On Monday, the markets broke out, again, to all-time highs. This is not surprising and something that I noted over the weekend. To wit:

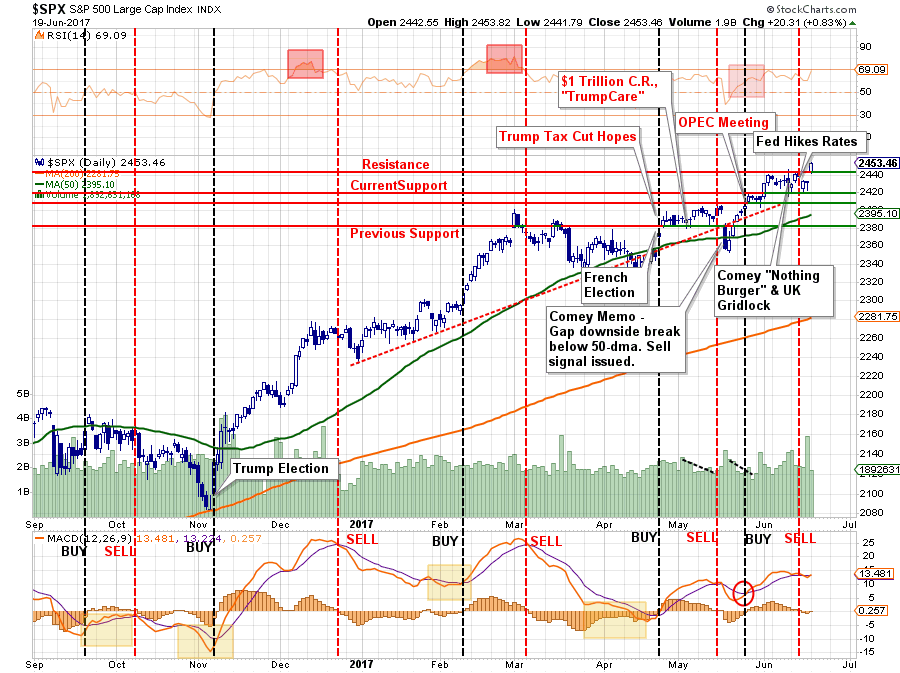

Stepping back from the sector-specific action, if you only looked at the S&P 500 to judge what was happening in the markets, you wouldn’t suspect anything was wrong.

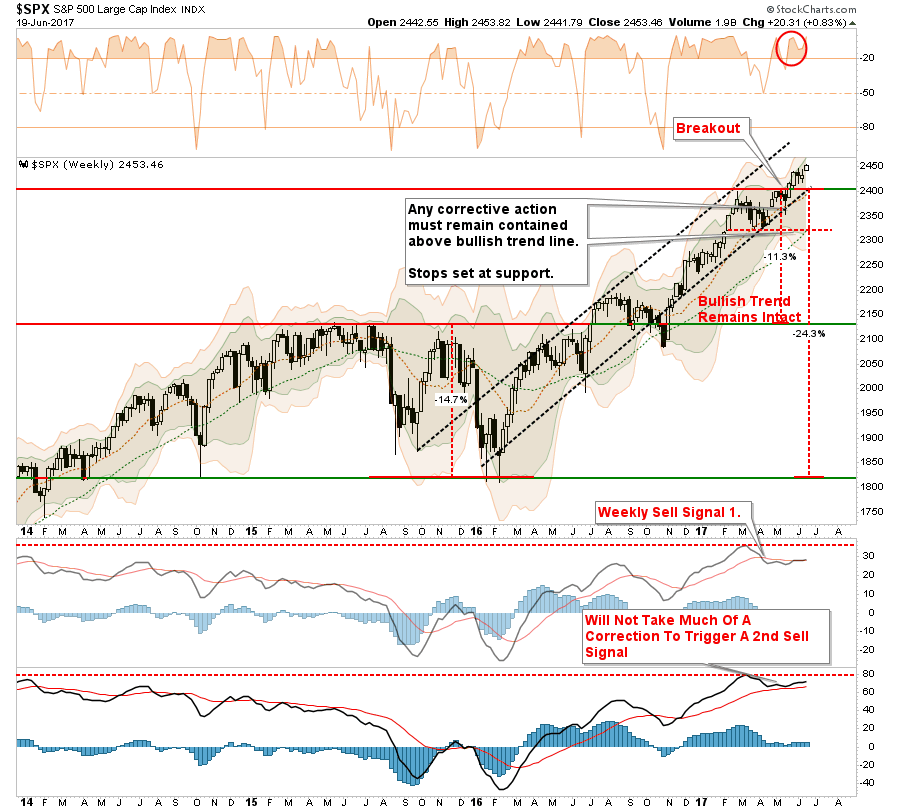

The market breakout remains intact currently with support at 2400 holding firm. The bullish trend line, which also intersects at 2400 remains critically important as the secondary buy/sell signal remains in positive territory. The only negative currently, despite improvement, is the ‘weekly sell signal-1’ remains triggered which keeps us on ‘alert.’ (It is also worth noting both signals remain at VERY high levels which suggest current upside remains somewhat limited.)

You can understand why more and more commentary is beginning to succumb to the ‘siren’s song’ of why ‘this time is different.’ Whether it is terrorist attacks, poor economic data, geopolitical tensions, or plunging oil prices, the market has continued its advance. It certainly seems to be ‘bulletproof.’

Last week, we added additional exposure for the second time since the “breakout” occurred.

Not surprisingly, I have gotten many emails questioning the addition given the current extension, over valuation and excess bullishness in the market. I can certainly understand the confusion. Buying “breakouts” is a function of participating in a momentum driven market and clearly “momentum” is in full swing currently. As I discussed with one of the firm’s clients on Friday, while the long-term return outlook is not favorable, in the short-term we have to invest in order to create returns when opportunities exist. In this regard, we buy “breakouts” when they are confirmed, as the recent breakout has been, because “new highs tend to lead to further new highs.”

Despite, one news headline to the next, the market has continued to push higher and last week’s test of “support,” set the market up for Monday’s move to “new highs.” While sustainability remains key, we remain invested currently with very tight stops, and some hedges, already in place.

But it is in that inherent breakout that we continue to see the rise of exuberance over the reality of fundamentals.

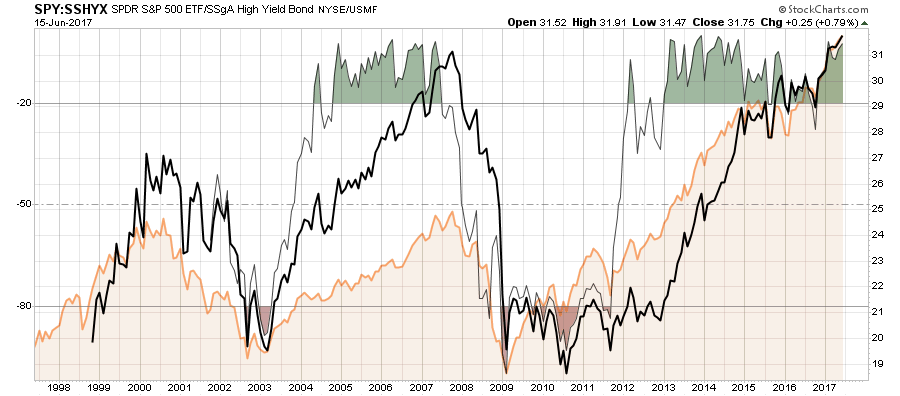

There is very little concern about the risk being taken on by investors currently without any regard for the underlying risk as they chase ‘yield and return.’

The forgotten piece of this ‘fairytale’ is that RISK = How much you LOSE when you are wrong.

Currently, the risk/reward ratio is currently heavily skewed against investors in both the short, intermediate and long-term outlook.

The Evaporation Of Risk

As stated, the word “RISK” is not normally associated with positive outcomes.

I was visiting with a new client of the firm last week who had just transferred over from one of the “big box” financial firms. Of course, as usual, she began to regurgitate the media-driven myths of how she was a “long term” investor, how she was diversified and that she was willing to ride out the “wiggles” in the market.

It takes me only a couple of questions to quickly derail these myths.

- What did you do in 2001-2002 and/or 2008?

- How did you feel?

- Are you willing to do that again?

Since the dot.com bust, when I began asking those questions, I have NEVER had anyone tell me:

- I sold near the top and bought near the bottom. (Sell High/Buy Low)

- It was a truly terrific experience watching half of my money disappear.

- Absolutely, just tell me when so I can get some popcorn.

In this particular case, she happened to be an avid “poker player” and enjoyed going to Las Vegas for a “few hands” at the tables.

Poker is an extremely easy comparison to investing as the general rules of risk management apply to both. The conversation was quick.

“Do you go ‘all in’ on every hand your are dealt?”

“Of course, not” she responded.

“Why not?”

“Because I will lose all my money,” she said.

“You say that with a lot of certainty. Why?”

“Well, I am not going to win every hand, so if I bet everything, I will certainly lose everything” she stated.

“Correct. So why do you invest that way?”

“………….Silence………………….”

The issue of “risk,” as stated above, whether it is in the financial markets or a hand of poker is the same. It is simply how much money you lose when the “bet” you made goes wrong.

In poker, most individuals can not calculate the odds of drawing a winning hand. However, while they may not know the odds of drawing a “full house” in a 7-card poker hand is just 2.6%, they do know the odds of “winning” with such a hand are fairly high. Therefore, they are comfortable betting heavier on that particular hand.

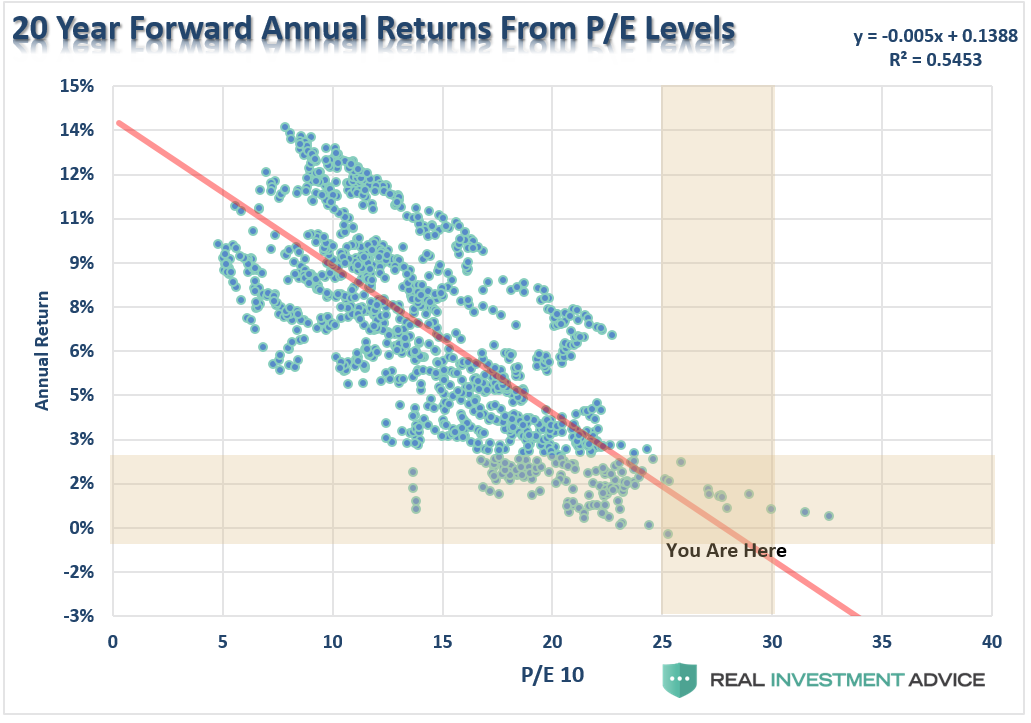

But when it comes to investing, they are comfortable betting the retirement savings on a market which, at current valuation levels, has a long history of delivering less than optimistic results. I have shown you the following chart before, and statistically speaking the odds simply aren’t in your favor.

Despite this simple reality, investors continue to chase stocks as if future returns over the next 10 years will be as profitable as the last 10 years. This most likely will not be the case.

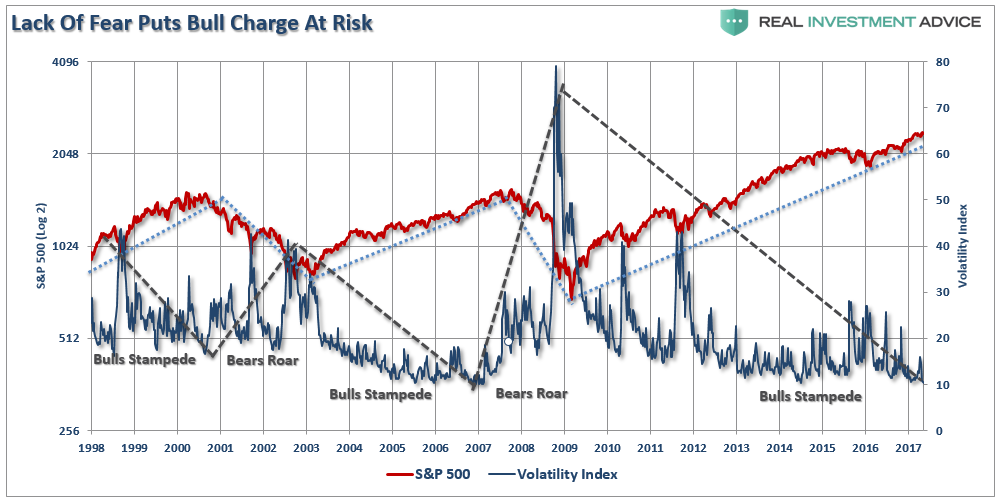

Yet, the “evaporation of risk” continues to accelerate as the market seemingly becomes ever more immune to “bad news,” or should I just say “news.”

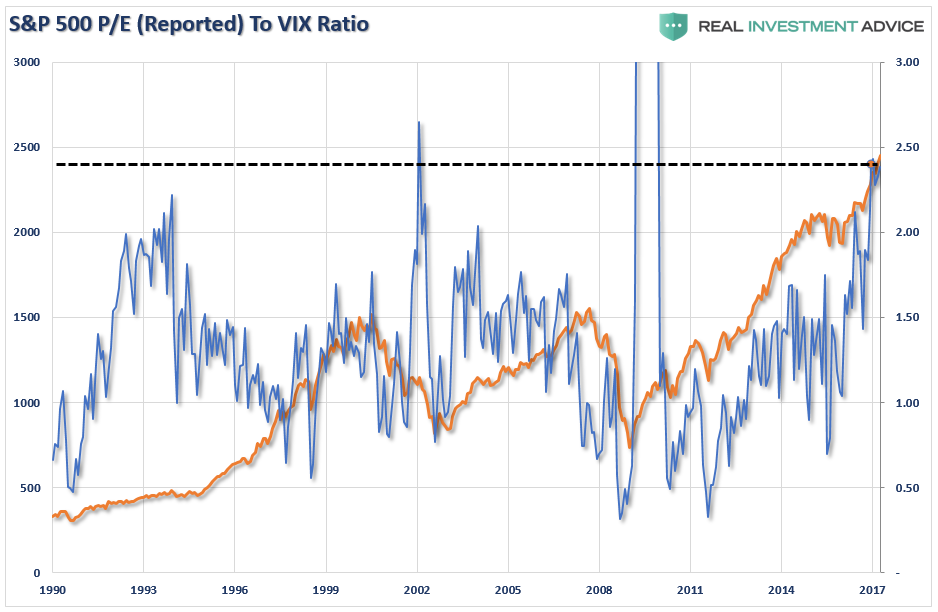

The S&P 500 P/E to VIX ratio is also elevated to levels that have normally warned that you are betting on a losing hand.

The issue of understanding risk/reward is the single most valuable aspect of managing a portfolio. Chasing performance in the short-term can seem to be a profitable venture, just as if hitting a “hot streak” playing poker can seem to be a “no lose” proposition.

But in the end, the “house always wins” unless you play by the rules.

8-Rules Of Poker

1) You need an edge

As Peter Lynch once stated:

Investing without research is like playing stud poker and never looking at the cards.

There is a clear parallel between how successful poker players operate and those who are generally less sober, more emotional, and less expert. The financial markets are nothing more than a very large poker table where your job is to take advantage of those who allow emotions to drive their decisions and those who “bet recklessly” based on “hope” and “intuition.”

2) Develop an expertise in more than one area

The difference between winning occasionally and winning consistently in the financial markets is to be able to adapt to the changing market environments. There is no one investment style that is in favor every single year – which is why those that chase last years performing mutual funds are generally the least successful investors over a 10- and 20-year period.

As the great Wayne Gretzky once said:

I skate where the puck is going to be, not where it has been.

3) Figure out why people are betting against you.

“We know nothing for certain.” We know what a company’s business is today, maybe even what they are most likely to do in the coming months. We can determine whether the price of its stock is trending higher or lower. But in the grand scheme of things, we don’t know much. In fact, we are closer to knowing nothing than to knowing everything, so let’s just round down and be done with it.

Managing a portfolio for “what we don’t know” is the hardest part of investing. With stocks, we have to always remember that there is always someone on the other side of the trade. Every time some fund manager on television encourages you to “buy,”someone else has to be willing to sell those shares to you. Why are they selling? What do they know that you don’t?

3) Don’t assume you are the smartest person at the table.

When an investment meets your objectives, be willing to take some profits. When it begins to break down, hedge the risk. When your reasons for buying have changed, be willing call it a day and walk away from the table.

4) It often pays to pass, and 5) Know when to quit and cash in your chips

Kenny Rogers summed this up best:

If you’re gonna play the game, boy…You gotta learn to play it right – You’ve got to know when to hold ’em. Know when to fold ’em. Know when to walk away. Know when to run. You never count your money when you’re sittin’ at the table. There’ll be time enough for countin’ when the dealin’s done.

This is the hardest thing for individuals to do. Your portfolio is your “hand” and there are times that you have to get rid of bad cards (losing positions) and replace them with hopefully better ones. However, even that may not be enough. There are times that things are just working against you in general and it is time to walk away from the table.

All great investors develop a risk management philosophy (a sell discipline) and combining that with a set of tools to implement that strategy. This increases the odds of success by removing the emotional biases that interfere with investment decisions. Just as a professional poker player is disciplined with his craft, a disciplined strategy allows for the successful navigation of a fluid investment landscape. A disciplined strategy no only tells you when you to “make a bet,” but also when to “walk away.”

6) Know your strengths AND your weaknesses & 7) When you can’t focus 100% on the task at hand – take a break.

Two-time World Series of Poker winner Doyle Brunson joked a bit about his book with which he had thrown around two alternative ideas for titles before going with “Super/System“. The first was “How I made over $1,000,000 Playing Poker,” and the second equally accurate idea was, “How I lost over $1,000,000 playing Golf.“

The larger point here is that invariably there will be things in life that you are good at, and there are things you are much better off paying someone else to do.

Many investors believe they can manage money effectively on their own – and they are likely right as long as they are in a cyclical bull market. Of course, this idea is equivalent to being the only person seated at a poker table and the dealer deals all the cards face up. You might still lose a hand every now and then, but most likely you are going to win.

8) Be patient

Patience is hard. Most investors want immediate gratification when they make an investment. However, real investments can take years to produce their real results, sometimes, even decades. More importantly, as with playing poker, you are not going to win every hand and there are going to be times that nothing seems to be “going your way”. But that is the nature of investing; no investment discipline works ALL of the time. However, it is sticking with your discipline and remaining patient, provided it is a sound discipline to start with, that will ultimately lead to long-term success.

Those are the rules. Play by them and you have a better chance of winning. Don’t and you will likely lose more than you can currently imagine. As the old saying goes:

If you look around the poker table and can’t spot the pigeon, it’s probably you.”