Bank of the Ozarks, Inc.’s (NASDAQ:OZRK) third-quarter 2017 earnings of 75 cents per share surpassed the Zacks Consensus Estimate by a penny. Moreover, the bottom line jumped 13.6% on a year-over-year basis.

Higher net interest income and non-interest income acted as tailwinds. Also, enhanced loans and deposits supported the results. However, expenses escalated during the quarter.

Further, an increase in nonperforming loans and higher provision for loan and lease losses perhaps disappointed investors. As a result, the stock lost 2.7% after the announcement.

Net income available to common shareholders came in at $96 million, surging 26.3% year over year.

Revenue Growth Offsets Rise in Costs

Net revenue grew 18.6% from the prior-year quarter to $242.4 million. However, the figure missed the Zacks Consensus Estimate of $244 million.

Net interest income jumped 19.7% year over year to $209.7 million. Nonetheless, net interest margin, on a fully taxable equivalent basis, decreased 6 basis points (bps) to 4.84%.

Non-interest income totaled $32.7 million, up 12% from the year-ago quarter. The rise mainly reflected higher loan service, maintenance and other fees, net gains on investment and other income.

Non-interest expenses were $84.4 million, up 7.1% year over year. The increase was due to a rise in all expense components except salaries and employee benefits.

Bank of the Ozarks’ efficiency ratio was 34.38% compared with 38.07% in the prior-year quarter. A fall in efficiency ratio indicates higher profitability.

Strong Balance Sheet

As of Sep 30, 2017, total loans and leases (including purchased loans) were $15.78 billion, up 11.4% year over year, while total deposits surged 11.2% year over year to $16.82 billion.

Further, as of the same date, the company had total assets of $20.77 billion, while shareholders equity was $3.3 billion.

Weak Credit Quality

The ratio of non-performing loans and leases, as a percentage of total loans and leases, increased 3 bps to 0.11% as of Sep 30, 2017. Also, provision for loan and lease losses increased 9.8% from the prior-year quarter to $7.8 million.

Further, annualized net charge-off ratio for all loans and leases increased 2 bps year over year to 0.09%.

Profitability Ratios

At the end of the reported quarter, return on average assets was 1.89%, up from 1.80% in the year-ago quarter. However, return on average common equity decreased from 12.18% to 11.56%.

Our Take

The results reflect improvement in margins and loan growth. Bank of the Ozarks is well positioned for steady earnings growth driven by rising revenues and inorganic growth strategy.

However, continued increase in provision for loan losses is a major concern. Further, its exposure to real estate loans remains a concern, as any deterioration in real estate prices might hurt its financials.

Also, escalating costs act as a headwind for the company. In fact, expenses are expected to continue rising as the company is expanding into newer areas organically as well as through acquisitions.

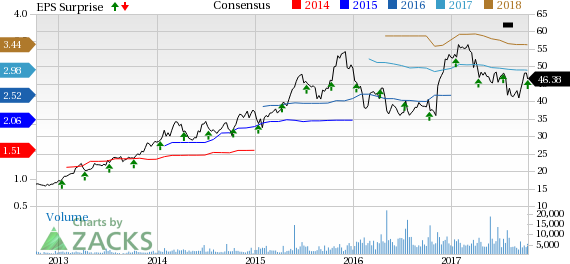

Bank of the Ozarks Price, Consensus and EPS Surprise

Bank of the Ozarks currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Among other Southeast banking stocks, results are expected from First Horizon National Corporation (NYSE:FHN) on Oct 13, BancorpSouth, Inc. (NYSE:BXS) on Oct 18 and Regions Financial Corporation (NYSE:RF) on Oct 24.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Regions Financial Corporation (RF): Free Stock Analysis Report

First Horizon National Corporation (FHN): Free Stock Analysis Report

BancorpSouth, Inc. (BXS): Free Stock Analysis Report

Bank of the Ozarks (OZRK): Free Stock Analysis Report

Original post

Zacks Investment Research