The New Zealand dollar/US dollar pair rose to 0.7280 last week, showing a six-week rise. As you know, last week the Reserve Bank of New Zealand kept interest rates unchanged at 1.75%. In the accompanying statement, the leadership of the central bank adhered to an emphatically cautious rhetoric about the future prospects of monetary policy.

"Monetary policy will remain soft for a significant period," said RBNZ manager Graham Wheeler. "Numerous uncertainty factors" in the country and in the world compel the central bank to be cautious.

The rate of the New Zealand dollar has increased by 3% since May, which is a problem for the RBNZ. Many other central banks of the world are striving to accelerate inflation and strengthen commodity-dependent commodity exports of the economy.

Nevertheless, the tendency of the US dollar to decline in the world foreign exchange market creates prerequisites for the growth of the NZD/USD pair.

Today, market participants will follow the data on New Zealand's foreign trade balance for May, which are published at 21:45 (GMT). With positive data, the New Zealand dollar will receive additional support.

Technical analysis

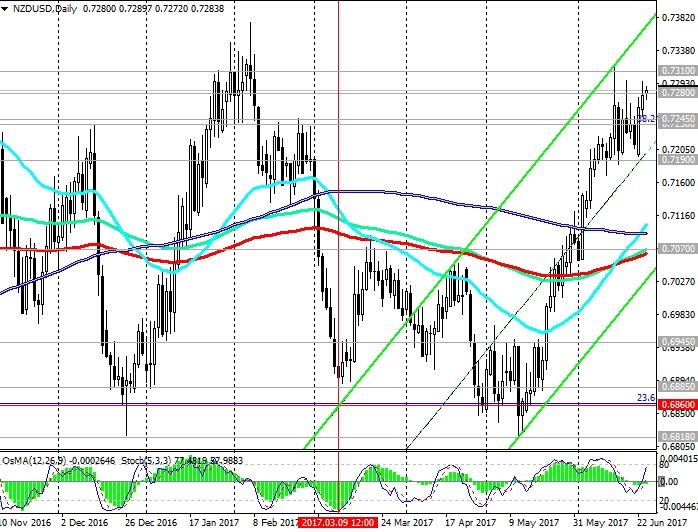

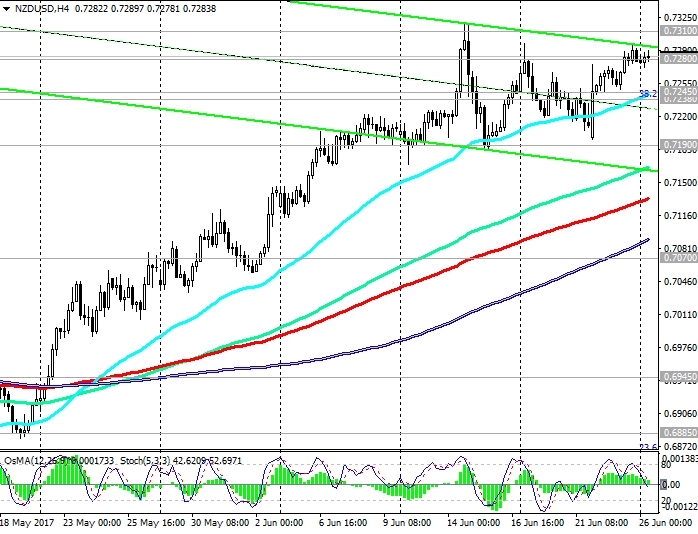

As a result of active growth, which began in the middle of last month, the pair NZD/USD broke through the strong resistance levels 0.7190 (EMA144 on the weekly chart), 0.7238 (Fibonacci level 38.2% upward correction to the global wave of the pair's decline from the level of 0.8800, which began in July 2014 Year, the low of December 2016) and is currently trading at the resistance level of 0.7280 (EMA200 on the weekly chart).

The NZD/USD pair maintains positive dynamics, while OsMA and Stochastic indicators on the daily, weekly, monthly charts are on the buyers’ side.

At the same time, the NZD/USD pair is in the zone of strong resistance levels of 0.7280, 0.7310 (the top line of the descending channel on the weekly chart), from which there may be a retreat and a decline in the channel.

In this regard, it is worth paying attention to the indicators OsMA and Stochastics, which on the 1-hour, 4-hour charts are deployed to short positions.

The breakdown of support levels of 0.7245 (EMA200 on the 1-hour chart), 0.7238 could trigger a further decline in the NZD/USD pair.

The difference between the monetary policies of RBNZ and the Fed is still a strong fundamental factor in favor of reducing the NZD/USD pair.

Support levels: 0.7245, 0.7238, 0.7190, 0.7165, 0.7100, 0.7070

Resistance levels: 0.7280, 0.7310, 0.7380, 0.7440