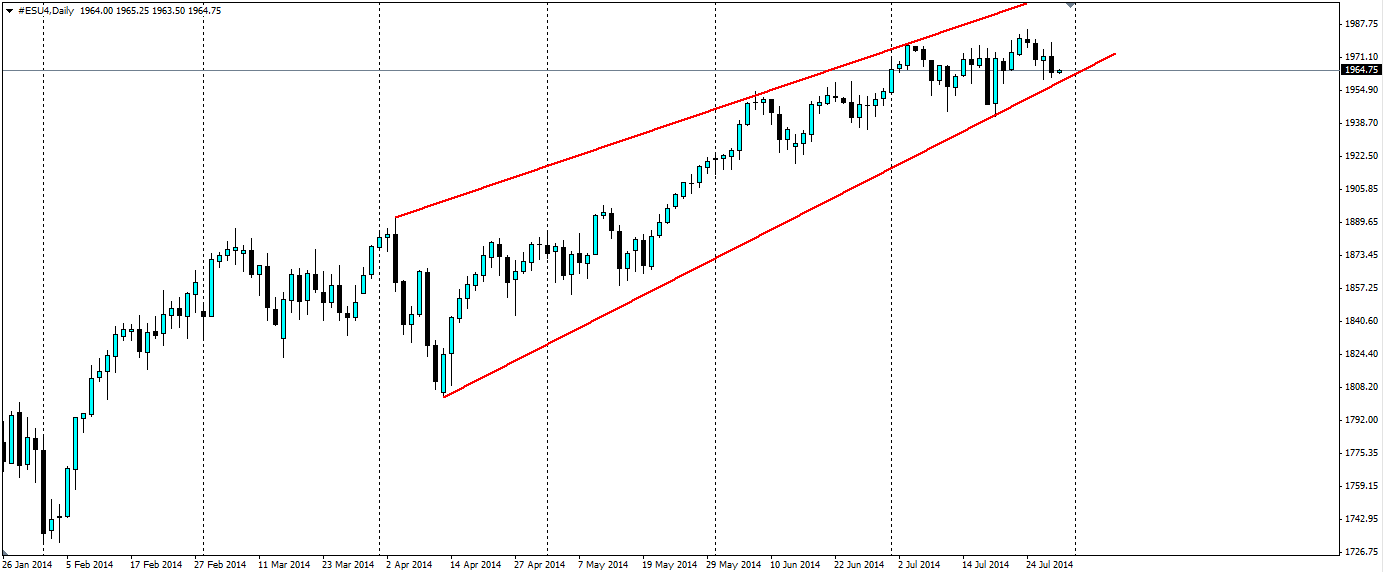

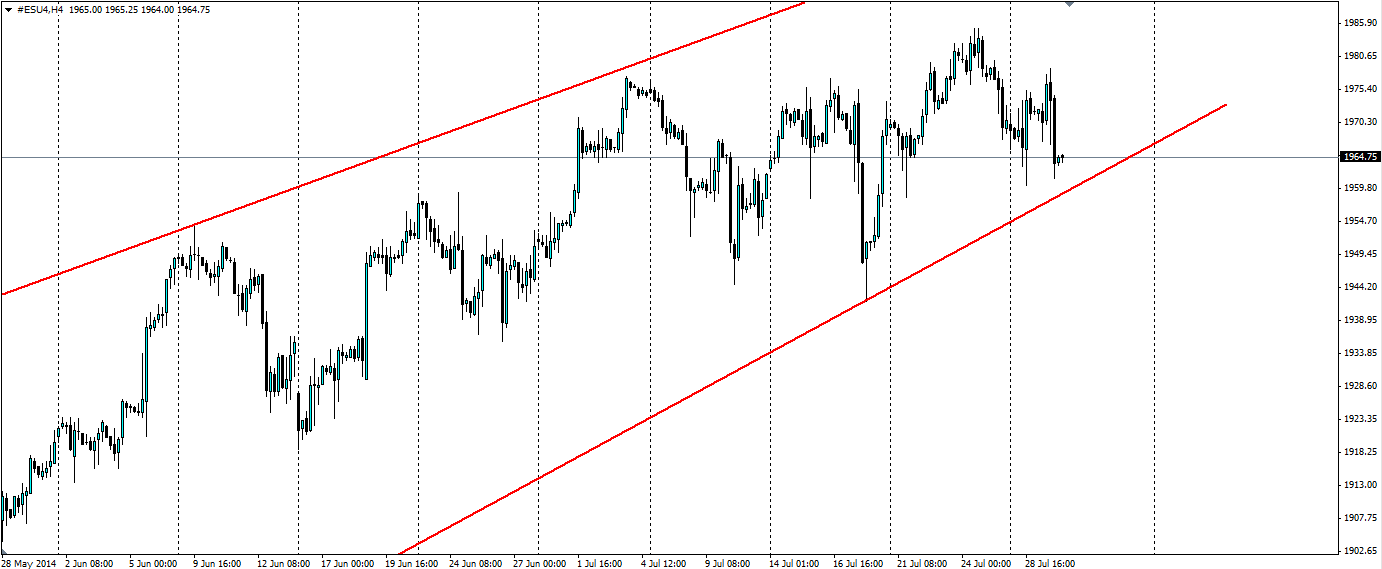

The S&P 500 index currently following an upward sloping wedge as the price moves north in an ever tightening band. It looks to have just bounced off the trend line and will target fresh all-time highs in the weeks to come if the US economic data stays favourable.

The earnings season in the US is a big driver of the S&P 500 index and so far it has been positive. 46% of companies in the S&P 500 have delivered results and a solid 80% of those have announced positive. This optimism had pushed the S&P 500 to an all-time high during the week, however, it pulled back late in the week as traders took profits and one or two big companies announced losses (such as Visa and Amazon). The general consensus is that the earnings season will end positively and this should help the index respect the current bullish trend line.

The big test will come later this week when the US Non-farm Payroll data comes out. The last two reports have showed strong job creation (+217k and +288k respectively) which pushed the S&P 500 index to all-time highs on both occasions. This month has a higher estimate than both of the previous two, which could put more pressure on the report if it does not excel, however, this reflects the optimism in the US at the moment and provides a good omen for US bulls.

There is plenty of other data that could buoy the S&P this week. Advance GDP later today (30th Jul 12:30 GMT) will give a good snapshot of the state of the wider economy and couldn’t possibly be worse than last quarter’s -2.9% (annualised). This round the market is expecting +3.1%, which is a massive turnaround if it comes in as expected and will no doubt boost the markets.

The Federal Funds Rate and FOMC statement also today (18:00 GMT) will give the market an idea of the current thoughts of the US Federal Reserve. The interest rate has a large impact on equities as it creates demand based on the yield differential. Equities have been on a dream run partly because the interest rate means borrowing costs for investment are low and also because equities yield more than deposits. Interest rates are expected to stay at 0.25% and Quantitative Easing is expected to be scaled back by another US$10b. Any hawkish talk from the FED will negatively affect equities as there will be less cash to boost asset prices, however FED Chairwoman Janet Yellen is seen as dovish so do not expect any hard talk this time around.

The S&P 500 is likely to keep a very close eye on the economic calendar along with the remaining companies yet to report earnings. The consensus is for more positive data and if that is the case look for the bullish channel to hold firm and the all-time highs to be tested. Beware, as all of this news will increase volatility, which could knock out stop losses before the party begins.