The recent weakness of the US dollar has seen precious metals post impressive gains. Financial headlines have been trumpeting the gold rally, as the yellow metal broke its all-time record earlier this week, closing at $1,942 on Monday. The metal pushed even higher on Tuesday, climbing to $1,981 before retreating to lower ground. Given this impressive rally, the lofty $2,000 level appears within reach.

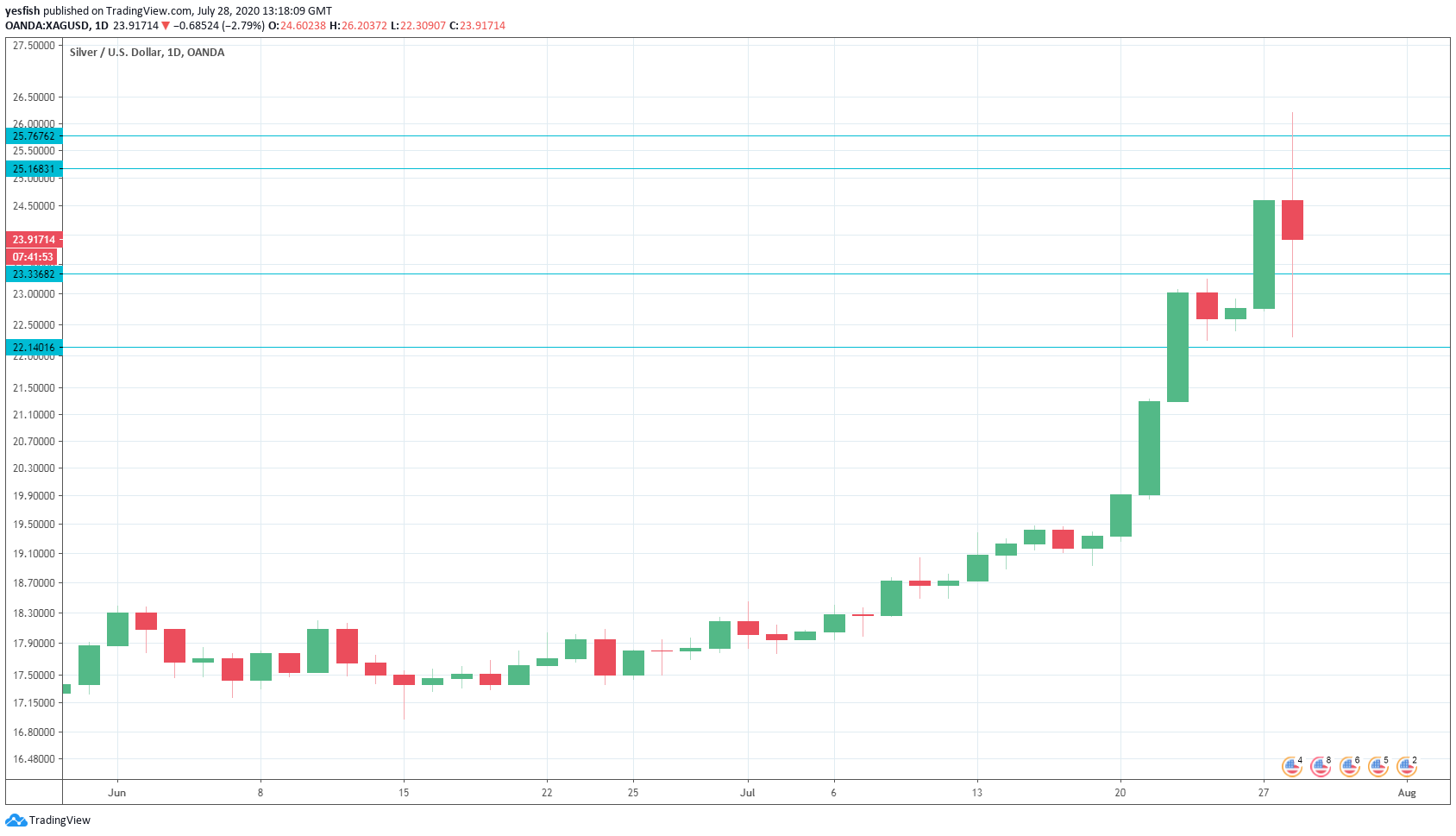

Overshadowed somewhat by the market excitement over the gold rally, silver prices have also recorded sharp gains of late. Last week, silver jumped 17.7%, punching above $23.00. Silver didn’t take a breath this week, breaking above $26.00 and gaining another 4.3%. All told, the metal has exploded in the month of July, with spectacular gains of 30.8%.

There are several reasons why nervous investors are flocking to safe-haven assets such as gold and silver. First, tensions between the US and China have escalated, with tit-for-tat consulate closings. Second, the spike in coronavirus cases worldwide has put the markets on edge. Finally, a US pandemic stimulus bill is bogged down in Congress, at a time when the US recovery appears to have taken a step back.

Silver could add to its gains this week. The Fed holds its monthly policy meeting on Wednesday. There is talk that the Fed could add further easing measures, such as negative rates. This would likely sour investors towards the dollar and would be bullish for silver prices. As well, the US releases the first estimate of GDP for the second quarter, with the forecast standing at a staggering -35.0%. Even if the decline is substantially lower, it’s quite likely that investors would react negatively, sending the greenback lower and pushing silver prices higher.

XAG/USD Technicals

XAG/USD is currently trading at 23.88, down 2.85% on the day. The pair posted gains early in the Asian session but then retreated. The pair posted further during European trade

- 23.34 is a weak support line. Below, there is support at 22.13

- 25.16 is the next resistance line. This is followed by resistance at 25.77