The US dollar index was trading higher on Monday. This comes following last Friday’s payrolls report. Investor expectations for a larger rate cut in July fell after a strong payrolls report showed a rebound in the labor market.

The Fed Chair, Jerome Powell is due to speak later today and tomorrow. Investors await further cues from him as the economic calendar remains largely quiet for the most part today.

Euro Muted to German Industrial Production

Germany’s industrial production data released on Monday saw a 0.3% increase on the month. However, construction output offset the gains in the manufacturing sector. On a year over year basis, Germany’s industrial output is down 3.2%. Meanwhile, the eurozone’s Sentix investor confidence report showed a decline to -5.8 from -3.3 earlier.

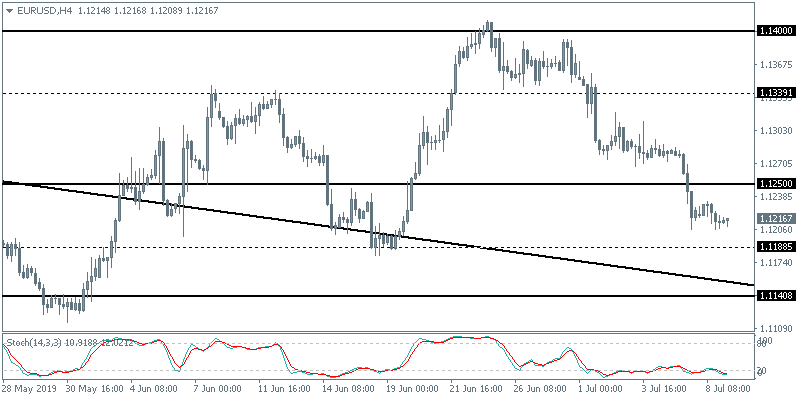

EUR/USD Likely to Extend Declines

The currency pair is likely to continue its downside. The minor support level at 1.1188 will be tested in the near term. If the support level holds, then we could expect to see a modest rebound in the currency pair. However, the EUR/USD will still maintain a sideways range above 1.1188. To the downside, a break down below 1.1188 support will see the EUR/USD extending losses to 1.1140.

Sterling Hovers Near 6-Month Low

The pound sterling was seen staying flat, hovering near a 6-month low on Tuesday. The pair was flat amid lack of any economic data to go by. The UK is set to elect a new Prime Minister and Boris Johnson remains the frontrunner. The currency pair could remain near the current lows, awaiting further catalysts.

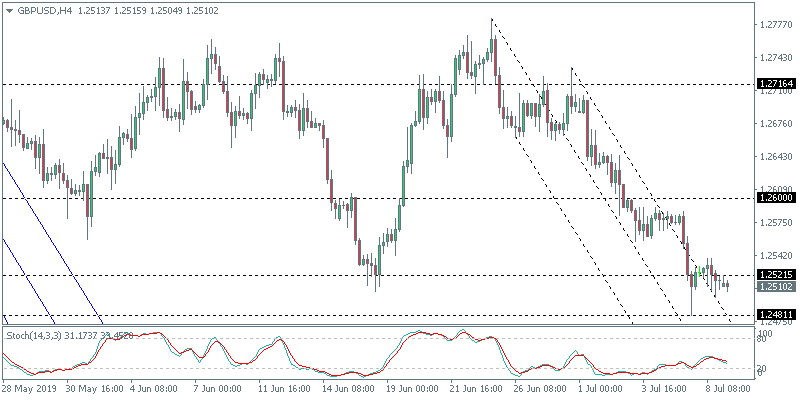

Will GBP/USD Bounce Back?

The currency pair remains steady near the 6-month low. The declines have invalidated the evolving inverse head and shoulders pattern. However, we could expect to see a modest bounce off this level in the near term. At the time of writing GBPUSD is trading near 1.2125. Following a break down below this level, the next lower support is seen at 1.2481.

Gold Declines for 4 Consecutive Sessions

The precious metal was seen maintaining its bearish momentum on Monday, although price action was relatively subdued. Gold prices fell 0.24% on the day. Economic data on the day was sparse with most of the technical trading coming out from Friday’s payrolls report.

Will Gold Extend Further Losses?

Price action in the precious metal currently indicates that there could be further downside. Following the breach of the rising trend line, gold briefly retested the breakout level before easing back lower. The immediate support at 1383.60 remains the key level of interest. If this support gives way, gold prices could extend further declines.