- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Spectrum (SPPI) Q4 Loss Widens Y/Y, Sales Miss, Stock Falls

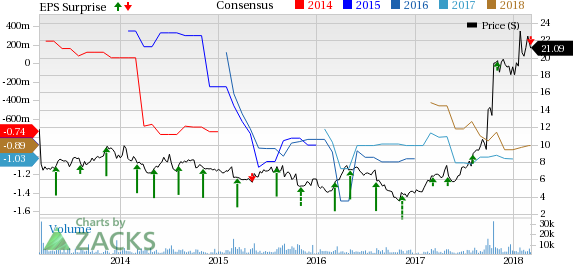

Spectrum Pharmaceuticals, Inc. (NASDAQ:SPPI) incurred a loss of 29 cents per share in the fourth quarter of 2017, wider than the Zacks Consensus Estimate of a loss of 25 cents and in line with the year-ago loss. Moreover, adjusted loss came in at 23 cents, wider than the year-ago loss of 10 cents.

Quarterly revenues came in at $28.6 million, down almost 18.9% from the year-ago quarter. The top line also missed the Zacks Consensus Estimate of $34 million.

Shares of the company were down almost 9.3% in after-hours trading on Mar 6, presumably due to wider loss and lower sales.

However, Spectrum Pharma’s shares have significantly outperformed the industry in the past year. The stock has gained 235.9% compared with the industry’s increase of 2.1%.

Quarter in Detail

Total product sales came in at $27.9 million, down 13.2% year over year. Sales were generated by six marketed products — Fusilev ($0.9 million), Folotyn ($11 million), Zevalin ($3.9 million), Marqibo ($1.2 million), Beleodaq ($2.7 million) and Evomela ($8.3 million). Evomela is facing pricing pressure due to generic entry.

License fees and service revenues were $0.6 million, down 79.4% from the prior-year quarter.

Adjusted research & development expenses were $21.3 million, up 38.1% from the year-ago quarter. Adjusted selling, general and administrative spending was up 22.1% to $19.1 million. The company is focused on the development of its two pipeline candidates, poziotinib and Rolontis.

2017 Results

Total product sales came in at $116.2 million, down 9.7% year over year.

Adjusted research & development (R&D) expenses were $63.4 million, up 17.2% from year ago period. Adjusted selling, general and administrative spending was up 2% to $65.4 million.

The company reported adjusted loss of 61 cents for the period, wider than the year-ago loss of 23 cents.

2018 Outlook

The company provided revenue guidance for 2018 in the range of $90-$110 million. The company expects R&D expenses to increase due to higher investment related to its pipeline.

Pipeline Update

Spectrum Pharma is evaluating poziotinib in two separate phase II studies for the treatment of lung cancer and a phase II study for breast cancer. In October 2017, the company presented results from a preliminary analysis of the lung cancer study. The candidate achieved an objective response rate of 73% in patients with EGFR exon 20 insertion mutations.

A phase III study, ADVANCE, was conducted under a Special Protocol Assessment (“SPA”) agreement with the FDA evaluating Rolontis for treatment of chemotherapy-induced neutropenia in patients with breast cancer. Last month, the company announced the successful completion of the ADVANCE study on Rolontis. The candidate demonstrated non-inferiority to Amgen Inc.’s (NASDAQ:AMGN) Neulasta in improving duration of severe neutropenia.

It has completed enrolling patients for an additional phase III study, RECOVER. Data from this study will be included in the biologics license application (“BLA”) along with ADVANCE study data, to be filed with the FDA.

The company expects to file a BLA for Rolontis in the fourth quarter of 2018.

Zacks Rank & Stocks to Consider

Spectrum Pharma carries a Zacks Rank #3 (Hold).

A couple of better-ranked stocks in the healthcare sector are Ligand Pharmaceuticals Incorporated (NASDAQ:LGND) and Regeneron Pharmaceuticals, Inc. (NASDAQ:REGN) . Both the stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Ligand’s earnings per share estimates have moved up from $3.78 to $4.15 for 2018 over the last 30 days. The company pulled off positive earnings surprises in three of the trailing four quarters with an average beat of 24.88%. Share price of the company has soared 53.4% over a year.

Regeneron’s earnings per share estimates have been revised from $17.13 to $18.65 and from $20.37 to $21.56 for 2018 and 2019, respectively, in the last 30 days. The company delivered a positive surprise in three of the last four quarters with an average beat of 9.15%.

Breaking News: Cryptocurrencies Now Bigger than Visa

The total market cap of all cryptos recently surpassed $700 billion – more than a 3,800% increase in the previous 12 months. They’re now bigger than Morgan Stanley (NYSE:MS), Goldman Sachs (NYSE:GS) and even Visa! The new asset class may expand even more rapidly in 2018 as new investors continue pouring in and Wall Street becomes increasingly involved.

Zacks’ has just named 4 companies that enable investors to take advantage of the explosive growth of cryptocurrencies via the stock market.

Click here to access these stocks >>

Regeneron Pharmaceuticals, Inc. (REGN): Free Stock Analysis Report

Amgen Inc. (AMGN): Free Stock Analysis Report

Ligand Pharmaceuticals Incorporated (LGND): Free Stock Analysis Report

Spectrum Pharmaceuticals, Inc. (SPPI): Free Stock Analysis Report

Original post

Related Articles

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Every investor should know the term CEP, or customer engagement platform, because it is central to businesses' use of AI. CEPs provide software services to connect and communicate...

As markets try to look through the blizzard of policy changes flowing out of Washington, the crowd has shifted its preferences considerably in recent weeks based on a sector lens....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.