- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Regeneron, Sanofi Report Positive Top Line Skin Cancer Data

Regeneron Pharmaceuticals, Inc. (NASDAQ:REGN) along with partner Sanofi (NYSE:SNY) announced positive top-line efficacy results from a pivotal phase II study of its experimental candidate, cemiplimab. The EMPOWER-CSCC 1 study is being conducted on 82 patients with a type of skin cancer: advanced cutaneous squamous cell carcinoma (CSCC).

Cemiplimab is a checkpoint inhibitor targeting PD-1 (programmed death protein 1). The cemiplimab monotherapy study showed an overall response rate (ORR) of 46.3%. The median duration of response (DOR) had not yet been reached at the data cut-off point. At the time of this analysis, all patients had a minimum follow up of six months.

The safety profile in the study was generally consistent with approved anti-PD-1 agents. Notably, for patients with CSCC that cannot be cured by surgery or radiation, there are no FDA-approved treatment options. This is the largest prospective study ever conducted in this disease and many patients were able to achieve deep and durable responses. Hence, the candidate is expected to provide the company with access to a market promising huge potential.

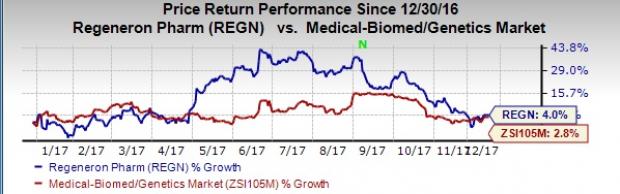

So far this year, shares of Regeneron have gained 4% compared with the industry’s growth of 2.8%.

Per the company’s press release, CSCC is the second most common and deadliest skin cancer after melanoma in the United States. The disease is also responsible for most deaths among non-melanoma skin cancer patients. Although it is easier to apprehend the condition in early stages, it becomes quite difficult to treat the same once progressed to advanced stages.

The data from the EMPOWER-CSCC 1 study will form the basis of a rolling Biologics License Application (BLA) submission to the FDA, which has been initiated and is expected to be completed in the first quarter of 2018. The company also expects to make a filing to the European Medicines Agency (EMA) in the first quarter of 2018.

The results were consistent with the positive phase I trial expansion cohort results reported at ASCO in June, 2017, which led to the candidate receiving Breakthrough Therapy Designation in September.

Zacks Rank & Stocks to Consider

Regeneron has a Zacks Rank #3 (Hold). Some better-ranked health care stocks in the same space are Sucampo Pharmaceuticals (NASDAQ:SCMP) and Corcept Therapeutics Inc. (NASDAQ:CORT) holding a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Sucampo’s earnings per share estimates have moved up from 3 cents to $1.12 for 2017 and from $1.15 to $1.19 for 2018, over the last 30 days. The company delivered a positive earnings surprise in three of the trailing four quarters, with an average beat of 15.63%. The share price of the company has increased 20.3% year to date.

Corcept’s earnings per share estimates have climbed from 78 cents to 88 cents for 2018, over the last 60 days. The company pulled off a positive earnings surprise in two of the trailing four quarters, with an average beat of 14.32%. The share price of the company has increased 136.4% year to date.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

Sanofi (SNY): Free Stock Analysis Report

Regeneron Pharmaceuticals, Inc. (REGN): Free Stock Analysis Report

Sucampo Pharmaceuticals, Inc. (SCMP): Free Stock Analysis Report

Corcept Therapeutics Incorporated (CORT): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Nvidia’s muted reaction keeps tech on edge, with chipmakers in focus. Nasdaq’s 20980-21000 support holds—for now. A break could mean trouble. With Nvidia done, GDP today and...

Nvidia’s earnings beat didn’t erase investor concerns over slowing growth. Soft Q1 guidance and valuation worries may limit the stock’s upside. Weak network and gaming sales...

Shares of Etsy (NASDAQ:ETSY) are down approximately 7% since the company reported earnings on February 19. Concerns over slowing growth are overriding revenue and earnings that...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.