Last week’s review of the macro market indicators suggested, as we kicked off the summer and headed into the shortened Holiday week that the equity markets looked solid and positive. Elsewhere Gold ((ARCA:GLD) looked stuck in a holding pattern while Crude Oil (NYSE:USO) continued to rise. The US Dollar Index (NYSE:UUP) and US Treasuries (ARCA:TLT) were both biased higher. The (Shanghai Composite) was doing a good job of holding support but showing no signs of strength while the Emerging Markets (ARCA:EEM) were biased to the upside. Volatility (VIX) looked to remain subdued and biased lower keeping the bias higher for the equity index ETF’s SPDR S&P 500 (ARCA:SPY), iShares Russell 2000 Index (ARCA:IWM) and PowerShares QQQ (NASDAQ:QQQ). Their charts agreed, with the SPY and QQQ looking strong on both timeframes while the IWM lagged on the weekly timeframe.

I added a caution that the Dollar, Treasuries and Oil are moving higher would cause many to raise caution on equities as they do not all move together in theory. But they can advance for long period before any change. Stick to what the price action is saying.

The week played out with Gold moving lower out of consolidation while Crude Oil found resistance again and pulled back slightly. The US Dollar also meet prior resistance and stalled while Treasuries made a new higher high before a pullback. The Shanghai Composite continued its bounce off of support but without vigor while Emerging Markets consolidated before a pullback Friday. Volatility made a new 7 year low Monday and held there the rest of the week. The Equity Index ETF’s all responded with moves higher. The SPY to new all time highs, the IWM over the recent resistance area and the QQQ’s back to their 14 year high. What does this mean for the coming week? Lets look at some charts.

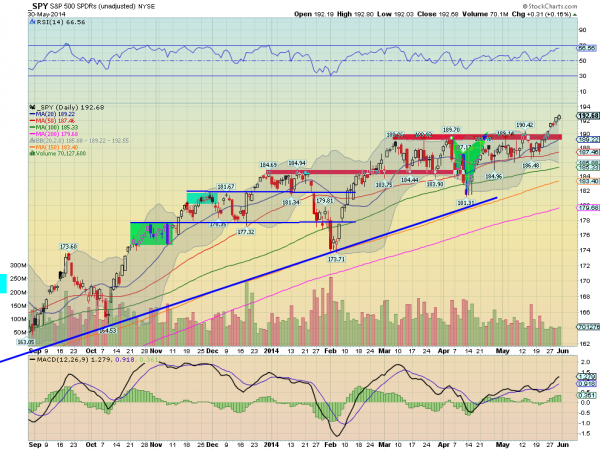

SPY Daily, SPY

SPY Weekly, SPY

The SPY finally peeked over the consolidation zone to end last week and that was the catalyst for a launch higher Tuesday to start the run into the May month end. The gap up held and continued higher ending the week near the high and at a new all-time high close. The Bollinger Bands® are expanding higher with a rising RSI and a MACD that is rising. Translation: More bullishness. The weekly chart shows the range break as well and the same Bollinger bands moving up. The RSI is rising and the MACD is just now crossing up. Wow! There is a target higher on a Measured Move at 197.30 and support lower comes at 190.42 and 188.90. Continued Upward Price Action

As May ends and June begins the equity markets look very bullish. Elsewhere look for Gold to continue lower while Crude Oil has an upward bias. The US Dollar Index is biased to pullback in the uptrend while US Treasuries may consolidate or pullback in their stronger uptrend. The Shanghai Composite looks headed lower again while Emerging Markets are pulling back in the uptrend. Volatility looks to remain subdued and biased to the downside keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts show the SPY and QQQ in good uptrends while the IWM is consolidating with an upward bias. It may have the best potential. Gold moving lower and the potential for the Dollar to pullback and maybe Treasuries is a better scenario for equities. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.