- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Proteostasis Stock Surges On Positive Data From CF Studies

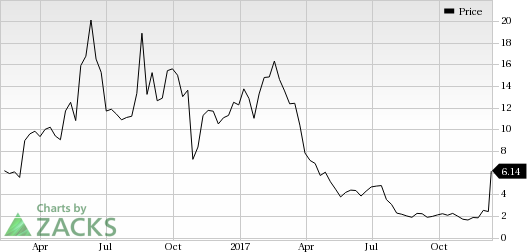

Proteostasis Therapeutics, Inc.’s (NASDAQ:PTI) shares surged more than 160% on Dec 12 after the announcement of positive results from studies evaluating its three cystic fibrosis ("CF") pipeline candidates. The three candidates include PTI-428 (a cystic fibrosis transmembrane conductance regulator [CFTR] amplifier), PTI-801 (a CFTR corrector) and PTI-808 (a CFTR potentiator).

PTI-428 and PTI-801 were evaluated in patients who were on background therapy with Vertex Pharmaceuticals Incorporated’s (NASDAQ:VRTX) Orkambi.

Shares of the company were up 60.7% in the past six months, outperforming the industry’s decline of 0.6% in that period.

The most advanced candidate, PTI-428, was evaluated in a phase II study in CF patients on background Orkambi therapy. Data showed that the addition of PTI-428 to Orkambi had mean absolute improvements in ppFEV1 (a measure of the lung function used for the disease) of 5.2% from baseline compared to placebo. It also showed a mean relative improvement of 9.2%. Data demonstrates that PTI-428 amplifies the effect of Orkambi in responding patients (ppFEV1

The dose ranging phase I study evaluating PTI-801 showed a mean improvement in ppFEV1 of approximately 4% from baseline. Moreover, a phase I study evaluating PTI-808 showed that the candidate is well tolerated in patient population.

Proteostasis is also evaluating the combination of PTI-428, PTI-801 and PTI-808 in CF patients in an early stage study. A preliminary analysis showed that the combination is well tolerated in patients and has the potential to be developed for once-daily dosing.

Zacks Rank & Stocks to Consider

Proteostasis carries a Zacks Rank #3 (Hold).

A couple of better-ranked stocks in the pharma sector include ACADIA Pharmaceuticals Inc. (NASDAQ:ACAD) and Corcept Therapeutics Inc. (NASDAQ:CORT) . Both the stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

ACADIA’s loss estimates narrowed from $2.44 to $2.41 for 2017 and from $1.67 to $1.59 over the last 30 days. The company came up with a positive earnings surprise in three of the trailing four quarters with an average beat of 9.95%. The company’s shares have returned 5.7% so far this year.

Corcept’s earnings per share estimates have increased from 78 cents to 88 cents for 2018 over the last 60 days. The company delivered a positive earnings surprise in two of the trailing four quarters with an average beat of 14.32%. The company’s stock is up 131.3% so far this year.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

Vertex Pharmaceuticals Incorporated (VRTX): Free Stock Analysis Report

ACADIA Pharmaceuticals Inc. (ACAD): Free Stock Analysis Report

Proteostasis Therapeutics, Inc. (PTI): Free Stock Analysis Report

Corcept Therapeutics Incorporated (CORT): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Every investor should know the term CEP, or customer engagement platform, because it is central to businesses' use of AI. CEPs provide software services to connect and communicate...

As markets try to look through the blizzard of policy changes flowing out of Washington, the crowd has shifted its preferences considerably in recent weeks based on a sector lens....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.