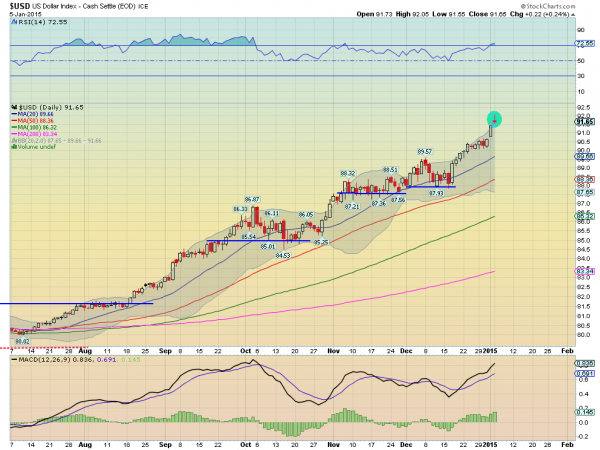

The US Dollar Index has been on a tear since breaking higher in July. It has managed a few consolidation periods along the way to a more than 10% rise. The longer term trend looks to continue higher but for those with a shorter focus there may be an opportunity for a counter trend trade to the downside. The clues lie in two charts.

The first is the daily chart of the US Dollar Index (NYSE:UUP), (DXY). This shows a Shooting Star candle that ended the day on Monday. A Shooting Star is distinguished by the long upper shadow after a gap up in an uptrend. It is thought to be a signal of a possible reversal, from the make up of the candle. The push higher into the top of the shadow failed and sellers overwhelmed buyers and pushed it back lower. A possible exhaustion sign.

There are other clues as well. The price is outside of the Bollinger Bands® and the momentum indicator RSI is overbought. Both are signs that it is possibly extended. Japanese Candlestick traders know that this signal needs to be confirmed by a lower close the next day, and you would be wise to wait too, because overbought can always get more overbought.

Delving into that Shooting Star a bit more closely using the 15 minute chart above gives a possible target for the downside. The abnormally shaped Head and Shoulders top gives a downside price object to at least 91.20. This remains active as long as the thrust higher does not break the top of the right shoulder over 91.82. Not a huge move but enough for a trader or a place to put a buy order if you have missed the run.