I often get asked where I’m investing my retirement money. And these days, I’m also asked if this is even an appropriate time to buy stocks!

Well, I personally am buying. For starters, my 401(K) runs on autopilot. Every month, my contribution (and “Brett Inc.” company match) is plowed into Vanguard’s Dividend Growth Fund (VDIGX). No diversification, no market timing–100% into VDIGX.

Why this fund? Because in my plan, I have to choose from a set list Vanguard funds. And I’m naturally looking for an emphasis on dividend growth because I know it’s the path to 10%+ returns every year, a wealth-creating snowball!

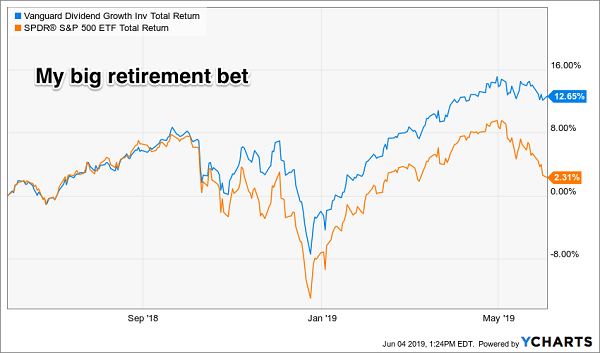

As far as 401(K) options go, VDIGX is a good one. It’s outperformed the S&P 64% to 57% over the last five years, largely thanks to its “pullback-proof” qualities. It really shines in turbulent years like ours:

Why I Don’t Diversify Beyond VDIGX

Now before you go looking for VDIGX, let’s talk about two important things:

- The fund closed itself to new money back in 2016. This means existing shareholders can buy more, but you can’t if you don’t yet own a share.

- This is a blessing in disguise because you can do better than VDIGX.

How? By improving on its winning formula.

Step #1: Buy Only the Fastest Growing Dividends

Dividends drive the stock market. While current yields provide a significant part of today’s return, it is the growth of these dividends that determines tomorrow’s return.

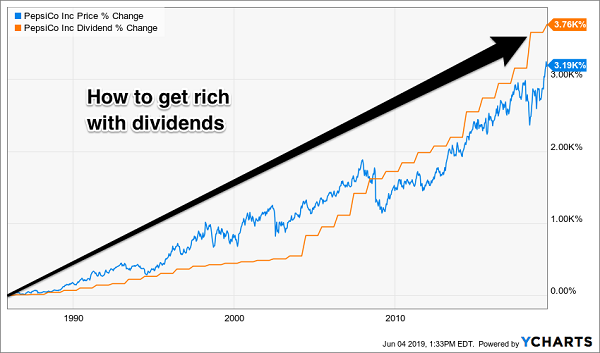

Let’s spy on VDIGX’s holdings to see how this works. Its number five position, PepsiCo (NASDAQ:PEP), has made its investors rich thanks to its ability to grow its dividend. Check out the orange staircase below–that’s the payout that PepsiCo hikes every year. Its stock price (blue line below) is attracted to the payout curve like a magnet. Here’s their relationship since the beverage maker began paying a dividend:

Every Pepsi Payout Refreshes the World

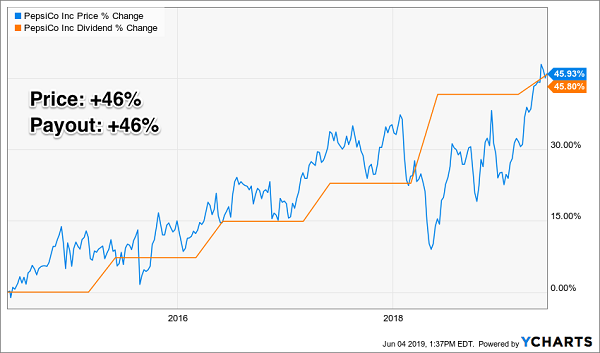

And we can see that over the last five years, its 46% payout growth has perfectly predicted its 46% price gains:

For the Love of It(s Dividend)

PepsiCo’s payout growth has slowed in recent years as it’s filled the market for sugar water. Sub-10% annual dividend growth should be unacceptable for true dividend growth investors like us! I have no choice but to tolerate it with VDIGX (given my Vanguard restriction) but you don’t have to take it. Here’s an easy way to ditch the rearview mirror.

Step #2: Focus on Future Dividend Growth

PepsiCo’s best years of payout growth are behind it. Same goes for many Dividend Aristocrats, the stocks that have hiked their dividends for 25 or more consecutive years. They are treated like royalty, so their valuations are always high and their current yields are rather low. But it doesn’t make sense to reward past accomplishments since the stock market is a forward–looking vehicle.

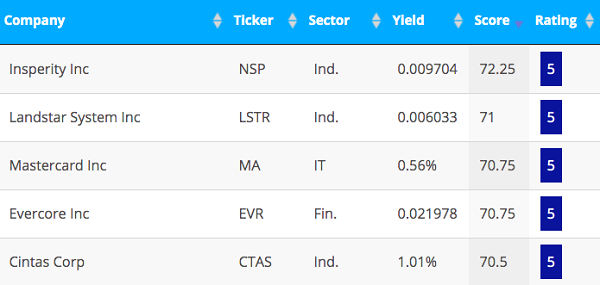

The best forward-looking dividend growth tool that I am aware of is Reality Shares’ DIVCON system. It ranks the dividend payers amongst the 1200 largest US companies across a variety of fundamental factors, including profitability, earnings growth, cash flow and leverage. As I write these are DIVCON’s five favorite stocks:

A one-click way to invest in this system’s top ideas is the DIVCON Leaders Dividend ETF (LEAD). It holds the top 61 names and shuffles its deck yearly to boot any stocks that drop and buy those that rise in its rankings.

Since you’ve read this far, I’m sure you believe there is room for further improvement. You’re right! My third secret goes beyond the machines and screens to require some human oversight. We’re going to take the top ideas above and cherry pick opportunities where a “dividend magnet” is outpacing its price.

Step #3: Find the Runaway Dividend Magnet

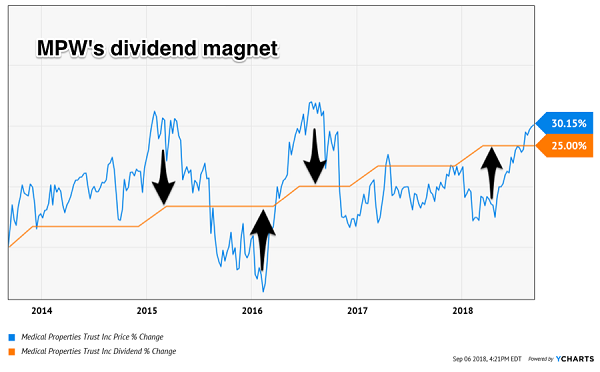

My Contrarian Income Report readers will fondly remember Medical Properties Trust (MPW), a hospital landlord we bought and later sold for 105% total returns. MPW’s dividend magnet was part of our secret, and the fact that we bought when the price was lagging dividend growth and sold after it had overtaken it. The “up” arrows below show good times to be a buyer, while the “down” arrows indicate times to hold or sell:

The Cues from a Dividend Magnet

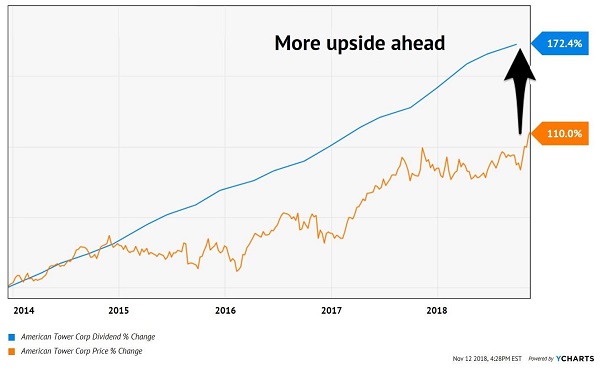

VDIGX holding American Tower (NYSE:AMT) had a runaway dividend magnet last November when I recommended the stock for my Hidden Yields subscribers. At the time, I wrote:

Investors have enjoyed 172% payout growth over the last five years. But they’ve actually been shortchanged thus far in terms of returns, having to settle for “only” 101% price gains:

AMT’s Stock Price Has Further To Go

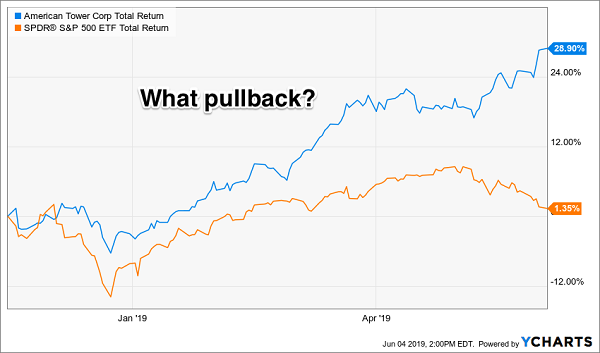

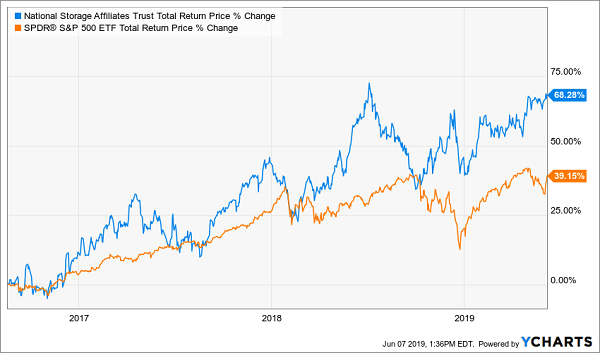

Sure enough, the dividend magnet didn’t take long to pull AMT’s price higher. The stock has popped 29% since that day. It’s a big reason why VDIGX and my Hidden Yields portfolio have whipped the market in recent months:

Dividend Magnets Don’t Care (About the S&P 500)

National Storage Associates (NSA) is the best self-storage stock that most investors have never heard of. While the share prices of its competitors have stagnated lately due to market saturation, NSA is more nimble and smarter.

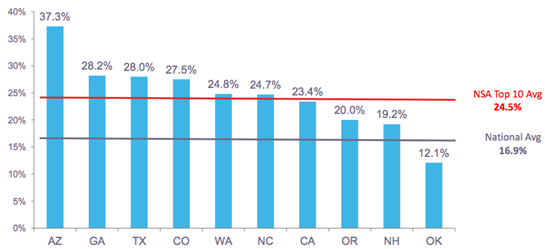

The firm’s unique strategy lets it “cherry pick” the best storage operators and locations. It puts its “stores” in high-growth places, with its top 10 states (home to 92% of its facilities) being projected to grow 45% faster than the national average:

More Population Means More Demand for Self-Storage

NSA the stock is too small to attract Vanguard’s attention, which is a good thing for agile individual investors like us. Shares pay 4.3% today and management is in the habit of raising its dividend not once but twice per year. These “double raises” are a big reason we’re well on our way to doubling our money in just a few years:

The Power of “Hidden” Yields (and Their Growth)

Would I put new money into NSA today? We can actually do even better by focusing on seven dividend growers that are flashing “buy” today.

Step #4: Seven More Stocks for 15% Returns Per Year, Forever

My research indicates each of these investments could easily pay you 15% per year. That’s enough to double your money in under 5 years. Imagine, turning a retirement ‘pot’ of $250,000 into $500,000… or… $500,000 into $1,000,000… and on it goes.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."