Cerner Corporation (NASDAQ:CERN) is expected to gain from recent developments and a solid guidance.

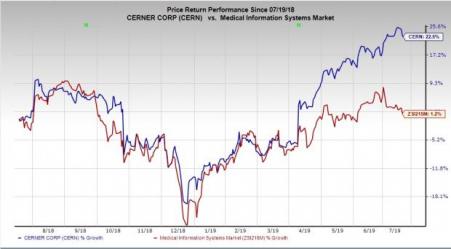

The Zacks Rank #2 (Buy) stock has rallied 22.5% compared with the industry’s 1.2% rise and the S&P 500 index’s 5.7% rally.

For the trailing four quarters, Cerner has a positive average earnings surprise of 0.8%.

Let’s take a look at the factors that are currently favoring Cerner.

What’s Favoring the Stock?

View Strong

For the second quarter of 2019, Cerner expects revenues between $1.41 billion and $1.46 billion.

Adjusted earnings per share (EPS) in the quarter are expected to be 63-65 cents.

Cerner has kept its 2019 revenue guidance intact. The company continues to expect revenues between $5.65 billion and $5.85 billion.

Moreover, Cerner raised the 2019 EPS view. The company now expects the metric in the range of $2.64-$2.72, above the previously mentioned $2.57-$2.67.

Developments

Cerner has seen some developments in recent times which have helped bolster the company’s foothold in the healthcare IT space.

For instance, the company recently invited innovators and application developers to be part of its next groundbreaking advancement in advancing consumers’ access to electronic health records (EHRs). This explains the company’s excellence and focus on the effective use of digital healthcare records.

Further, Cerner unveiled a new heath network — Anuva Health. The platform combines in-person and virtual health care services for employers looking to provide a unique benefit of improved health at lower costs to employees. Anuva Health is expected to put a check on rising healthcare costs.

Earlier, Cerner collaborated with DrFirst, a leading provider of medication management and data solutions on a new and innovative offering, to help providers tackle the opioid epidemic. Notably, with DrFirst, Cerner will be able to connect the EHR to each state’s prescription drug monitoring program in the United States.

Which Way Are Estimates Treading?

For the second quarter, the Zacks Consensus Estimate for Cerner’s EPS is pegged at 64 cents, suggesting year-over-year growth of 3.2%. The same for revenues stands at $1.44 billion, indicating a year-over-year increase of 5.1%.

For 2019, the Zacks Consensus Estimate for Cerner’s EPS is pinned at $2.67, suggesting 9% growth, while the same for revenues stands at $5.74 billion, calling for a 6.9% rise.

Other Key Picks

Other top-ranked stocks in the broader medical space are DENTSPLY SIRONA (NASDAQ:XRAY) , Penumbra (NYSE:PEN) and AmerisourceBergen (NYSE:ABC) . While DENTSPLY and Penumbra sport a Zacks Rank #1 (Strong Buy), AmerisourceBergen carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Penumbra’s long-term earnings growth is expected to be 21.5%.

DENTSPLY’s long-term earnings growth is projected at 11.5%.

AmerisourceBergen’s long-term earnings growth is expected to be 7.6%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Cerner Corporation (CERN): Free Stock Analysis Report

Penumbra, Inc. (PEN): Free Stock Analysis Report

DENTSPLY SIRONA Inc. (XRAY): Free Stock Analysis Report

AmerisourceBergen Corporation (ABC): Free Stock Analysis Report

Original post