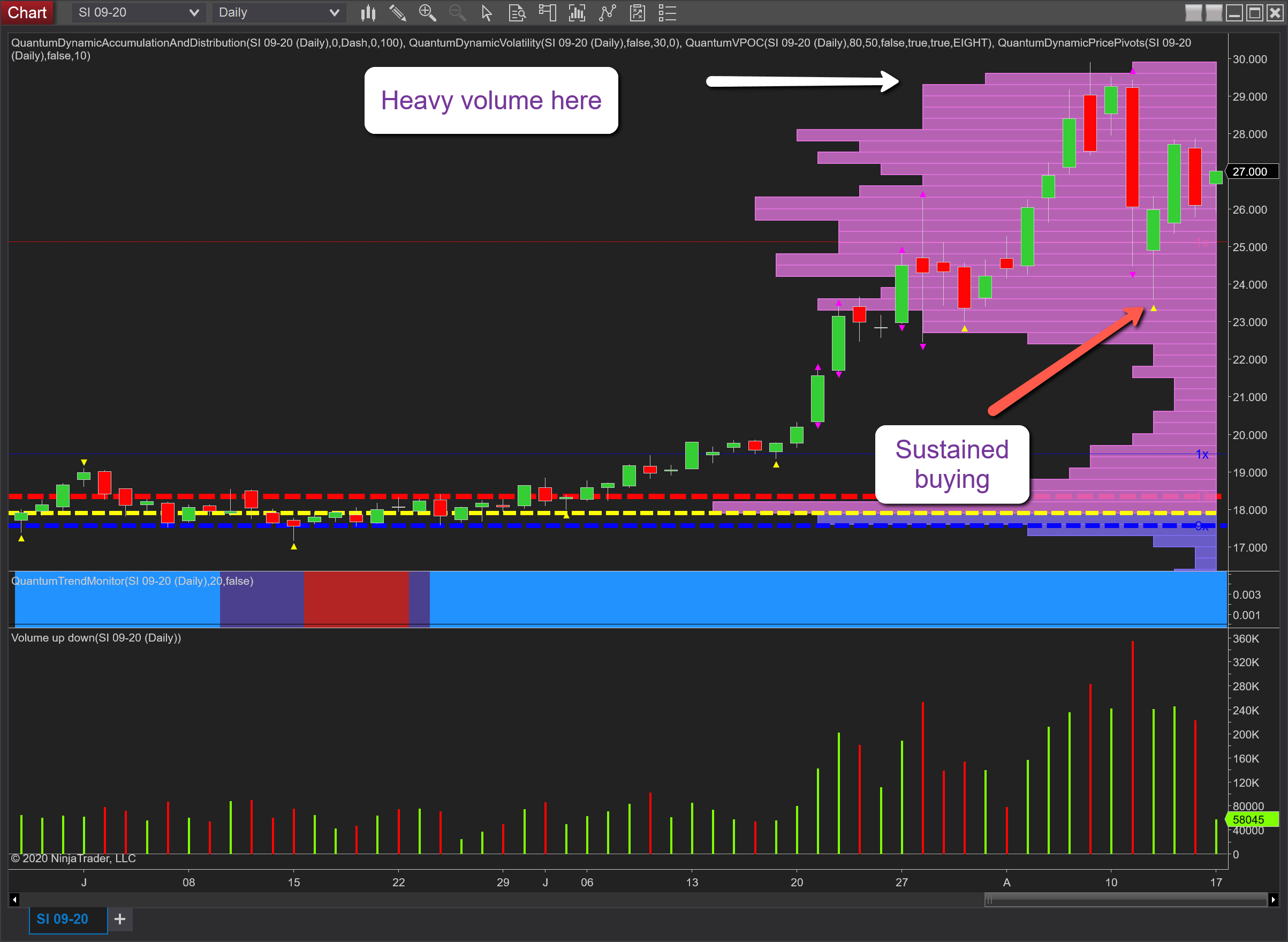

For silver, the picture is an identical one to gold on the daily chart, yet the weekly timeframe gave us an early warning signal of this short-term reversal. So if we start with the daily chart for silver, here too we have a plunge lower on ultra high volume, although the candle closed with a deep wick to the lower body signalling strong buying. This was confirmed by the candle of the following day which too closed with a deep lower wick and high volume.

And as with gold we also have the volatility trigger confirming that here too, the price action has moved outside the average true range, and we can, therefore, expect to see either congestion or a reversal. However, there is a key difference on the VPOC histogram to the right of the chart (y-axis) and as we can see silver is trading in a high volume node which extends all the way to the 29$ per ounce region.

What this means is that progress in any recovery is likely to be laboured. Nevertheless, the longer-term outlook for silver remains bullish (as for gold), with a recovery of the $30 per ounce region then heralding further bullish momentum to follow. So the message is the same as for gold investors. Don’t panic as the longer-term outlook remains positive.