- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

How To Profit Off Of The Gambling Capital Of The World

The gambling capital of the world, Macau, China, a region that brings in more than 5 times the gambling revenue of Las Vegas, has American casino investors at the edge of their seats. Within the most populous country in the world, Macau is the only place in which casinos are allowed and they are booming. Some of the largest US casinos bring in a majority of their income from Macau operations

Macau just released its strongest year-over-year growth figures all year for June causing US casino stocks like Wynn Resorts (NASDAQ:WYNN) , MGM International (NYSE:MGM) and Las Vegas Sands (NYSE:LVS) to jump this week. So far this week WYNN is up 6.2%, LVS is up 5%, and MGM is up 0.8%, with these returns aligning with each companies’ Macau exposure.

WYNN is the most exposed to China with over 75% of its EBITDA being driven by Macau, followed by LVS which derives almost 60% of its EBITDA from Macau operations, and MGM is the least exposed with 24% of its EBITDA coming from this region. Macau is driving that majority of all three of these firms growth with this region’s total gambling revenue growing strong double-digit figures in the last 2 years.

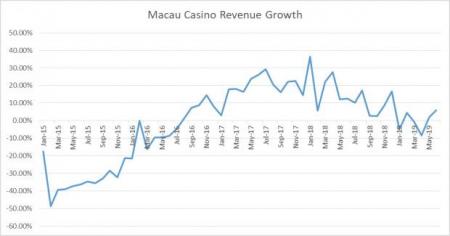

Below is Macau’s year-over-year casino revenue growth by month. 2017 and ’18 both saw robust expansion while 2019 has seen a slowdown. The past 2 months Macau has experienced positive growth and these casinos are hoping this growth can continue.

Gambling Performance

The US-China trade war is impacting these highly exposed casinos indirectly. Gambling firms typically have a high betas because they generally do well when the overall populous is doing well. If the general population has extra discretionary spending as well as positive income outlook they feel much more comfortable gambling with a portion of it. This trade war has caused a bit of uncertainty about future income for the Chinese, leading gambling revenues in Macau to experience a deceleration.

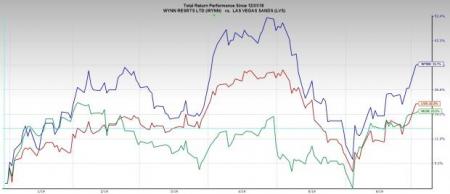

Over the last 52-weeks the least exposed casino to China, MGM, has performed the best while the most exposed, WYNN, has performed the worst. This trend has reversed since the start of 2019 with WYNN seeing returns of over 35% as the Chinese gambling outlook continues to brighten.

Valuation

LVS and WYNN are both trading at enterprise values that are 10x their forward EBITDA (EV/EBITDA), which is on the lower end of their 5-year trend with highs around 14x and lows around 8.5x.

Wynn Resorts is the most volatile of the three both because of its substantial amount of leverage combined with its excessive China exposure.

MGM, WYNN, and LVS all pay out a yield of 1.8%, 3%, and 5% in dividends annually. These dividend yields are a nice cushy fixed income for stocks that experience a considerable amount of volatility.

Take Away

As the trade war subsides and China’s economy stabilizes, these China exposed casinos could show investors a sizable return.

LVS is the largest publicly traded casino in the world and is my casino pick. It has the international exposure to drive growth in the future but less leverage than WYNN. It is able to boast reasonable valuation multiples with both forward EV/EBITDA and P/E falling below the industry average and both multiples are sitting on the lower side of this firm’s 5-year trend. The massive 5% dividend yield that LVS hands out to investors annually gives me some peace of mind about jumping into such a volatile stock.

All of these stocks hold a significant amount of risk and I would limit exposure, but they have a place in a well-diversified portfolio.

This Could Be the Fastest Way to Grow Wealth in 2019

Research indicates one sector is poised to deliver a crop of the best-performing stocks you'll find anywhere in the market. Breaking news in this space frequently creates quick double- and triple-digit profit opportunities.

These companies are changing the world – and owning their stocks could transform your portfolio in 2019 and beyond. Recent trades from this sector have generated +98%, +119% and +164% gains in as little as 1 month.

Click here to see these breakthrough stocks now >>

MGM Resorts International (MGM): Free Stock Analysis Report

Las Vegas Sands Corp. (LVS): Free Stock Analysis Report

Wynn Resorts, Limited (WYNN): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Warren Buffett and Berkshire Hathaway (NYSE:BRKa) always make headlines in February when the firm holds its annual meeting. Among the many takeaways is what the company has been...

While Tuesday I wrote about the strength of junk bonds in the face of risk-off ratios (TLT v. SPY, HYG), today, I am still quite concerned about Granny Retail or the consumer...

Nvidia (NASDAQ:NVDA) shook things up by reporting revenue of $39.3 billion for the quarter while guiding next quarter to $43 billion. This was slightly below the pattern’s...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.