2017 saw continuing growth in assets, earnings, NAV, dividends and dividend cover. Primary Health Properties' (LON:PHP) EPRA NAV total return for the year was 16.4%. The prospects for further growth are good, with a strong pipeline of investment opportunities, a reduced LTV and average cost of debt, and substantial undrawn borrowing facilities. While yield tightening has benefited capital growth in recent years, it also increases the cost of acquisitions, and indications of accelerating rent growth are a positive development.

Strong income and capital growth in 2017

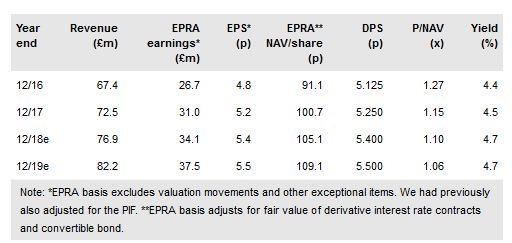

Rental income grew 7.1%, driven by acquisitions, funded developments completing and asset management. Asset growth and one-off start-up costs in Ireland increased the cost ratio slightly, but it remains one of the lowest in the sector, and EPRA earnings grew 15.7% (EPRA EPS 8.3%). The increased dividend was substantially covered and PHP is on track for 5.4p of dividends this year, which would be the 22nd year of growth. The net initial yield (NIY) tightened to 4.91%, driving revaluation gains worth 10.4p per share, with EPRA NAV per share increasing 10.5% to 100.7p. In addition, £71.9m was committed to acquisitions, with the portfolio value reaching £1.362bn. Our forecasts are little changed, other than capturing the higher valuation in NAV and assuming full conversion of the convertible bond, reducing gearing (c 5%) and diluting EPS (c 3%) until reinvested.

To read the entire report Please click on the pdf File Below: