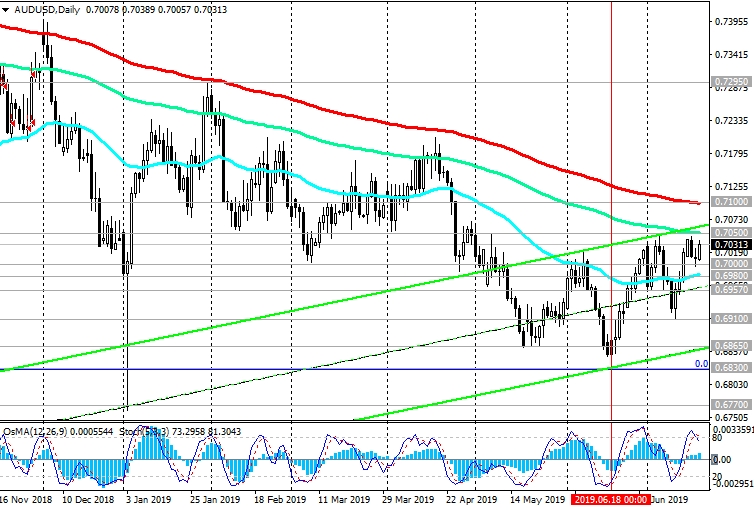

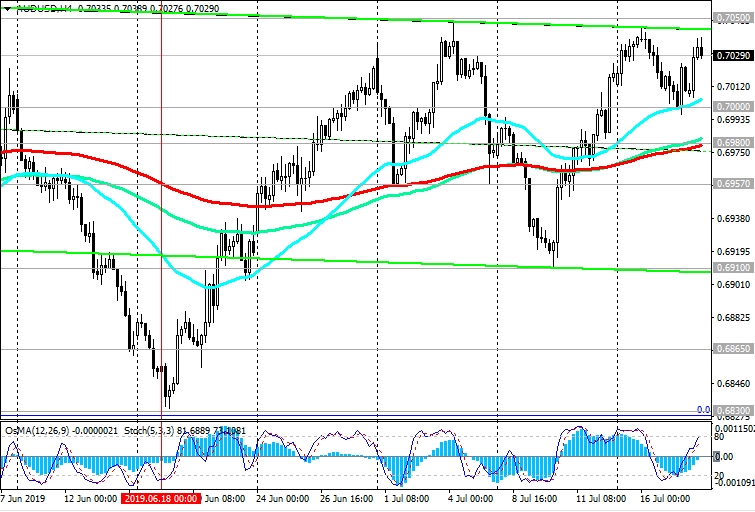

Despite the correctional growth that began in the middle of last month, AUD/USD continues to trade below key resistance levels of 0.7050 (EMA144 on the daily chart), 0.7100 (EMA200 on the daily chart), remaining in a long-term bearish trend. The last global wave of decline began in July 2014 from 0.9500. The minima of this wave and of 2016 are located near the level of 0.6830. The signal for the resumption of sales will be the breakdown of the support level of 0.6980 (ЕМА200 on the 4-hour chart). Growth above the resistance levels of 0.7050, 0.7100 is unlikely. Below these key resistance levels, short positions remain preferred. Mostly negative trend.

Intermediate reduction targets are located at support levels of 0.6910 (July lows), 0.6830 (minimums of the global decline wave, which began in July 2014 from 0.9500); long-term - at around 0.6770 (2019 lows).

Australia's leading labor market indicators point to a further slowdown in employment growth. It is likely that at this pace that testifies more about a slowdown than about the growth of the Australian labor market, the RBA leadership may go for a further easing of monetary conditions.

Unemployment remains at 5.2%, which is much higher than the forecast of the RBA, which assumed that in the 2nd quarter it will be 5%. Earlier, the RBA stated that they would like to see a fall in unemployment to 4.5% or less, as this will help accelerate wage growth and inflation rates.

From the news today, which can increase volatility in the foreign exchange market, including in the pair AUD/USD, it is worth paying attention to the publication at 12:30 (GMT) of the macro statistics block from the USA. Weekly data on the number of unemployment claims in the US can cause an increase in volatility in trading in USD, if they are very different from the predicted values, especially for the worse.

Support levels: 0.7000, 0.6980, 0.6957, 0.6910, 0.6865, 0.6830, 0.6800, 0.6770

Resistance Levels: 0.7050, 0.7100

Trading Recommendations

Sell in the market. Stop Loss 0.7060. Take-Profit 0.7000, 0.6980, 0.6957, 0.6910, 0.6865, 0.6830, 0.6800, 0.6770

Buy Stop 0.7060. Stop Loss 0.6990. Take-Profit 0.7100