- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Guidewire (GWRE) To Acquire Cyber Risk Analyst -- Cyence

Guidewire Software, Inc. (NYSE:GWRE) recently announced its intent to acquire Cyence for approximately $275 million, or $265 million net of $10 million cash on hand, which is subject to certain transaction-related adjustments.

Cyence determines the economic impact of a cybercrime via a software platform that is built on cybersecurity related data science. We anticipate this acquisition to enrich Guidewire’s product portfolio, which is meant for Property and Casualty insurers.

Given the growing rate of cybercrime related monetary losses, this is expected to be a valuable addition for Guidewire. Recently, in an article, IDG Communications quoted Cybersecurity Ventures stating that worldwide spending related to cybersecurity is projected to cross $1 trillion during 2017 to 2021. We believe the enhancement of the portfolio with cyber risk analytics solutions will be a positive for Guidewire in the long run.

Shares of Guidewire have gained 59.2% year to date, outperforming the 27.3% rally of the industry it belongs to.

Guidewire’s Inorganic Growth Trajectory

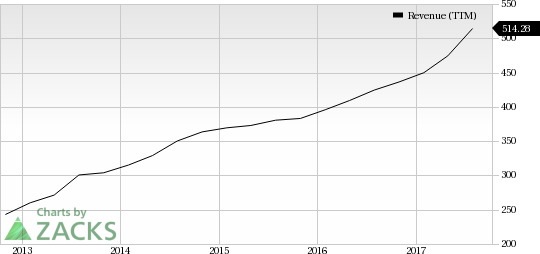

We note that Guidewire’s acquisition strategy has boosted the company’s top line. The company’s acquisition of ISCS in February 2017, now called InsuranceNow, added around $16.2 million in hosting revenues in fiscal 2017.

FirstBest (now called Guidewire Underwriting Management) and EagleEye Analytics (now known as Guidewire Predictive Analytics), which were acquired in 2016, and GuidewireNow (previously called ISCS) are a few prominent segments of the company.

The cross-selling of the product suites has increased customer base and revenue generation. Guidewire’s customer base has expanded consistently as evident from the addition of nine new customers in fourth-quarter 2017.

Other Strategic Initiatives

Guidewire is slowly shifting from the term-license based model to subscription base. This will be beneficial for the company in the long run as the majority of the enterprises are expected to lean toward cloud-based infrastructure going forward. The company expects subscription sales to rise to 20% to 30% in fiscal 2018 from 6% in fiscal 2017.

Guidewire’s cloud deployment partner, Amazon’s (NASDAQ:AMZN) Web Services is also gaining momentum and this bodes well for it. According to Gartner, the global Software-as-a-Service (SaaS) market is expected to increase at a four-year CAGR of 18.4% over 2016–2020 time frame. This is also a positive for the company.

However, the fact that its total addressable market (TAM) is limited only to the insurance sector is a headwind for the company in our view. Additionally, the transition from a term-license to a cloud-based model will negatively impact the top line in the short haul.

Zacks Rank and Key Picks

Guidewire currently has a Zacks Rank #3 (Hold).

Better-ranked stocks in the broader technology space include Applied Materials, Inc. (NASDAQ:AMAT) and Micron Technology, Inc. (NASDAQ:MU) , both sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The long-term earnings growth rate for Applied Materials and Micron is 17.1% and 10%, respectively.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Guidewire Software, Inc. (GWRE): Free Stock Analysis Report

Micron Technology, Inc. (MU): Free Stock Analysis Report

Applied Materials, Inc. (AMAT): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

As markets try to look through the blizzard of policy changes flowing out of Washington, the crowd has shifted its preferences considerably in recent weeks based on a sector lens....

Nvidia’s muted reaction keeps tech on edge, with chipmakers in focus. Nasdaq’s 20980-21000 support holds—for now. A break could mean trouble. With Nvidia done, GDP today and...

Here’s where I see stocks now: Yes, we’ve got some legitimate concerns as some economic warning signs appear—and run up against the tech-driven optimism that’s powered stocks to...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.