- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

RPM's Q3 Results To Be At Higher End Of Previous Guidance

RPM International Inc. (NYSE:RPM) recently announced that it expects revenues, adjusted EBIT and earnings for third-quarter fiscal 2020 to be at the higher end of its previously announced guidance.

Chief Executive Frank Sullivan stated that even amid the COVID-19 outbreak, RPM’s supply chain and business operations remain strong. He also claimed that its March operating results are solid. Further, he revealed that the company intends to meet the changing needs of customers in this unprecedented period.

During fiscal second-quarter 2020 earnings release, the company anticipated revenue growth of 2.5-4%. It also expects adjusted EBIT growth within 25-30% and adjusted earnings in the high-teens to low-20-cent range.

Initiatives to Drive Growth

Fiscal third quarter is seasonally weak, thanks to slowing down of painting and construction activity due to cold and snowy weather. Nonetheless, RPM anticipates fiscal third-quarter results — set to be released on Apr 8 — to come in at the high end of its prior guidance, as the 2020 MAP to Growth initiative has started paying off. In the first six months of fiscal 2020, its earnings increased 27.6% and adjusted EBIT margin improved 210 basis points (bps) year over year.

It remains focused on its previously set target of 540-bps improvement in operating margin through 2020. The company is on track to reduce costs by closing plants, merging IT system, centralizing more of its back-office functions and rationalizing manufacturing footprint. Out of 31 plant consolidations, 19 have been completed in the fiscal second quarter.

For fiscal 2020, the company expects double-digit adjusted EBIT growth of 20-24%. Also, its earnings are expected in the range of $3.30-$3.42 per share, indicating a significant improvement from the fiscal 2019 level of $2.71.

In addition to restructuring, acquisitions have also been an important part of RPM’s growth strategy. Acquisitions added 1.5% to net sales in the first half of fiscal 2020 and 1.4% in fiscal 2019.

Our Take

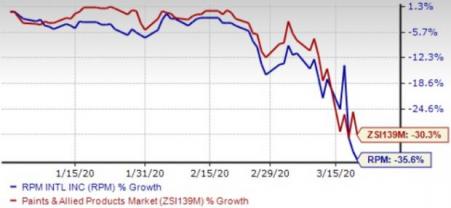

Over the past year, RPM’s shares have declined 35.6% compared with the industry’s 30.3% fall. The company has been witnessing negative impact of foreign currency translation. Also, higher costs and expenses added to the woes. In the first six months of fiscal 2020, foreign currency headwinds negatively impacted sales growth by 1.3%. In the fiscal second quarter, SG&A expenses increased 50 bps year over year.

Despite the above-mentioned headwinds, we believe that the recent news will lift investors’ sentiments going forward.

Zacks Rank & Key Picks

Currently, RPM carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the Zacks Construction sector include D.R. Horton, Inc. (NYSE:DHI) , M.D.C. Holdings, Inc. (NYSE:MDC) and Meritage Homes Corporation (NYSE:MTH) , each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

D.R. Horton, M.D.C. Holdings and Meritage Homes’ long-term earnings are expected to grow 10.7%, 8.5% and 6.8%, respectively.

Free: Zacks’ Single Best Stock Set to Double

Today you are invited to download our latest Special Report that reveals 5 stocks with the most potential to gain +100% or more in 2020. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

This pioneering tech ticker had soared to all-time highs and then subsided to a price that is irresistible. Now a pending acquisition could super-charge the company’s drive past competitors in the development of true Artificial Intelligence. The earlier you get in to this stock, the greater your potential gain.

See 5 Stocks Set to Double>>

D.R. Horton, Inc. (DHI): Free Stock Analysis Report

Meritage Homes Corporation (MTH): Free Stock Analysis Report

M.D.C. Holdings, Inc. (MDC): Free Stock Analysis Report

RPM International Inc. (RPM): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

As markets try to look through the blizzard of policy changes flowing out of Washington, the crowd has shifted its preferences considerably in recent weeks based on a sector lens....

Nvidia’s muted reaction keeps tech on edge, with chipmakers in focus. Nasdaq’s 20980-21000 support holds—for now. A break could mean trouble. With Nvidia done, GDP today and...

Here’s where I see stocks now: Yes, we’ve got some legitimate concerns as some economic warning signs appear—and run up against the tech-driven optimism that’s powered stocks to...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.