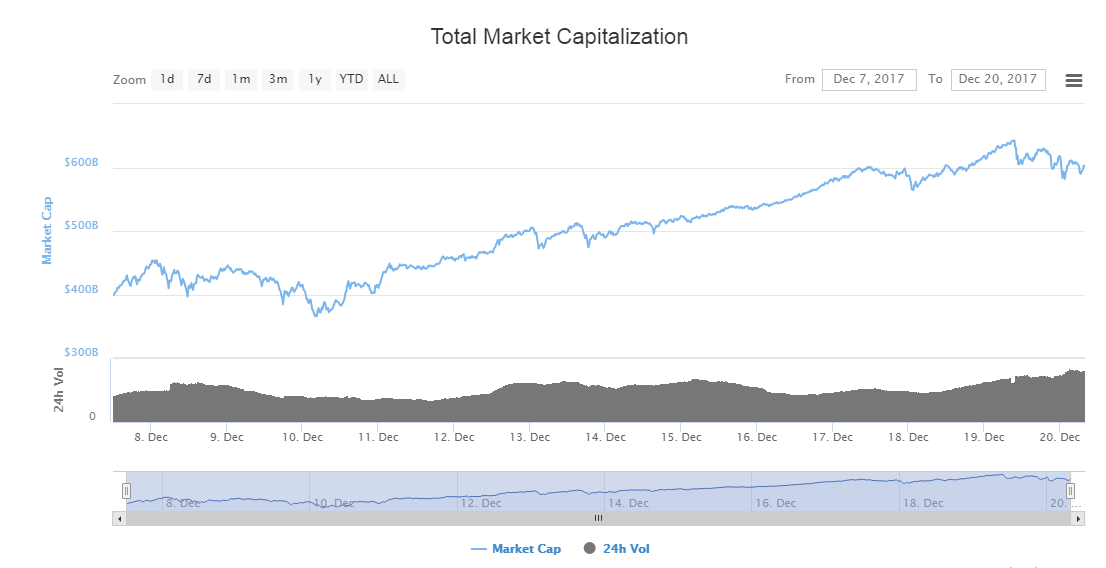

Looks like we've got a pullback coming in on the Crypto market at the moment with many coins down 10% or more off of their all time highs.

This market is risky and hard to predict in the short term so we can't really know if this pullback will get much deeper or be reversed within the next few hours.

With that said, many of you who already have significant profits may be wondering just how to redistribute them into a more long term, more sustainable portfolio.

This is exactly what we did in the webinar yesterday. Using my own portfolio as an example and using the help of some of our more experienced clients we demonstrated some of the principles of proper portfolio management using the power of social trading.

Check out the recording of our session here: http://etoro.tw/2kPWXei

Today's Highlights

Trumps Taxes are Close

The South Korea Hack

Bitcoin Cash Grabs the Spotlight

Please note: All data, figures & graphs are valid as of December 20th. All trading carries risk. Only risk capital you're prepared to lose.

Traditional Markets

Donald Trump's tax cut plan is now so close that Wall Street traders are literally starting to salivate. Though, we've heard from many economists and even the top officials at the US Federal Reserve, the ones who are effectively in charge of the US Dollar, that this plan will not have a trickle-down effect on the economy.

Analysts point out that this plan is likely to increase the wealth of the ultra-rich at the expense of the US Deficit. The ones at the top are most likely to hoard the additional income rather than redistribute it. So what we're looking at is a plan that will in effect accelerate the gap between the rich and poor in the United States.

Many have called the plan a "fiscal sugar high."

So we should probably be a bit wary of the recent bull run because we all know what comes after a sugar high. There's an old trader saying "buy the rumor, sell the news."

Let's hope that's not the case here. In any case, if all goes according to plan the tax bill could be on President Trump's desk ready to sign within the next 48 hours or less.

Youbit Hacked

Now, we've seen before how some hacks can have a huge impact on the crypto markets but most have little effect. It usually depends on who gets hacked, where and how and who is affected by it.

This one is very important primarily because of the location. As we know, South Korea is one of the largest cryptotrading countries. So even though Youbit is not their biggest exchange site, the headlines that they're shutting down for business will be in every paper, every discussion board, and a regular topic of conversation there this morning.

Youbit has already halted all deposits and withdrawals and plans to return clients holdings at the rate of 75 cents on the Dollar. This is certainly the kind of thing that can put a damper on the buying frenzy in a critical location.

Further details of the hack will be watched closely by the entire community. Though it does seem in large part that the damage has been done and the recent rally is on hold for the time being. When and if it will resume remains to be seen.

Bitcoin Network Status

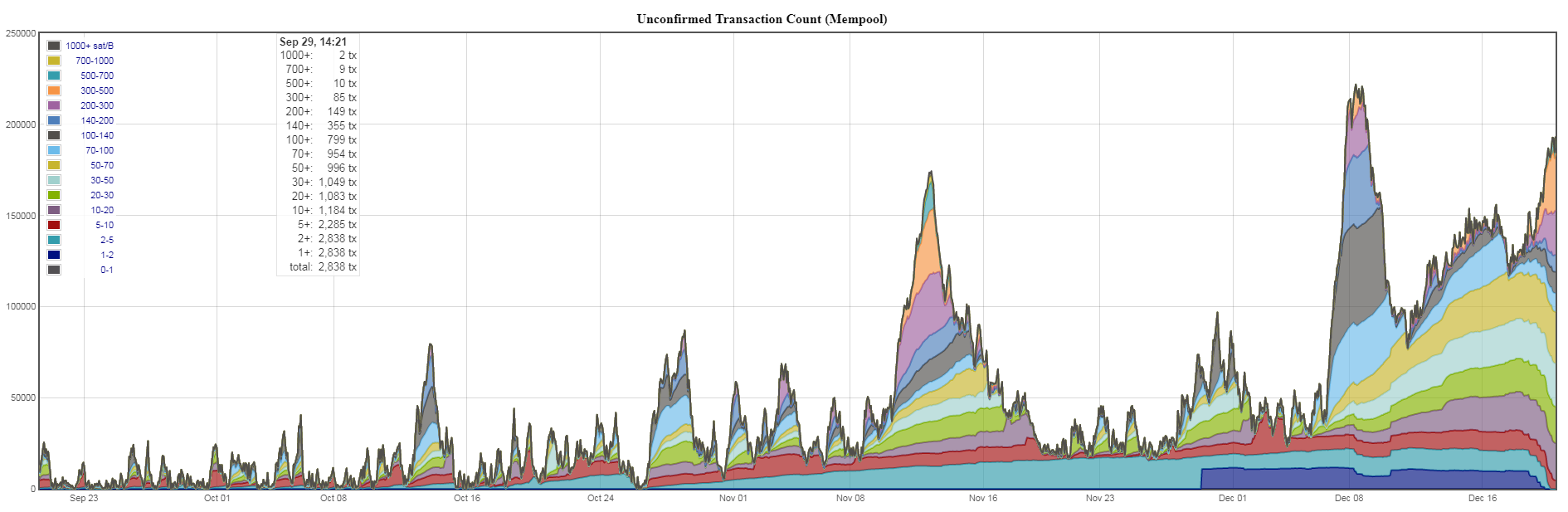

One of the hardest hit by this minor pullback has been bitcoin. We've been speaking about the sustainability of the bitcoin blockchain in these daily updates for several weeks now and it seems that the network is indeed nearing it's max capacity.

At the moment, there are 230,000 unconfirmed transactions in the mempool. The concerning thing is that this number has remained at elevated levels since December 6th.

This graph shows the number of unconfirmed transactions at any given time over the past three months.

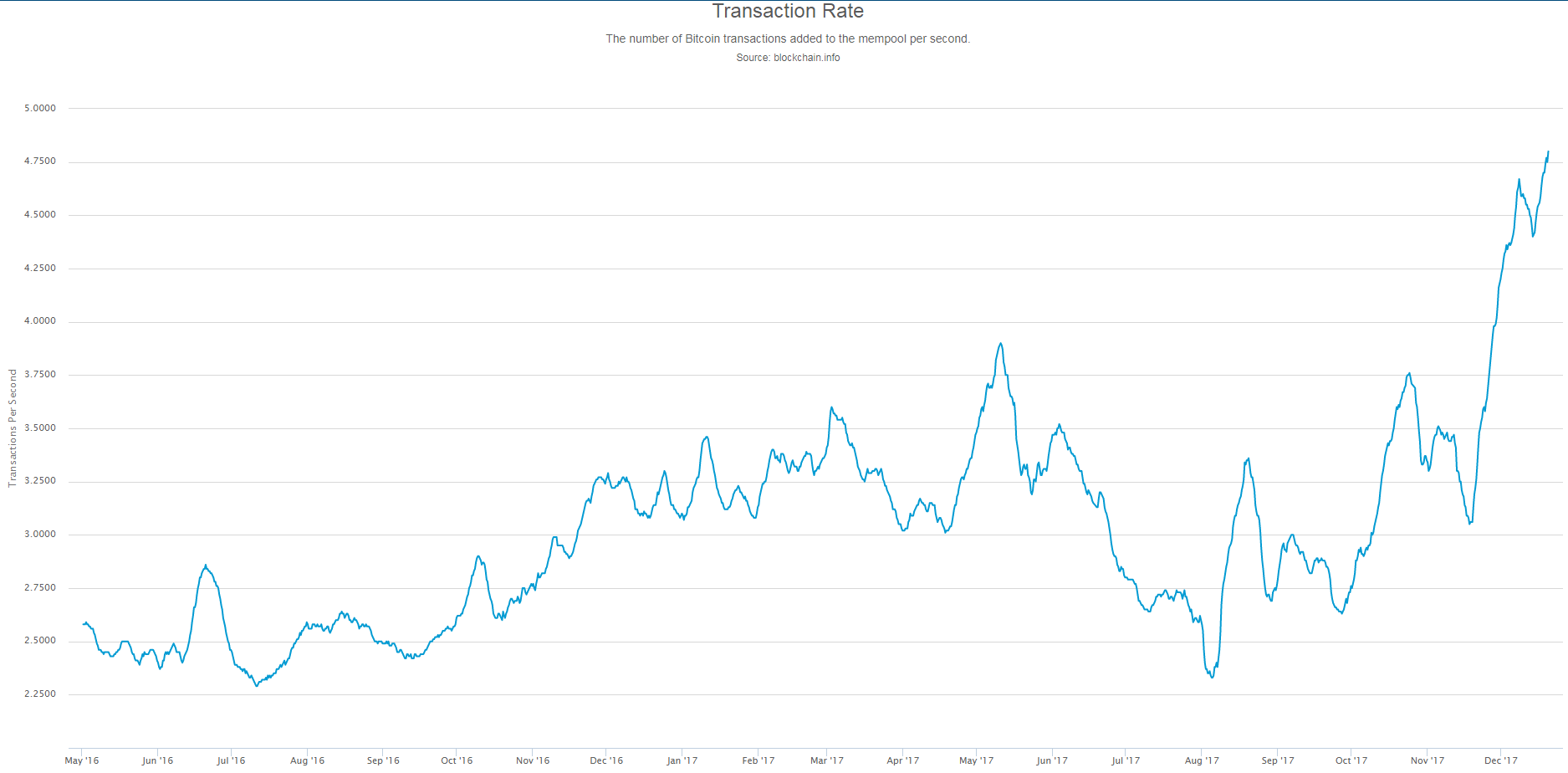

The amount of transactions happening per second continues to increase, now at 4.81 TPS.

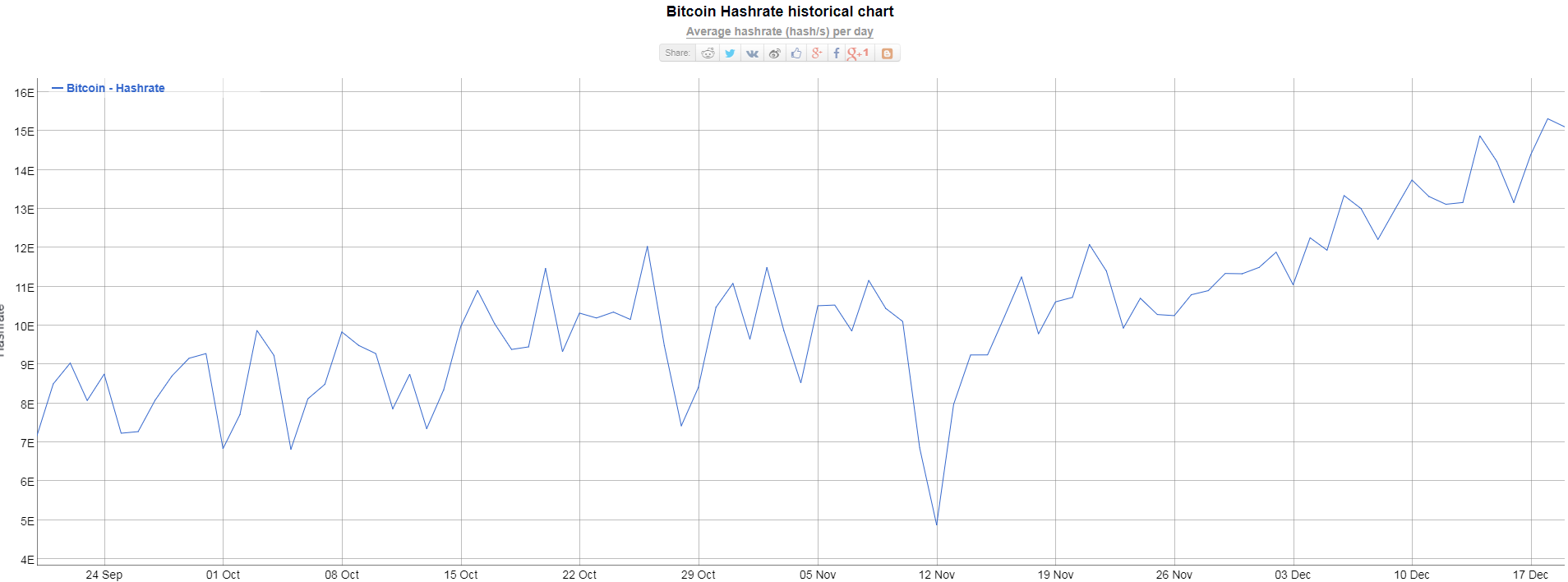

The good news is that it seems more computing power is joining the bitcoin mining force and the hashpower has also grown in the last three months.

Bitcash's Gain

As we've seen many times over the last few months, Bitcoin's loss is Bitcoin Cash's gain. Despite the pullback that we're seeing from the rest of the crypto market Bitcash is actually surging.

This graph shows the unique relationship between the two rival coins over the last month. Both of them have more than doubled in value over this time frame. But notice how many times when Bitcoin sees even a small pullback, Bitcash has a tendency to fly.

For the savvy investor, we need to check our politics at the door. No matter which one you believe has a better shot at replacing government backed money in the long run as a payment method and/or as a store of value, it may be prudent to have some amount of both in your overall portfolio.

As with any investment, the key is to diversify, diversify, diversify!

Wishing you a spectacular day ahead!

eToro, Senior Market Analyst

Disclosure: This content is for information and educational purposes only and should not be considered investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital you're prepared to lose.