The cycle of accumulation and distribution defines countertrend decline within cause building for the US dollar index (N:UUP).

The US dollar index or Dixie for short, an index or basket of trade weighted currencies, has been building cause since March 2015. Cause, a transfer of leverage and sentiment from weak (majority) to strong hands (minority), will transition the trend to mark up once enough 'energy' is accumulated to jump the creek.

US dollar index has been sending a message of caution since November 2014. Extreme DI readings below -80% not only advised tighter risk management for bulls through February 2015 but also foreshadowed the onset of cause (building) in March 2015. As long as the Dixie churns through cause, bearish headlines, many stoking the fire of fear, will convert the majority from bullish to bearish over time. This conversion process, the accumulation of the energy necessary to jump the creek of cause and transfer of ownership in which the minority fades the extreme pessimism of the majority, will fuel continuation of mark up.

Price

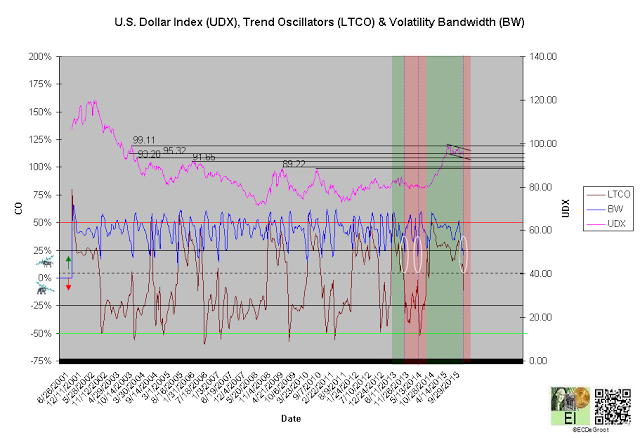

A negative trend oscillator (LTCO) defines a bearish crossover and down impulse (decline) from 94.79 since the second week of October (chart 1). The bears control the trend until reversed by a bullish crossover. Compression, a BW close below 25% highlighted by white circles and blue dotted lines, generally anticipates expansion. Bearish crossovers of price and leverage point towards a decline fueling expansion (see leverage).

A close above 99.11 jumps the creek and transitions the trend from cause to mark up. A close below 93.20 breaks the ice and signals a deeper correction with cause. The US dollar index has been building cause since March 2015.

Chart 1

Leverage

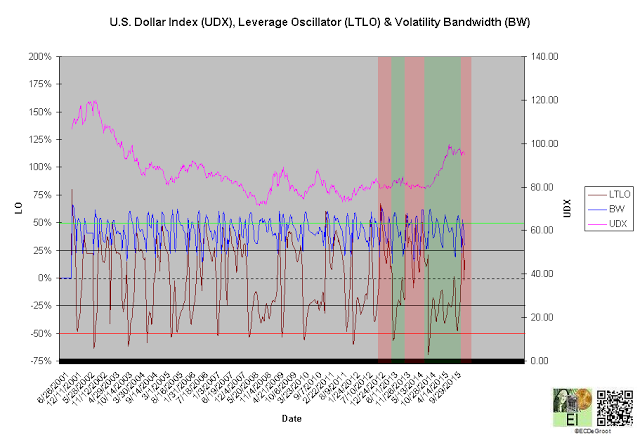

A positive long-term leverage oscillator defines a bearish crossover, up impulse, and bear phase (chart 2). This phase supports the decline and tightens risk management for the bulls (see price).

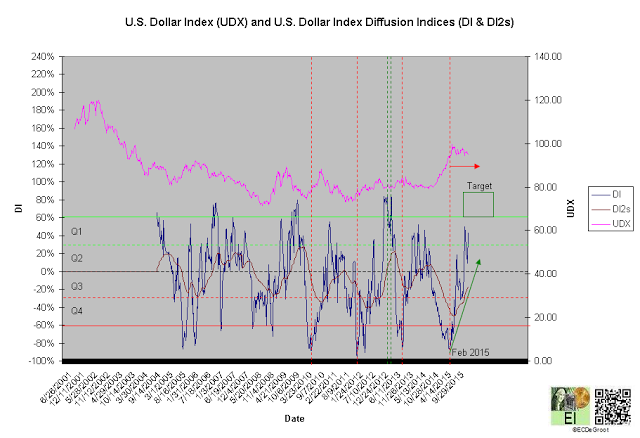

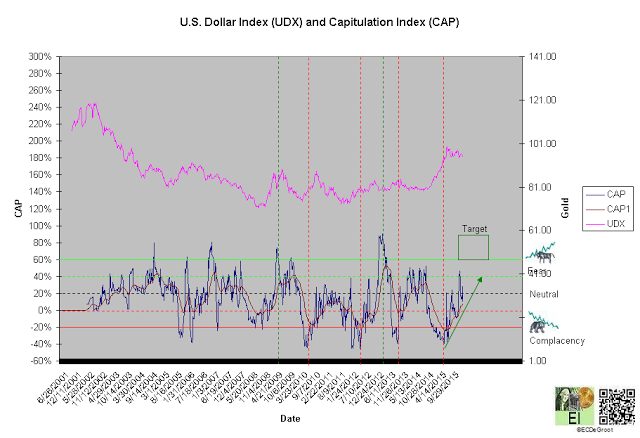

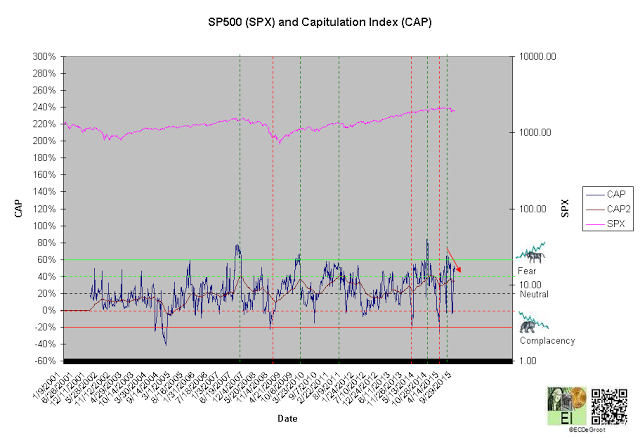

A diffusion index (DI) of 44% defines Q3 distribution (chart 3). A capitulation index (CAP) of 29% supports DI's relatively neutral message (chart 4). DI and CAP's trend, broader flows of leverage and sentiment from extreme distribution (red dotted line) to accumulation and extreme complacency (red dotted line) to fear supporting the bears (green arrows), should not only continue to extreme concentrations but also restrain upside expectations until reversed (see price).

Chart 2

Chart 3

Chart 4

Time/Cycle

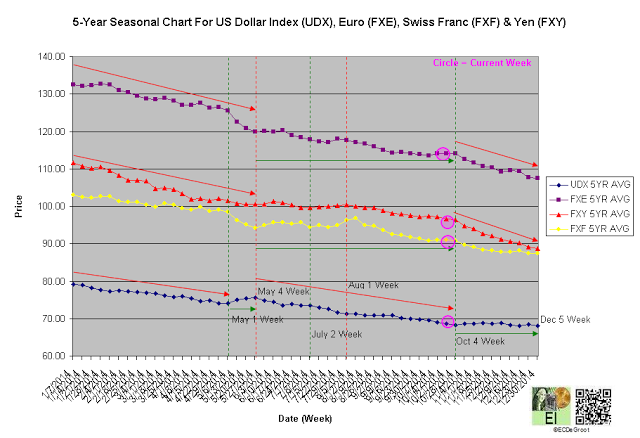

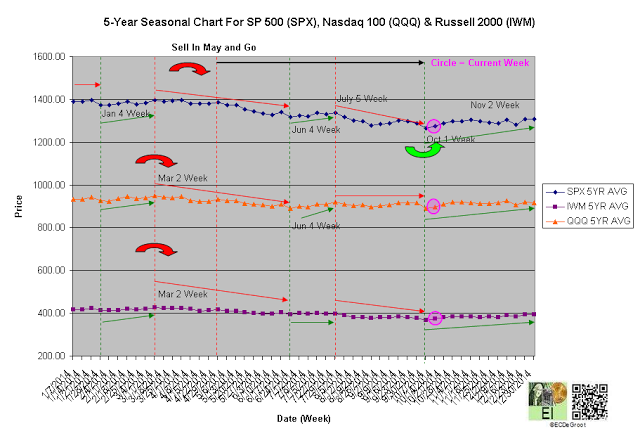

The 5-year seasonal cycle defines weakness until the fourth week of October (chart 5). This path of least resistance that supports the decline also restrains upside expectations (see price).

Chart 5

Time/Cycle

The 5-year seasonal cycle defines strength until the end of the year (chart 5). This path of least resistance supports restrained downside expectations (see price).

Chart 5