Silver Non-Commercial Speculator Positions:

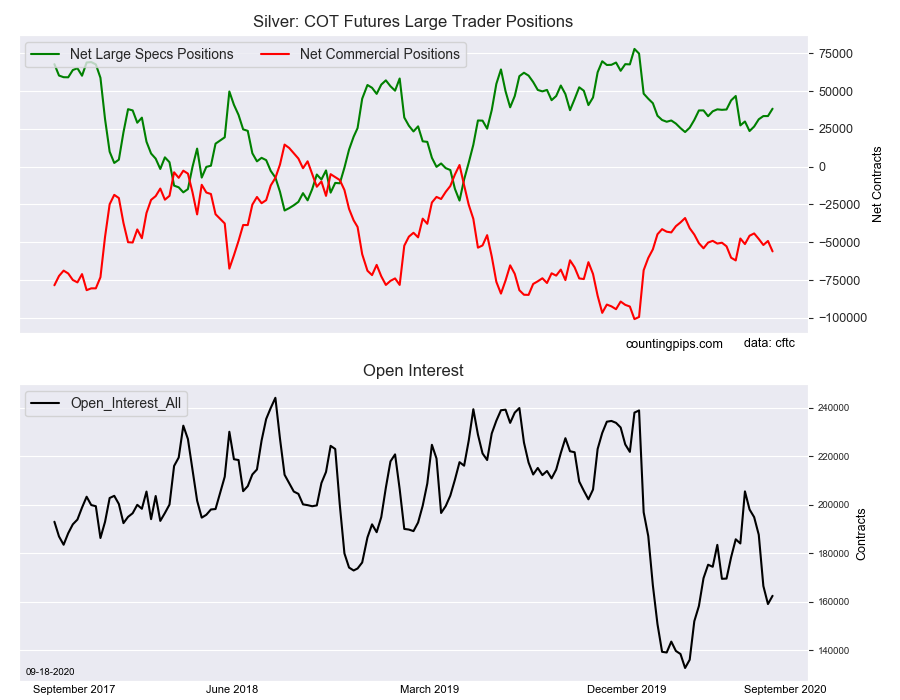

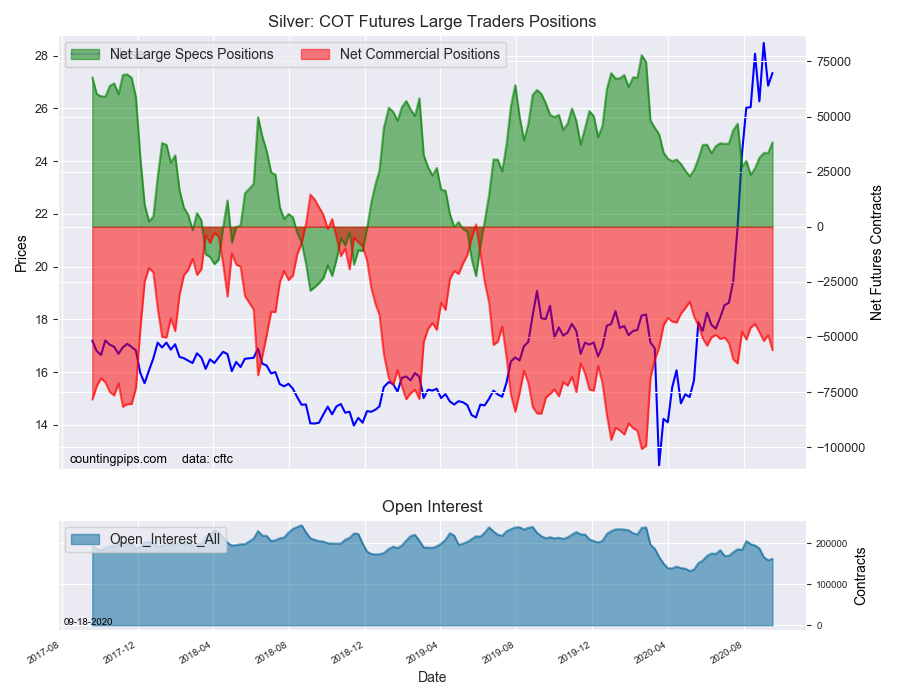

Large precious metals speculators increased their bullish net positions in the Silver futures markets once again this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Silver futures, traded by large speculators and hedge funds, totaled a net position of 38,349 contracts in the data reported through Tuesday September 15th. This was a weekly advance by 4,869 net contracts from the previous week which had a total of 33,480 net contracts.

The week’s net position was the result of the gross bullish position (longs) gaining by 3,985 contracts (to a weekly total of 77,004 contracts) while the gross bearish position (shorts) fell by -884 contracts for the week (to a total of 38,655 contracts).

Silver speculative positions rose again this week for the fifth consecutive week and for the eighth time in the past ten weeks. The climb in bullish bets pushed the current standing to the highest level since July 21st, a span of eight weeks. Silver positions have now remained in an overall bullish standing for sixty-seven consecutive weeks dating back to June of 2019 although the current level (+38,349 contracts) comes in just a bit lower than the 2020 average weekly level of +41,649 contracts.

Silver Commercial Positions:

The commercial traders' position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -56,007 contracts on the week. This was a weekly decrease of -6,888 contracts from the total net of -49,119 contracts reported the previous week.

Silver Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the Silver Futures (Front Month) closed at approximately $27.34 which was an uptick of $0.48 from the previous close of $26.86, according to unofficial market data.