- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Ross Stores (ROST) Stock Slips After Q4 Earnings Miss

Ross Stores, Inc. (NASDAQ:ROST) just released its fourth-quarter and full year 2017 financial results, posting adjusted earnings of $0.88 per share and revenues of $4.07 billion. Currently, Ross Stores is a Zacks Rank #2 (Buy) and is down nearly 3% to $78 per share in after-hours trading shortly after its earnings report was released.

ROST:

Missed earnings estimates. The company posted adjusted earnings of $0.88 per share, missing the Zacks Consensus Estimate of $0.93 per share. Unadjusted earnings were $1.19 per share, which includes a $0.10 per share benefit from the 53rd week and another $0.21 from the new Republican tax law.

Beat revenue estimates. The company saw revenue figures of $4.07 billion, topping our consensus estimate of $3.95 billion.

Ross Stores revenues jumped from $3.51 billion in the year-ago period. Ross’ board also approved both an increase in the stock repurchase authorization for 2018 to $1.08 billion and a higher quarterly cash dividend of $0.225 per share.

Looking ahead, the company now expects to post fiscal 2018 same-store sales growth between 1% and 2%. Ross also expects to report full year 2018 earnings per share between $3.86 and $4.03.

“Fourth quarter operating margin grew 95 basis points to 14.6%, up from 13.6% in the prior year,” CEO Barbara Rentler said in a statement. “This improvement was driven by a combination of strong merchandise margin, expense leverage from solid gains in same store sales, and the impact of the 53rd week.”

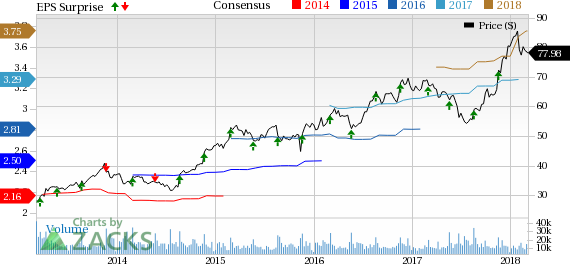

Here’s a graph that looks at ROST’s Price, Consensus and EPS Surprise history:

Ross Stores, Inc. is a company headquartered in Dublin, California, operates Ross Dress for Less (Ross), the largest off-price apparel and home fashion chain in the United States, the District of Columbia and Guam. Ross offers first-quality, in-season, name brand and designer apparel, accessories, footwear and home fashions for the entire family at savings of 20% to 60% off department and specialty store regular prices every day.

Check back later for our full analysis on ROST’s earnings report!

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Ross Stores, Inc. (ROST): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Nvidia’s muted reaction keeps tech on edge, with chipmakers in focus. Nasdaq’s 20980-21000 support holds—for now. A break could mean trouble. With Nvidia done, GDP today and...

Here’s where I see stocks now: Yes, we’ve got some legitimate concerns as some economic warning signs appear—and run up against the tech-driven optimism that’s powered stocks to...

Nvidia’s earnings beat didn’t erase investor concerns over slowing growth. Soft Q1 guidance and valuation worries may limit the stock’s upside. Weak network and gaming sales...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.