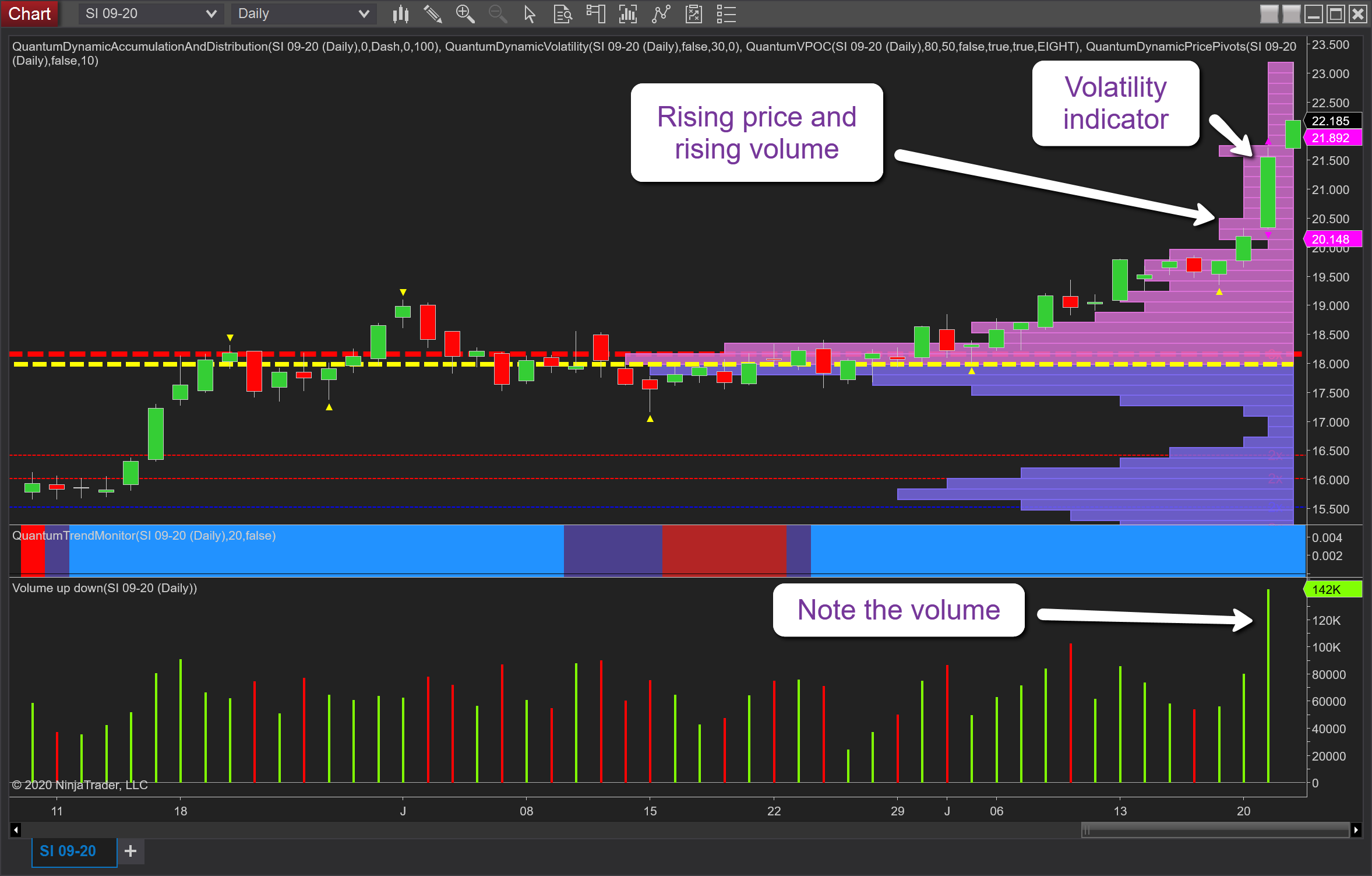

Over the last few days, silver has been rising steadily, with yesterday’s price action injecting a sustained move higher with the widespread candle closing on ultra high volume and closing at $21.55 per ounce. This move has continued into early trading today, as we move into the $22 per ounce area.

On the 13th July I wrote a post titled ‘Reasons to be cheerful for silver investors’ and this is what I concluded :

"At the time of writing silver is trading at $19.55 per ounce and peeking into the low volume node of the volume point of control histogram which extends through to $20.50 per ounce which is an excellent signal, as we can expect to see the metal move through this region with ease as a result.

So after the dire price action of March, reasons to be cheerful for silver investors as we are set to see the metal move strongly into the roaring twenties and beyond!"

On the chart below, note the fall in the volume on the volume point of control histogram, which is falling into a low volume node and therefore we can expect to see this bullish momentum continue.

However, one note of caution here, as yesterday’s price action triggered the volatility indicator which signals the price has moved outside the average true range and therefore we might expect a pause point or even a reversal. So you have been warned. In addition, the volume looks extreme so two warning signals here.

Longer-term, however, with the break above the technical congestion area and with the US dollar falling, expect silver to continue higher along with gold longer-term.