- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Sunoco's $3.3B Deal With 7-Eleven Faces Creditors Objection

A number of debt holders have raised objection against downstream petroleum distributor Sunoco LP’s (NYSE:SUN) $3.3 billion deal with Japan-based retail conglomerate Seven & I Holdings Co., Ltd. Bondholders have apparently raised an objection against a reported modification in the terms of the $1.6B-credit agreement. They demand higher monetary grants and enhanced protection to agree to the changes in the bond indentures.

The deal with 7-Eleven was announced in April and is scheduled to close by the second half of 2017. Per the deal, Sunoco is to sell around 1,100 convenience stores and gas stations in Texas and other states to 7-Eleven. Per the deal, the partnership will also enter a 15-year agreement with 7-Eleven to sell 2.2 billion gallons of fuel annually.

The deal will help the partnership to partially pay down $4.51 billion debt. The 15-year supply agreement will also provide the partnership with regular long-term income thereby improving Sunoco’s financial profile.Sunoco will utilize cash proceeds to repurchase equity, including the $300-million investment made by its parent company Energy Transfer Equity (NYSE:ETE) in March along with some of the units owned by Energy Transfer Partners (NYSE:ETP) from the drop-down transactions last year.

Sunoco plans to sell another 200 stores and fuel outlets in North and West Texas by the end of the fourth quarter and expand its distribution business through acquisitions.

Energy companies like Hess Corporation (NYSE:HES) , Valero Energy Corporation (NYSE:VLO) and others have divested gas stations to focus on the core business of exploring, transporting and refining oil and gas.

The divestiture is likely to improve the weak financial profile of Sunoco and enable it to pursue acquisitions. However, these retail stores are a major contributor to Sunoco’s earnings. Therefore, whether the partnership will be able to maintain its current pay-out level post the closure of the divesture remains a wait-and-watch story.

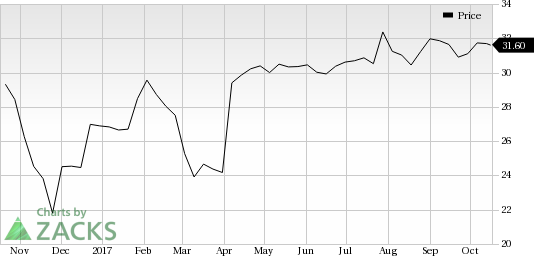

Sunoco currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Sunoco Logistics Partners LP (ETP): Free Stock Analysis Report

Energy Transfer Equity, L.P. (ETE): Free Stock Analysis Report

Sunoco LP (SUN): Free Stock Analysis Report

Hess Corporation (HES): Free Stock Analysis Report

Original post

Related Articles

Nvidia’s earnings beat didn’t erase investor concerns over slowing growth. Soft Q1 guidance and valuation worries may limit the stock’s upside. Weak network and gaming sales...

Warren Buffett and Berkshire Hathaway (NYSE:BRKa) always make headlines in February when the firm holds its annual meeting. Among the many takeaways is what the company has been...

While Tuesday I wrote about the strength of junk bonds in the face of risk-off ratios (TLT v. SPY, HYG), today, I am still quite concerned about Granny Retail or the consumer...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.