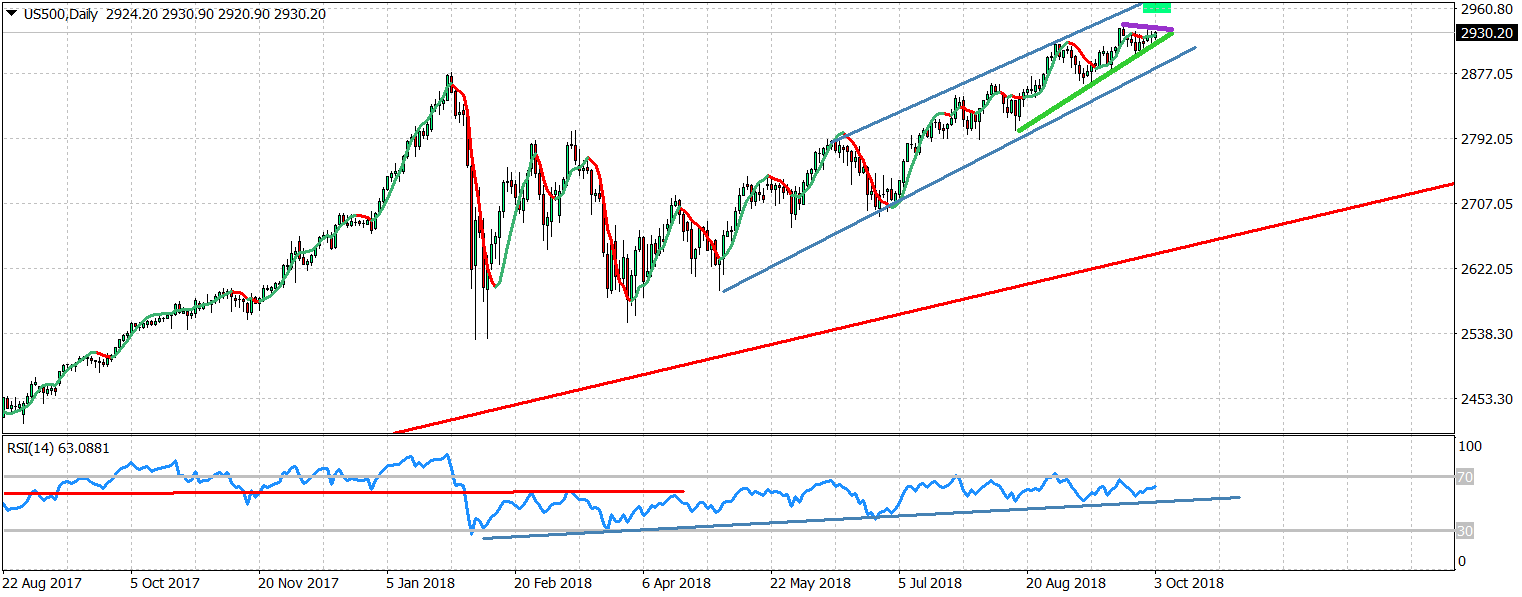

Greetings everyone, we remain bullish SPX as price continues to make higher highs and higher lows.

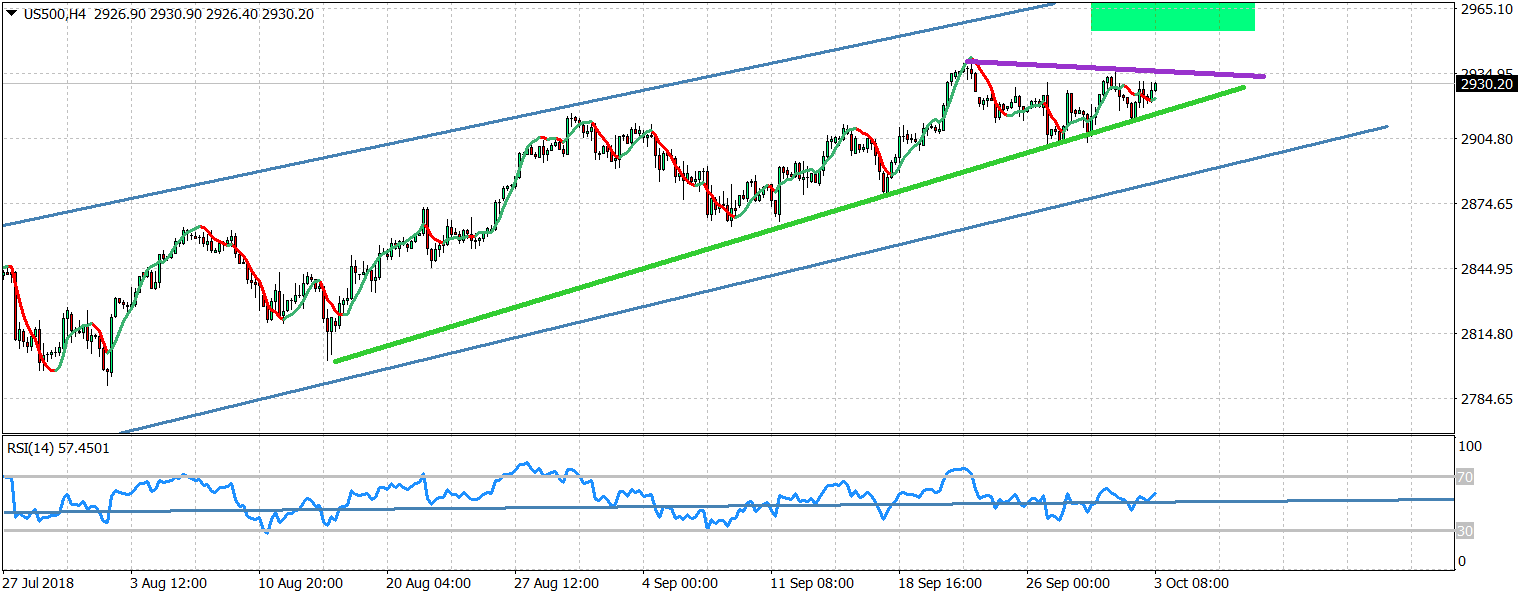

Price behavior so far is supportive of the bullish trend as price breaks resistance levels, comes back for a back test at previous resistance levels and previous highs. Monday welcomed the NAFTA deal with a gap up but prices came back on Tuesday to close the gap.

Price pulled back towards 2920-2910 which was the level that we tested from below around 26-27 September. Price is also respecting the green upward sloping trend line. Resistance is at 2936. If SPX breaks above 2936 I would expect prices to continue towards next target level of 2975-3000.

There are bearish divergence signs (RSI) in the daily weekly charts. This is an important warning. But only a warning. Not a reversal signal. Unless we see a clear break below 2865 I cannot say that an important top is in. Until then I consider pull backs as buying opportunities.

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that June be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.