Last week was one of solid gains for the price of oil, which saw the WTI contract rally following the sharp falls of the last few weeks, to close at $41.32 per barrel and move away from the volatility candle.

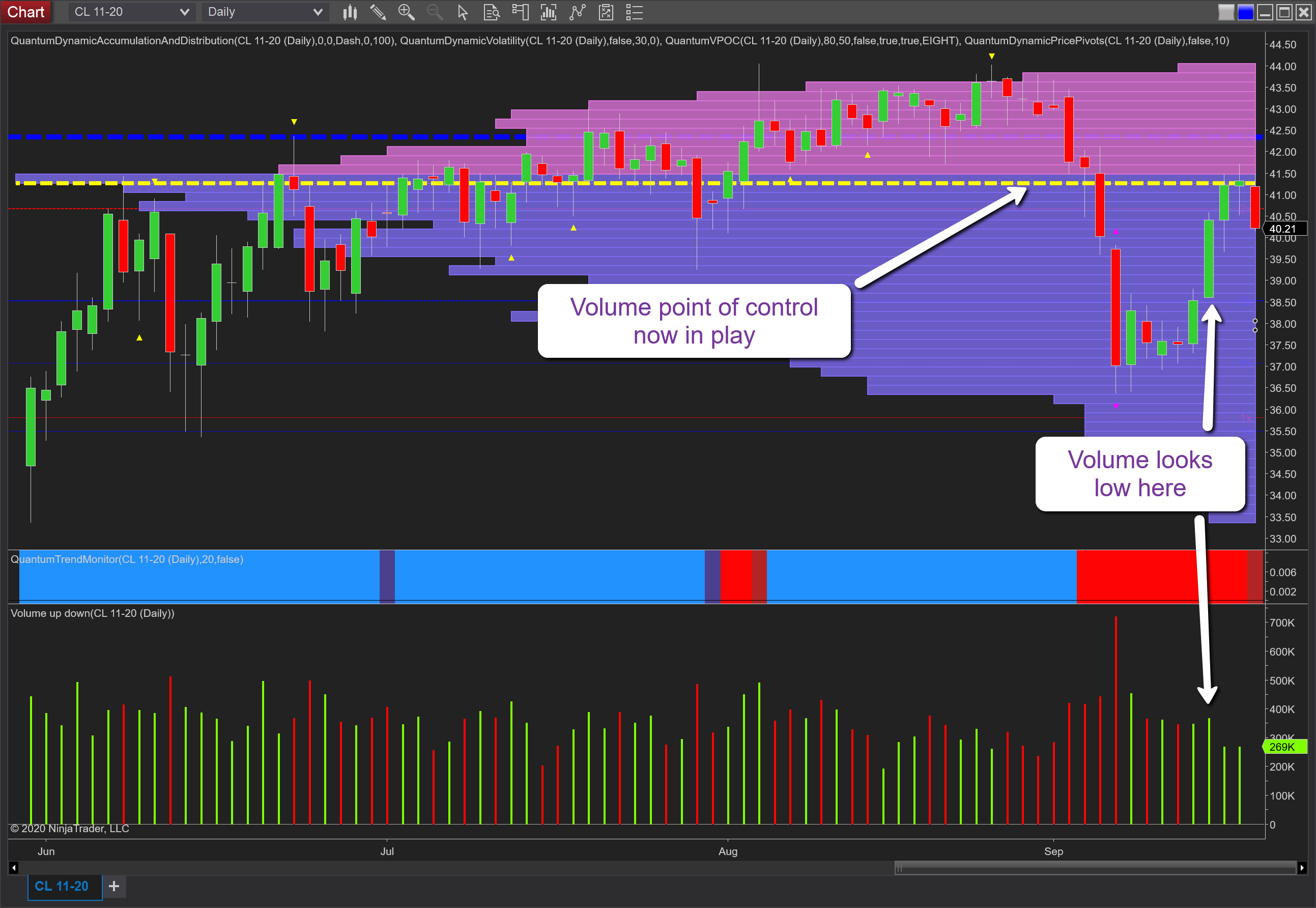

However, as we can see from the daily chart, this is precisely on the volume point of control as denoted by the yellow dashed line and, therefore, no surprise to see this is where the market paused as is generally the case. The volume point of control denotes not only the fulcrum of market sentiment and where price is in equilibrium with no strong bullish or bearish sentiment, but it is also where we have the heaviest concentration of volume on the chart over time and, therefore, is a point at which price is likely to congest. Therefore, today’s sell-off is to be expected.

What is also interesting is last week’s volume during the rally higher. Note the buying volume that fell away on both Thursday and Friday. In addition, consider the volume of Wednesday and associated price action. Here we had a widespread up candle and almost double that of the previous day, yet note the volume bar which is only marginally higher. For a candle of this magnitude, we should have expected to see considerably more volume if the preceding day can be considered as the benchmark, so Wednesday’s price action looks anomalous.

Given we have now reached the volume point of control and with no end to the constant stream of bad news concerning the virus, demand for oil is likely to remain weak globally. Moreover, OPEC’s apparent inability to manage the supply-demand equation is also bearish for the commodity.